Question: Question one. Using the dividend growth model, an analyst has estimated that her company's cost of equity capital is 18% per annum. The current ex-dividend

Question one.

Using the dividend growth model, an analyst has estimated that her company's cost of equity capital is 18% per annum. The current ex-dividend share price is 211.7 Rand, and the current dividend is 12 cents per share. Do calculations to show what rate of dividend growth the analyst is assuming.

Required: 1. Determine the rate of dividend growth that the analyst is assuming. Use calculations to support your answer

2. Use the information provided below to calculate the market value of the Debenture:

INFORMATION: R3 million 11%, debentures due in 5 years and the current yield-to-maturity is 8%.

3 Suppose shares in Ink Corporation have a beta of 0,80. The market risk premium is 8%, and the risk- free rate is 10%. Ink Corporation's last dividend was R2,00 per share, and the dividend is expected to grow at 8% indefinitely. The share currently sells for R24,00.

Required: Calculate the cost of equity capital using:

1 CAPM model

2 Gordon Growth Model.

Question two.

Heath Production manufactures chairs. Several weeks ago, the company received an enquiry from Rose Limited. Rose wants to market a foldable chair similar to one of Heath's, and has offered to purchase 11 000 units if the offer can be completed in three months. The cost data for Heath's foldable chair is as follow:

Direct material. 16.40

Direct labour (0.125 @ $36 per hour) 4.50

Total manufacturing overhead 20.00

Total. $40.90

The normal selling price of Heath's foldable chair is $53.00. However, Rose has offered Heath only $31.50 because of the large quantity it is willing to purchase. Rose requires a modification of the design that will allow a $4.20 reduction in direct material cost.

The production manager of Heath notes that the company will incur $7400 in additional setup costs and will have to purchase a $4800 special equipment to manufacturing the units for Rose. The equipment will be discarded once the special order is completed.

Total manufacturing overhead costs are applied to production at the rate of $40 per machine hour. The figure is based, in part, on budgeted annual fixed overhead of $1 500 000 and planned production activity of 60 000 machine hours (5000 hours per month).

Rose will allocate $3600 of existing fixed administrative costs to the order as "part of the cost of doing business".

Required:

a) Which of the data above should be ignored in making the special order decision? For what reason? (1 mark)

b) Assume that Heath's present sales will not be affected by the special order, should the order be accepted from the financial point of view? Show calculation. (4 marks)

c) Assume that Heath's current production activity 80 per cent of planned machine hours, can the company accept the order and meet Rose's deadline? Explain. (2 marks)

Question 3.

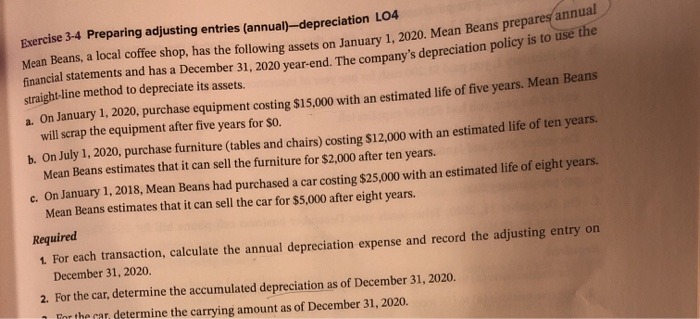

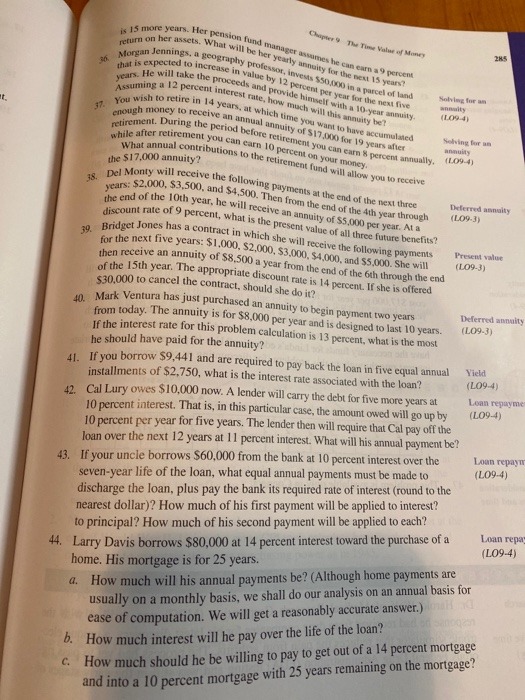

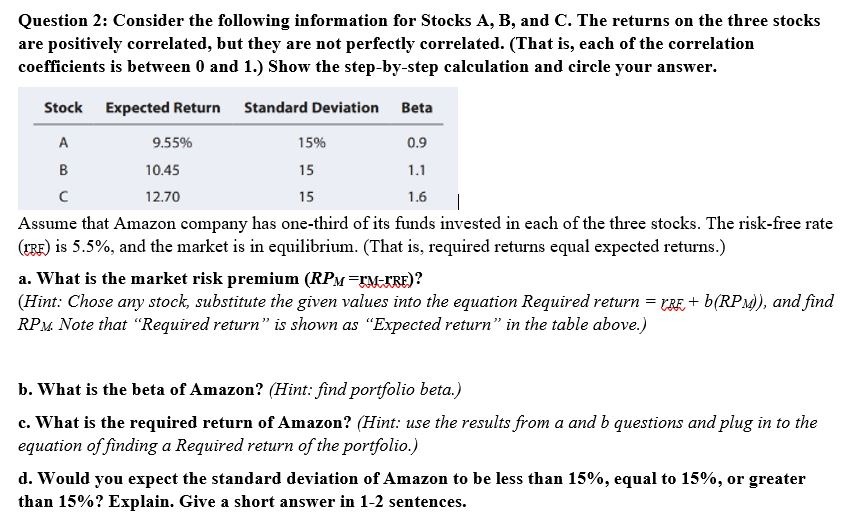

Exercise 3-4 Preparing adjusting entries (annual)-depreciation LO4 Mean Beans, a local coffee shop, has the following assets on January 1, 2020. Mean Beans prepares annual financial statements and has a December 31, 2020 year-end. The company's depreciation policy is to use the straight-line method to depreciate its assets. a. On January 1, 2020, purchase equipment costing $15,000 with an estimated life of five years. Mean Beans will scrap the equipment after five years for $0. b. On July 1, 2020, purchase furniture (tables and chairs) costing $12,000 with an estimated life of ten years. Mean Beans estimates that it can sell the furniture for $2,000 after ten years. c. On January 1, 2018, Mean Beans had purchased a car costing $25,000 with an estimated life of eight years. Mean Beans estimates that it can sell the car for $5,000 after eight years. Required 1. For each transaction, calculate the annual depreciation expense and record the adjusting entry on December 31, 2020. 2. For the car, determine the accumulated depreciation as of December 31, 2020. the car, determine the carrying amount as of December 31, 2020.Chapter 9 The Time Value of Money is 15 more years. Her pension fund manager assumes he can earn a 9 percent return on her assets. What will be her yearly annuity for the Best 15 years Morgan Jennings, I geography professor, invests $50,010 in a parcel of land that is expected to increase in value by 12 percent per year for the next five years. He will take the proceeds and provide himself with a 10-year annualy. Solving for an 37. Assuming a 12 percent interest rate, how much will this annuity bell annuity You wish to retire in 14 years, at which time you want to have accumulated enough money to receive an annual annuity of $17,000 for 19 years after retirement. During the period before retirement you can earn $ percent annually. Solving for an while after retirement you can earn 10 percent on your money. annuity (LO9-4) What annual contributions to the retirement fund will allow you to receive the $17,000 annuity? 18. Del Monty will receive the following payments at the end of the next three years: $2.000, $3.500, and $4,500. Then from the end of the 4th year through Deferred annuity the end of the 10th year, he will receive an annuity of $5,000 per year. At a (LO93) discount rate of 9 percent, what is the present value of all three future benefits? 89. Bridget Jones has a contract in which she will receive the following payments for the next five years: $1,000, $2,000, $3,000, $4,000, and $5,000. She will Present value then receive an annuity of $8.500 a year from the end of the 6ith through the end (LO9-3) of the 15th year. The appropriate discount rate is 14 percent. If she is offered $30.000 to cancel the contract, should she do it? 40. Mark Ventura has just purchased an annuity to begin payment two years Deferred annuity from today. The annuity is for $8,000 per year and is designed to last 10 years. (LO9-3) If the interest rate for this problem calculation is 13 percent, what is the most he should have paid for the annuity? 41. If you borrow $9,441 and are required to pay back the loan in five equal annual Vield installments of $2.750, what is the interest rate associated with the loan? (LO9-4) Cal Lury owes $10,000 now. A lender will carry the debt for five more years at Loan repayme 10 percent interest. That is, in this particular case, the amount owed will go up by (LO9-4) 10 percent per year for five years. The lender then will require that Cal pay off the loan over the next 12 years at 1 1 percent interest. What will his annual payment be? 43. If your uncle borrows $60,000 from the bank at 10 percent interest over the Loun repayw (LO9-4) seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest (round to the nearest dollar)? How much of his first payment will be applied to interest? to principal? How much of his second payment will be applied to each? Loan repa 44. Larry Davis borrows $80,000 at 14 percent interest toward the purchase of a (LO9-4) home. His mortgage is for 25 years. 4. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer. ) andHI d sanogen b. How much interest will he pay over the life of the loan? C. How much should he be willing to pay to get out of a 14 percent mortgage and into a 10 percent mortgage with 25 years remaining on the mortgage?Question 2: Consider the following information for Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Show the step-by-step calculation and circle your answer. Stock Expected Return Standard Deviation Beta A 9.55% 15% 0.9 B 10.45 15 1.1 C 12.70 15 1.6 Assume that Amazon company has one-third of its funds invested in each of the three stocks. The risk-free rate (IRF) is 5.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) a. What is the market risk premium (RPM =PM-CRE)? (Hint: Chose any stock, substitute the given values into the equation Required return = [RE + b(RPM)), and find RPM. Note that "Required return" is shown as "Expected return" in the table above.) b. What is the beta of Amazon? (Hint: find portfolio beta.) c. What is the required return of Amazon? (Hint: use the results from a and b questions and plug in to the equation of finding a Required return of the portfolio.) d. Would you expect the standard deviation of Amazon to be less than 15%, equal to 15%, or greater than 15%? Explain. Give a short answer in 1-2 sentences