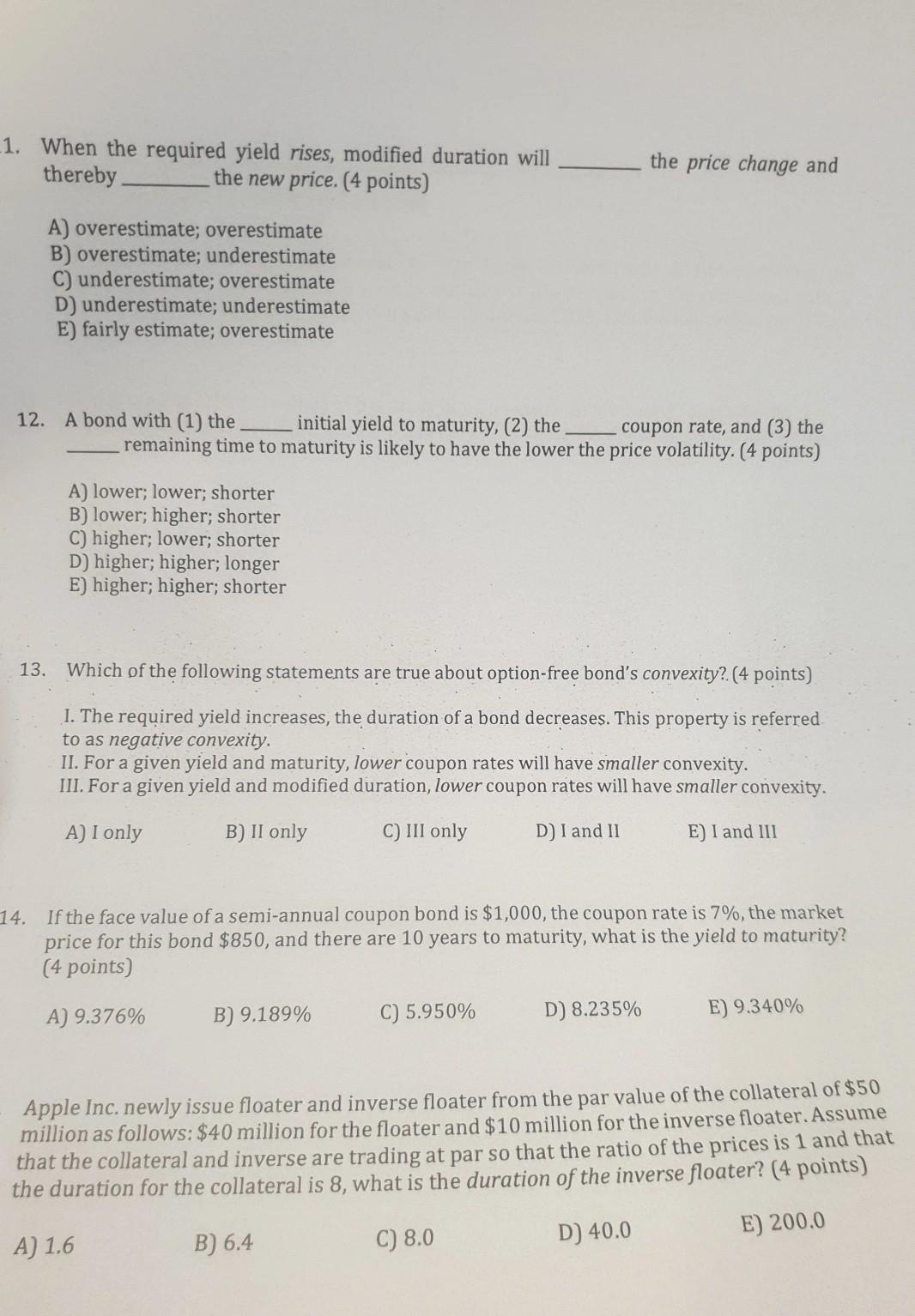

Question: 1. When the required yield rises, modified duration will thereby the price change and the new price. (4 points) A) overestimate; overestimate B) overestimate; underestimate

1. When the required yield rises, modified duration will thereby the price change and the new price. (4 points) A) overestimate; overestimate B) overestimate; underestimate C) underestimate; overestimate D) underestimate; underestimate E) fairly estimate; overestimate 12. A bond with (1) the initial yield to maturity, (2) the coupon rate, and (3) the remaining time to maturity is likely to have the lower the price volatility. (4 points) A) lower; lower; shorter B) lower; higher; shorter C) higher; lower; shorter D) higher; higher; longer E) higher; higher; shorter 13. Which of the following statements are true about option-free bond's convexity? (4 points) I. The required yield increases, the duration of a bond decreases. This property is referred to as negative convexity. II. For a given yield and maturity, lower coupon rates will have smaller convexity. III. For a given yield and modified duration, lower coupon rates will have smaller convexity. A) I only B) II only C) III only D) I and II E) I and III 14. If the face value of a semi-annual coupon bond is $1,000, the coupon rate is 7%, the market price for this bond $850, and there are 10 years to maturity, what is the yield to maturity? ( 4 points) A) 9.376% B) 9.189% C) 5.950% D) 8.235% E) 9.340% Apple Inc. newly issue floater and inverse floater from the par value of the collateral of $50 million as follows: $40 million for the floater and $10 million for the inverse floater. Assume that the collateral and inverse are trading at par so that the ratio of the prices is 1 and that the duration for the collateral is 8 , what is the duration of the inverse floater? ( 4 points) E) 200.0 A) 1.6 B) 6.4 C) 8.0 D) 40.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts