Question: 1. You are given some information about two mutual funds: Fidelity Magellan (FMAGX) and T Rowe Price Health Sciences Fund (PRHSX). Fund Average return Standard

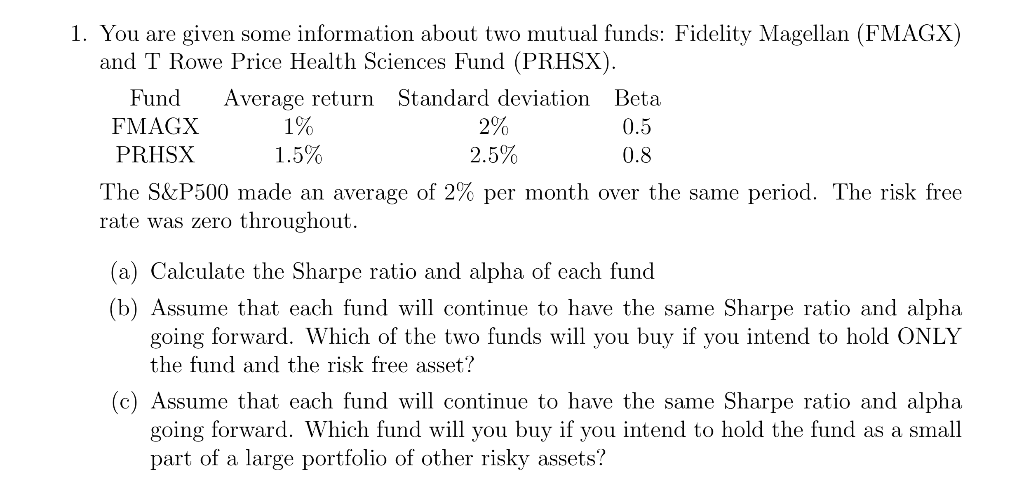

1. You are given some information about two mutual funds: Fidelity Magellan (FMAGX) and T Rowe Price Health Sciences Fund (PRHSX). Fund Average return Standard deviation Beta FMAGX 1% 2% 0.5 PRHSX 1.5% 2.5% 0.8 The S&P500 made an average of 2% per month over the same period. The risk free rate was zero throughout. (a) Calculate the Sharpe ratio and alpha of each fund (b) Assume that each fund will continue to have the same Sharpe ratio and alpha going forward. Which of the two funds will you buy if you intend to hold ONLY the fund and the risk free asset? Assume that each fund will continue to have the same Sharpe ratio and alpha going forward. Which fund will you buy if you intend to hold the fund as a small part of a large portfolio of other risky assets? 1. You are given some information about two mutual funds: Fidelity Magellan (FMAGX) and T Rowe Price Health Sciences Fund (PRHSX). Fund Average return Standard deviation Beta FMAGX 1% 2% 0.5 PRHSX 1.5% 2.5% 0.8 The S&P500 made an average of 2% per month over the same period. The risk free rate was zero throughout. (a) Calculate the Sharpe ratio and alpha of each fund (b) Assume that each fund will continue to have the same Sharpe ratio and alpha going forward. Which of the two funds will you buy if you intend to hold ONLY the fund and the risk free asset? Assume that each fund will continue to have the same Sharpe ratio and alpha going forward. Which fund will you buy if you intend to hold the fund as a small part of a large portfolio of other risky assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts