Question: 1. You established a straddle on Tesla using June 2021 call and put options with a strike option of $665. The call premium cost

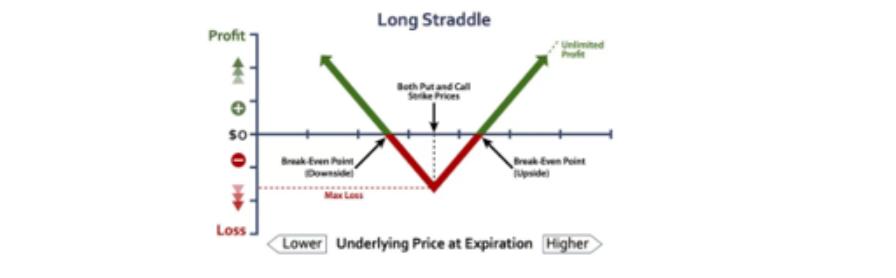

1. You established a straddle on Tesla using June 2021 call and put options with a strike option of $665. The call premium cost is $59.90 and the put premium is $63. a) What is the most that you can lose in the position? b) What will be the profit or loss is Tesla is selling at $720 in June? c) At what stock prices will be breakeven? 2. Read the Article: "Bucket List - Why everyone is now an option trader" from The Economist (1/16/2021) and answer the following question: a) Why small investors are massively becoming option traders? And what do you think are they going to be successful? Profit 4020 Loss J Break Even Paint Long Straddle Both Put and Call See Prices limited Break Even Point Lower Underlying Price at Expiration Higher

Step by Step Solution

3.43 Rating (140 Votes )

There are 3 Steps involved in it

1 Straddle on Tesla Options a The maximum potential loss in a straddle position is the total premium paid for both the call and put options In this ca... View full answer

Get step-by-step solutions from verified subject matter experts