Question: 1. Why does risk matter if it does not hurt the investor? Given that an investment made money, what difference does it make how the

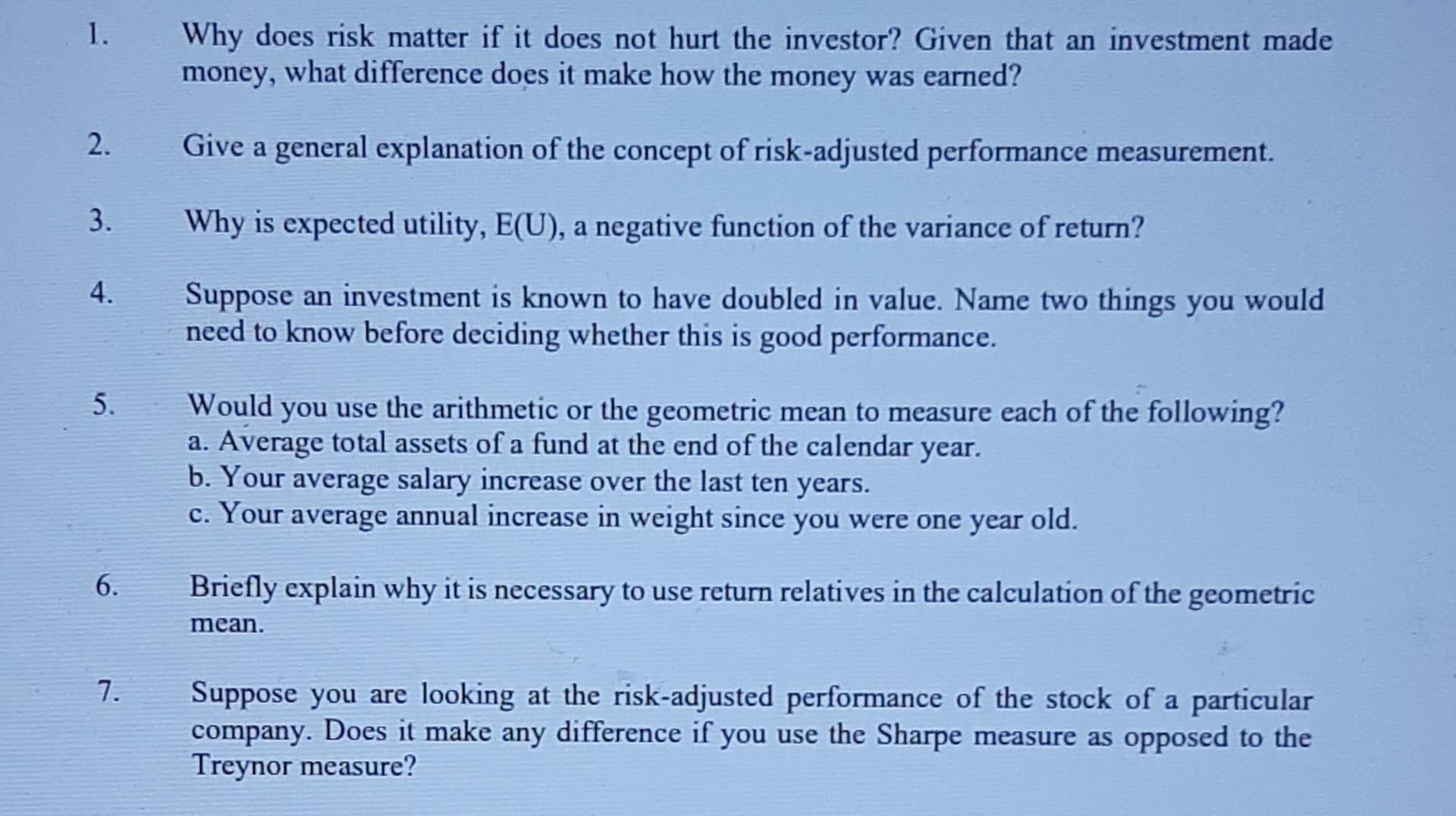

1. Why does risk matter if it does not hurt the investor? Given that an investment made money, what difference does it make how the money was earned? 2. Give a general explanation of the concept of risk-adjusted performance measurement. 3. Why is expected utility, E(U), a negative function of the variance of return? 4. Suppose an investment is known to have doubled in value. Name two things you would need to know before deciding whether this is good performance. 5. Would you use the arithmetic or the geometric mean to measure each of the following? a. Average total assets of a fund at the end of the calendar year. b. Your average salary increase over the last ten years. c. Your average annual increase in weight since you were one year old. 6. Briefly explain why it is necessary to use return relatives in the calculation of the geometric mean. 7. Suppose you are looking at the risk-adjusted performance of the stock of a particular company. Does it make any difference if you use the Sharpe measure as opposed to the Treynor measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts