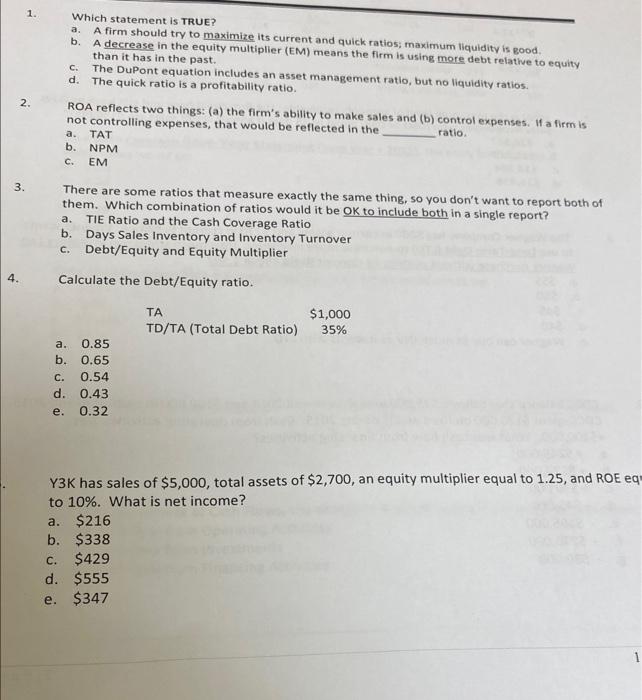

Question: 1. Which statement is TRUE? a. A firm should try to maximize its current and quick ratios; maximum liquidity is good. b. A decrease in

1. Which statement is TRUE? a. A firm should try to maximize its current and quick ratios; maximum liquidity is good. b. A decrease in the equity multiplier (EM) means the firm is using more debt relative to equity than it has in the past. c. The DuPont equation includes an asset management ratio, but no liquidity ratios. d. The quick ratio is a profitability ratio. 2. ROA reflects two things: (a) the firm's ability to make sales and (b) control expenses. If a firm is not controlling expenses, that would be reflected in the a. TAT b. NPM c. EM 3. There are some ratios that measure exactly the same thing, so you don't want to report both of them. Which combination of ratios would it be OK to include both in a single report? a. TIE Ratio and the Cash Coverage Ratio b. Days Sales Inventory and Inventory Turnover c. Debt/Equity and Equity Multiplier 4. Calculate the Debt/Equity ratio. a. 0.85 b. 0.65 c. 0.54 d. 0.43 e. 0.32 Y3K has sales of $5,000, total assets of $2,700, an equity multiplier equal to 1.25, and ROE eq to 10%. What is net income? a. $216 b. 5338 c. $429 d. $555 e. $347

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts