Question: You run a profitable conglomerate thinking about getting into the gelati business by acquiring the firm Alati Gelati (AG).Current info for you, AG and their

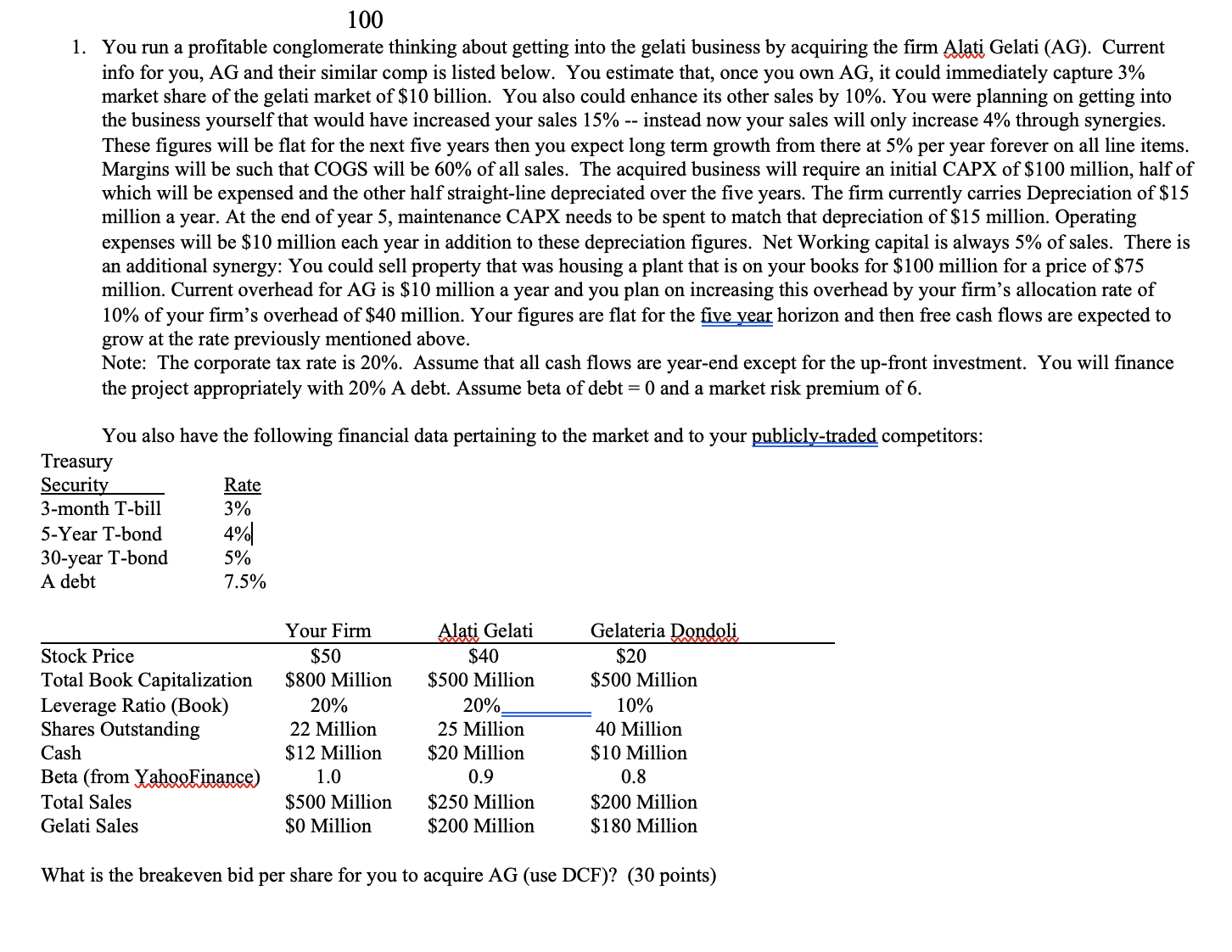

- You run a profitable conglomerate thinking about getting into the gelati business by acquiring the firm Alati Gelati (AG).Current info for you, AG and their similar comp is listed below.You estimate that, once you own AG, it could immediately capture 3% market share of the gelati market of $10 billion.You also could enhance its other sales by 10%. You were planning on getting into the business yourself that would have increased your sales 15% -- instead now your sales will only increase 4% through synergies. These figures will be flat for the next five years then you expect long term growth from there at 5% per year forever on all line items. Margins will be such that COGS will be 60% of all sales.The acquired business will require an initial CAPX of $100 million, half of which will be expensed and the other half straight-line depreciated over the five years. The firm currently carries Depreciation of $15 million a year. At the end of year 5, maintenance CAPX needs to be spent to match that depreciation of $15 million. Operating expenses will be $10 million each year in addition to these depreciation figures.Net Working capital is always 5% of sales.There is an additional synergy: You could sell property that was housing a plant that is on your books for $100 million for a price of $75 million. Current overhead for AG is $10 million a year and you plan on increasing this overhead by your firm's allocation rate of 10% of your firm's overhead of $40 million. Your figures are flat for the five year horizon and then free cash flows are expected to grow at the rate previously mentioned above.

Note:The corporate tax rate is 20%.Assume that all cash flows are year-end except for the up-front investment.You will finance the project appropriately with 20% A debt. Assume beta of debt = 0 and a market risk premium of 6.

You also have the following financial data pertaining to the market and to your publicly-traded competitors:

1. 100 You run a protable conglomerate thinking about getting into the gelati business by acquiring the rm 5131i, Gelati (AG). Current info for you, AG and their similar comp is listed below. You estimate that, once you own AG, it could immediately capture 3% market share of the gelati market of $10 billion. You also could enhance its other sales by 10%. You were planning on getting into the business yourself that would have increased your sales 15% -- instead now your sales will only increase 4% through synergies. These gures will be at for the next ve years then you expect long term growth from there at 5% per year forever on all line items. Margins will be such that COGS will be 60% of all sales. The acquired business will require an initial CAPX of $100 million, half of which will be expensed and the other half straight-line depreciated over the ve years. The rm currently carries Depreciation of $15 million a year. At the end of year 5, maintenance CAPX needs to be spent to match that depreciation of $15 million. Operating expenses will be $10 million each year in addition to these depreciation gures. Net Working capital is always 5% of sales. There is an additional synergy: You could sell property that was housing a plant that is on your books for $100 million for a price of $75 million. Current overhead for AG is $10 million a year and you plan on increasing this overhead by your rm's allocation rate of 10% of your rm's overhead of $40 million. Your gures are at for the M horizon and then free cash ows are expected to grow at the rate previously mentioned above. Note: The corporate tax rate is 20%. Assume that all cash ows are year-end except for the up-front investment. You will nance the project appropriately with 20% A debt. Assume beta of debt = 0 and a market risk premium of 6. You also have the following nancial data pertaining to the market and to your mm competitors: Treasury Security Rate 3-month T-bill 3 % 5-Year T-bond 4%l 30-year T-bond 5% A debt 7.5% Your Firm ' Gelati Gelateria Stock Price $50 $40 $20 Total Book Capitalization $800 Million $500 Million $500 Million Leverage Ratio (Book) 20% 20% 10% Shares Outstanding 22 Million 25 Million 40 Million Cash $12 Million $20 Million $10 Million Beta (from W 1.0 0.9 0.8 Total Sales $500 Million $250 Million $200 Million Gelati Sales $0 Million $2 00 Million $180 Million What is the breakeven bid per share for you to acquire AG (use DCF)? (30 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts