Question: 1. You've just decided upon your capital allocation for the next year, when you realize that you've underestimated both the expected return and the standard

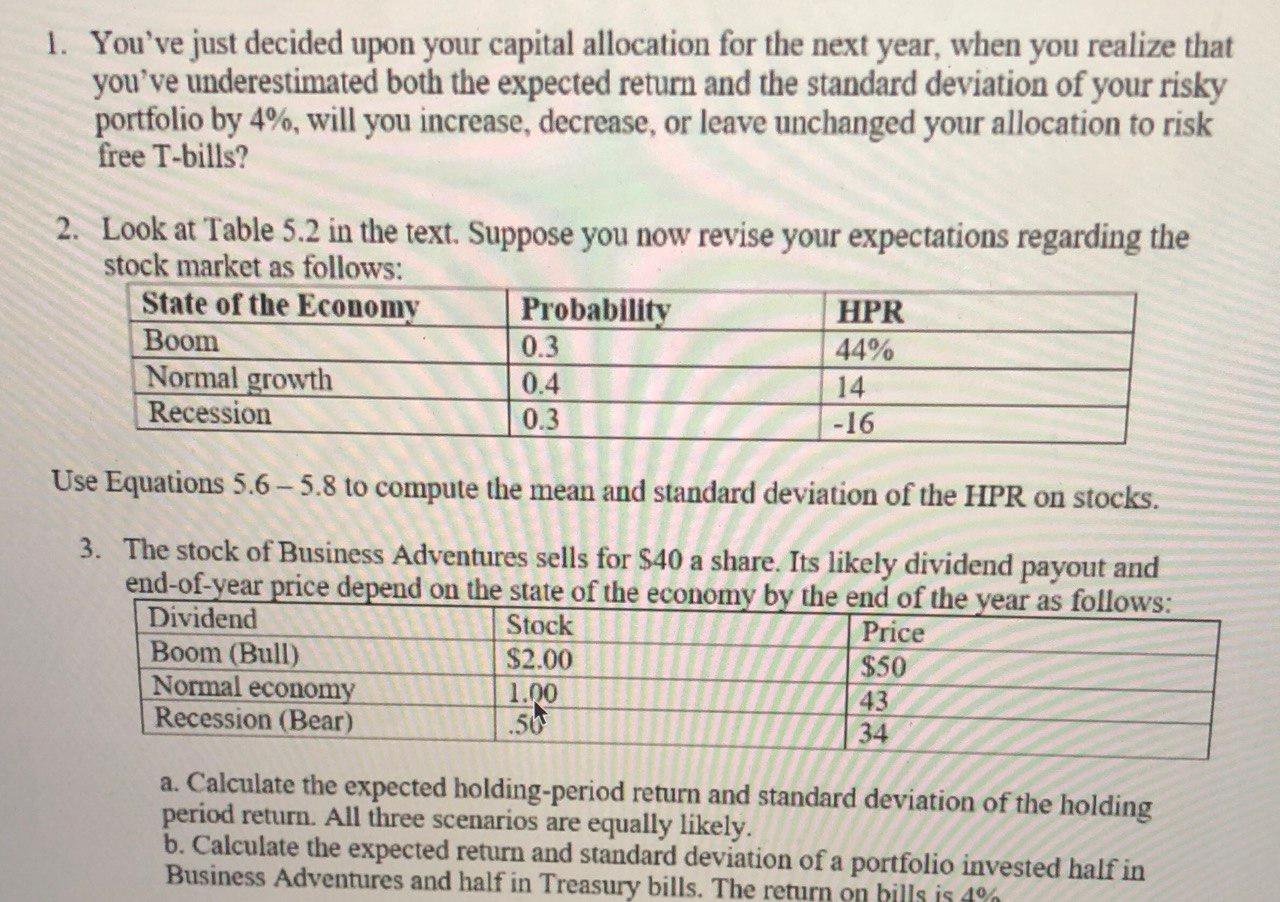

1. You've just decided upon your capital allocation for the next year, when you realize that you've underestimated both the expected return and the standard deviation of your risky portfolio by 4%, will you increase, decrease, or leave unchanged your allocation to risk free T-bills? 2. Look at Table 5.2 in the text. Suppose you now revise your expectations regarding the stock market as follows: State of the Economy Probability HPR Boom 0.3 44% Normal growth 0.4 14 Recession 0.3 -16 Use Equations 5.6 - 5.8 to compute the mean and standard deviation of the HPR on stocks. 3. The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Dividend Stock Price Boom (Bull) $2.00 $50 Normal economy 43 Recession (Bear) 50 34 1.00 a. Calculate the expected holding-period return and standard deviation of the holding period return. All three scenarios are equally likely. b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts