Question: 1 = Y 1 - w 1 L 1 - I 2 = Y 2 - w 2 L 2 + ( 1 - )

Output is determined by a CobbDouglas production function.

Show that the optimal level of investment of the firm is given by:

Hint: Use to eliminate from equation before deriving the firstorder conditions.

How does this equation compare with equation in the text? From the perspective of the

present, what is the interpretation of Can you think of a way to modify equation such

that investment is a function of current income,

Now assume that the firm has to pay taxes on its profits at a rate The total tax bill in any

period is:

;

The aftertax cash flow in each period is now given by:

obrace

Derive the investment function when the firm has to pay taxes. How has the existence of taxes

affected the investment equation?

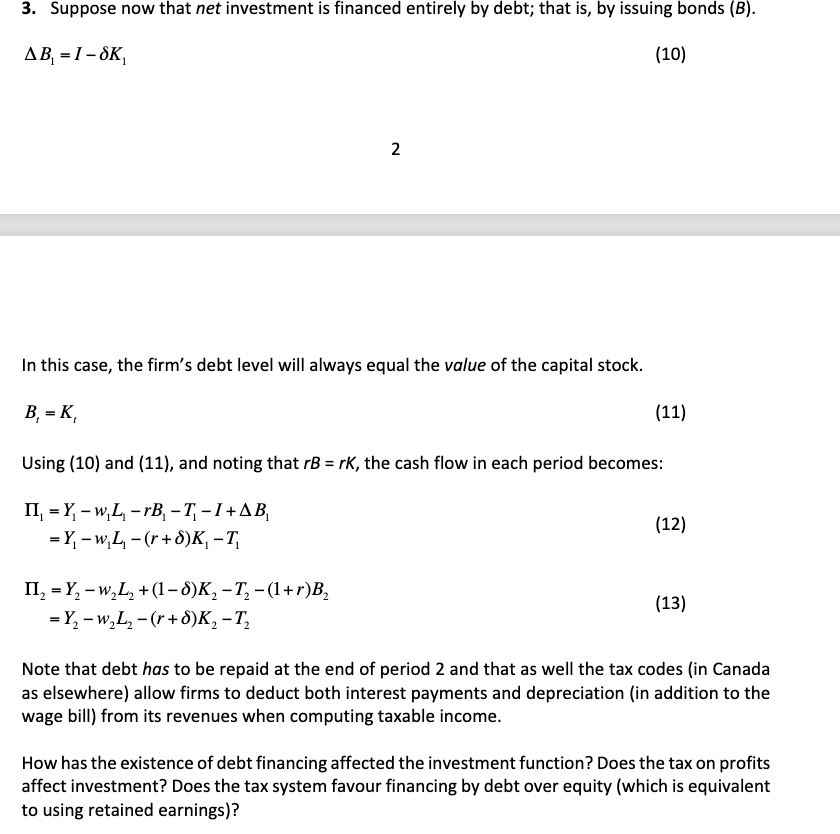

Suppose now that net investment is financed entirely by debt; that is by issuing bonds

Suppose now that net investment is financed entirely by debt; that is by issuing bonds

In this case, the firm's debt level will always equal the value of the capital stock.

Using and and noting that the cash flow in each period becomes:

Note that debt has to be repaid at the end of period and that as well the tax codes in Canada

as elsewhere allow firms to deduct both interest payments and depreciation in addition to the

wage bill from its revenues when computing taxable income.

How has the existence of debt financing affected the investment function? Does the tax on profits

affect investment? Does the tax system favour financing by debt over equity which is equivalent

to using retained earnings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock