Question: 1) yield to maturity calculations make one important assumption. which of the following is that assumption A) your interest income is earning the inflation rate

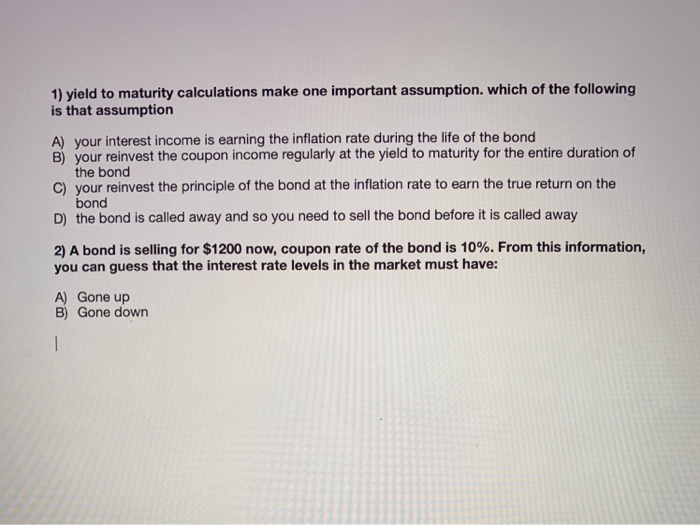

1) yield to maturity calculations make one important assumption. which of the following is that assumption A) your interest income is earning the inflation rate during the life of the bond B) your reinvest the coupon income regularly at the yield to maturity for the entire duration of the bond C) your reinvest the principle of the bond at the inflation rate to earn the true return on the bond D) the bond is called away and so you need to sell the bond before it is called away 2) A bond is selling for $1200 now, coupon rate of the bond is 10%. From this information, you can guess that the interest rate levels in the market must have: A) Gone up B) Gone down

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts