Question: 1. You must show your work and write solutions in details, including formulas in symbols. Illustrate how you plug numbers, given in each question, into

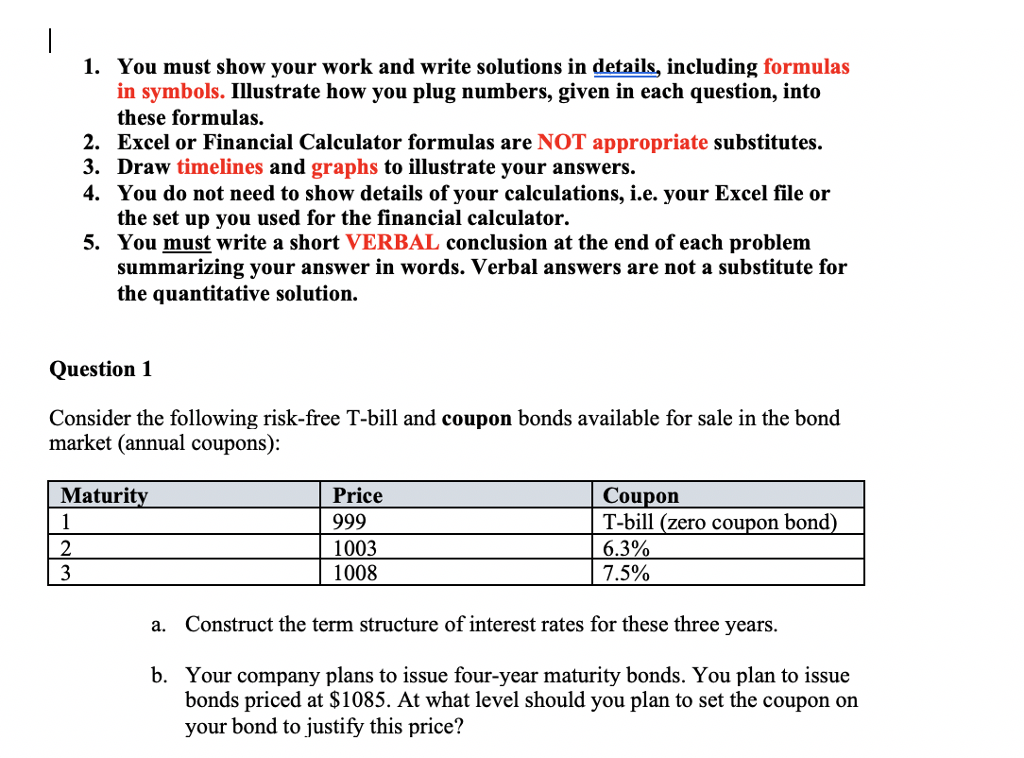

1. You must show your work and write solutions in details, including formulas in symbols. Illustrate how you plug numbers, given in each question, into these formulas. 2. Excel or Financial Calculator formulas are NOT appropriate substitutes. 3. Draw timelines and graphs to illustrate your answers. 4. You do not need to show details of your calculations, i.e. your Excel file or the set up you used for the financial calculator. 5. You must write a short VERBAL conclusion at the end of each problem summarizing your answer in words. Verbal answers are not a substitute for the quantitative solution. Question 1 Consider the following risk-free T-bill and coupon bonds available for sale in the bond market (annual coupons): Maturit Price Coupon T-bill (zero coupon bond 6.3% 7.5% 1003 1008 a. Construct the term structure of interest rates for these three years b. Your company plans to issue four-year maturity bonds. You plan to issue bonds priced at $1085. At what level should you plan to set the coupon on your bond to justify this price? 1. You must show your work and write solutions in details, including formulas in symbols. Illustrate how you plug numbers, given in each question, into these formulas. 2. Excel or Financial Calculator formulas are NOT appropriate substitutes. 3. Draw timelines and graphs to illustrate your answers. 4. You do not need to show details of your calculations, i.e. your Excel file or the set up you used for the financial calculator. 5. You must write a short VERBAL conclusion at the end of each problem summarizing your answer in words. Verbal answers are not a substitute for the quantitative solution. Question 1 Consider the following risk-free T-bill and coupon bonds available for sale in the bond market (annual coupons): Maturit Price Coupon T-bill (zero coupon bond 6.3% 7.5% 1003 1008 a. Construct the term structure of interest rates for these three years b. Your company plans to issue four-year maturity bonds. You plan to issue bonds priced at $1085. At what level should you plan to set the coupon on your bond to justify this price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts