Question: 1. You are a profitable conglomerate thinking about getting into the gelati business by acquiring the rm Alati Gelati (AG). Current info for you, AG

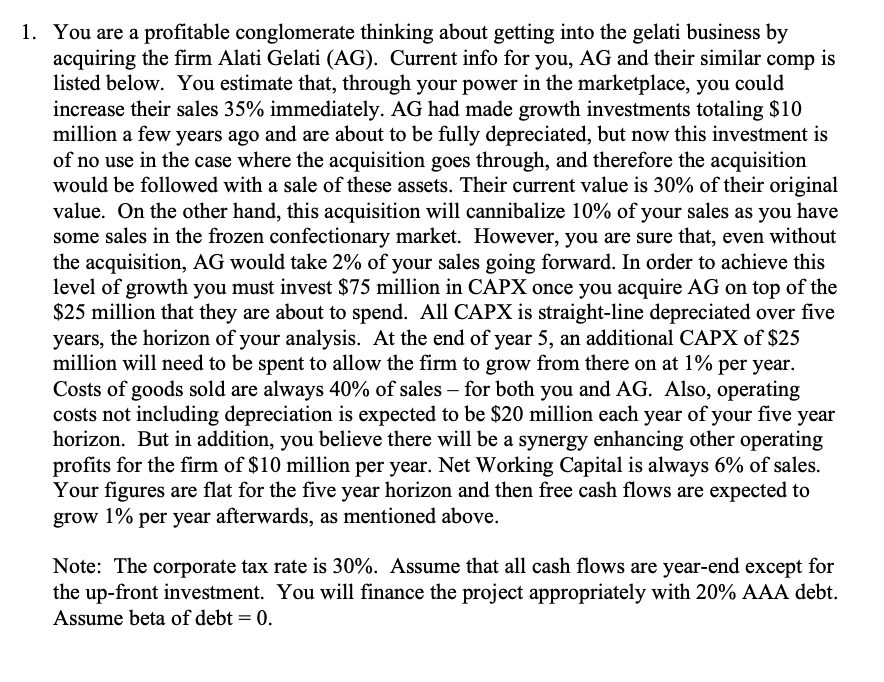

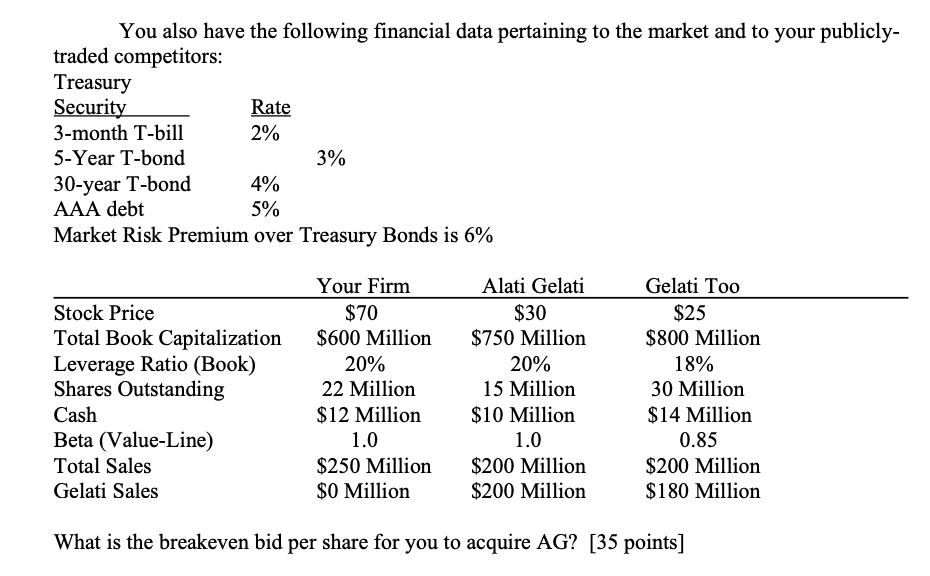

1. You are a profitable conglomerate thinking about getting into the gelati business by acquiring the rm Alati Gelati (AG). Current info for you, AG and their similar comp is listed below. You estimate that, through your power in the marketplace, you could increase their sales 35% immediately. AG had made growth investments totaling $10 million a few years ago and are about to be fully depreciated, but now this investment is of no use in the case where the acquisition goes through, and therefore the acquisition would be followed with a sale of these assets. Their current value is 30% of their original value. On the other hand, this acquisition will cannibalize 10% of your sales as you have some sales in the frozen confectionary market. However, you are sure that, even without the acquisition, AG would take 2% of your sales going forward. In order to achieve this level of growth you must invest $5 million in CAPX once you acquire AG on top of the $25 million that they are about to spend. All CAPX is straight-line depreciated over ve years, the horizon of your analysis. At the end of year 5, an additional CAPX of $25 million will need to be spent to allow the firm to grow from there on at 1% per year. Costs of goods sold are always 40% of sales for both you and AG. Also, operating costs not including depreciation is expected to be $20 million each year of your ve year horizon. But in addition, you believe there will be a synergy enhancing other operating profits for the firm of $10 million per year. Net Working Capital is always 6% of sales. Your figures are at for the five year horizon and then free cash ows are expected to grow 1% per year afterwards, as mentioned above. Note: The corporate tax rate is 30%. Assume that all cash ows are year-end except for the up-front investment. You will finance the project appropriately with 20% AAA debt. Assume beta of debt = 0. You also have the following financial data pertaining to the market and to your publicly- traded competitors: Treasury Security Rate 3-month T-bill 2% 5-Year T-bond 3% 30-year T-bond 4% AAA debt 5% Market Risk Premium over Treasury Bonds is 6% Your Firm Alati Gelati Gelati Too Stock Price $70 $30 $25 Total Book Capitalization $600 Million $750 Million $800 Million Leverage Ratio (Book) 20% 20% 18% Shares Outstanding 22 Million 15 Million 30 Million Cash $12 Million $10 Million $14 Million Beta (Value-Line) 1.0 1.0 0.85 Total Sales $250 Million $200 Million $200 Million Gelati Sales $0 Million $200 Million $180 Million What is the breakeven bid per share for you to acquire AG? [35 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts