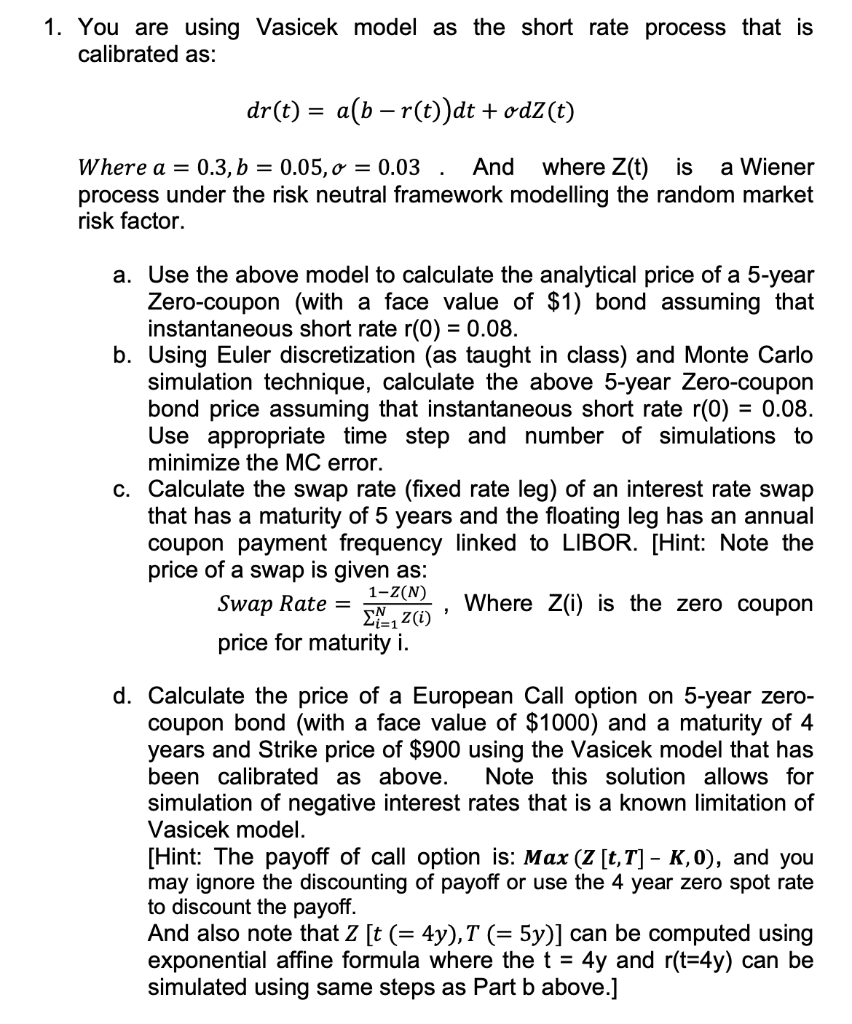

Question: 1. You are using Vasicek model as the short rate process that is calibrated as: dr(t)=a(br(t))dt+dZ(t) Where a=0.3,b=0.05,=0.03. And where Z(t) is a Wiener process

1. You are using Vasicek model as the short rate process that is calibrated as: dr(t)=a(br(t))dt+dZ(t) Where a=0.3,b=0.05,=0.03. And where Z(t) is a Wiener process under the risk neutral framework modelling the random market risk factor. a. Use the above model to calculate the analytical price of a 5-year Zero-coupon (with a face value of $1 ) bond assuming that instantaneous short rate r(0)=0.08. b. Using Euler discretization (as taught in class) and Monte Carlo simulation technique, calculate the above 5-year Zero-coupon bond price assuming that instantaneous short rate r(0)=0.08. Use appropriate time step and number of simulations to minimize the MC error. c. Calculate the swap rate (fixed rate leg) of an interest rate swap that has a maturity of 5 years and the floating leg has an annual coupon payment frequency linked to LIBOR. [Hint: Note the price of a swap is given as: Swap Rate =i=1NZ(i)1Z(N), Where Z(i) is the zero coupon price for maturity i. d. Calculate the price of a European Call option on 5-year zerocoupon bond (with a face value of $1000 ) and a maturity of 4 years and Strike price of $900 using the Vasicek model that has been calibrated as above. Note this solution allows for simulation of negative interest rates that is a known limitation of Vasicek model. [Hint: The payoff of call option is: Max(Z[t,T]K,0), and you may ignore the discounting of payoff or use the 4 year zero spot rate to discount the payoff. And also note that Z[t(=4y),T(=5y)] can be computed using exponential affine formula where the t=4y and r(t=4y) can be simulated using same steps as Part b above.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts