Question: 1 . Which firm has most liquid? 2 . What is the return to shareholders 3 . What is the NPV of buying sears? 4

Which firm has most liquid?

What is the return to shareholders

What is the NPV of buying sears?

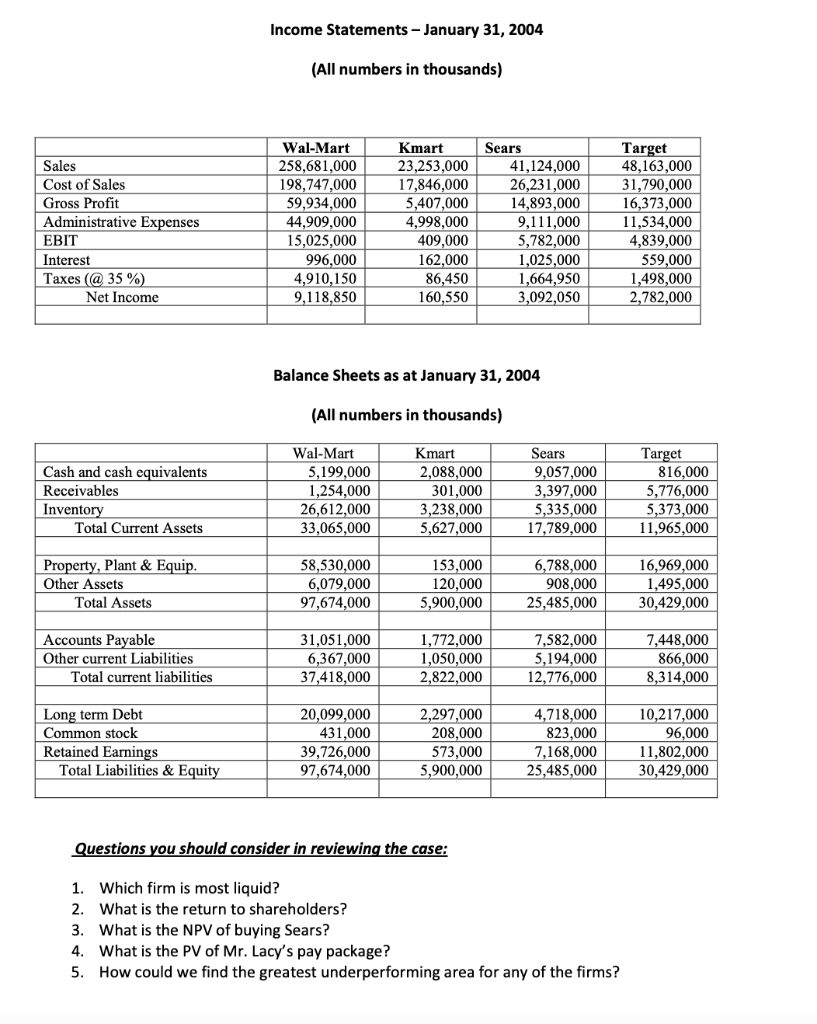

What is the PV of Mr Lacy's p Income Statements January

All numbers in thousands

tableWalMart,Kmart,Sears,TargetSalesCost of Sales,Gross Profit,Administrative Expenses,EBITInterestTaxes @Net Income,

Balance Sheets as at January

All numbers in thousands

tableWalMart,Kmart,Sears,TargetCash and cash equivalents,ReceivablesInventoryTotal Current Assets,Property Plant & Equip.,Other Assets,Total Assets,Accounts Payable,Other current Liabilities,Total current liabilities,Long term Debt,Common stock,Retained Earnings,Total Liabilities & Equity,

Questions you should consider in reviewing the case:

Which firm is most liquid?

What is the return to shareholders?

What is the NPV of buying Sears?

What is the PV of Mr Lacy's pay package?

How could we find the greatest underperforming area for any of the firms?ay package

How could we find the greatest underperforming area for any of the firms?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock