Question: 10. 11. 12. 13. 14. 15. b) The P4,000,000 note receivable is dated December 31, 2013, bears interest at 9%, and is due on December

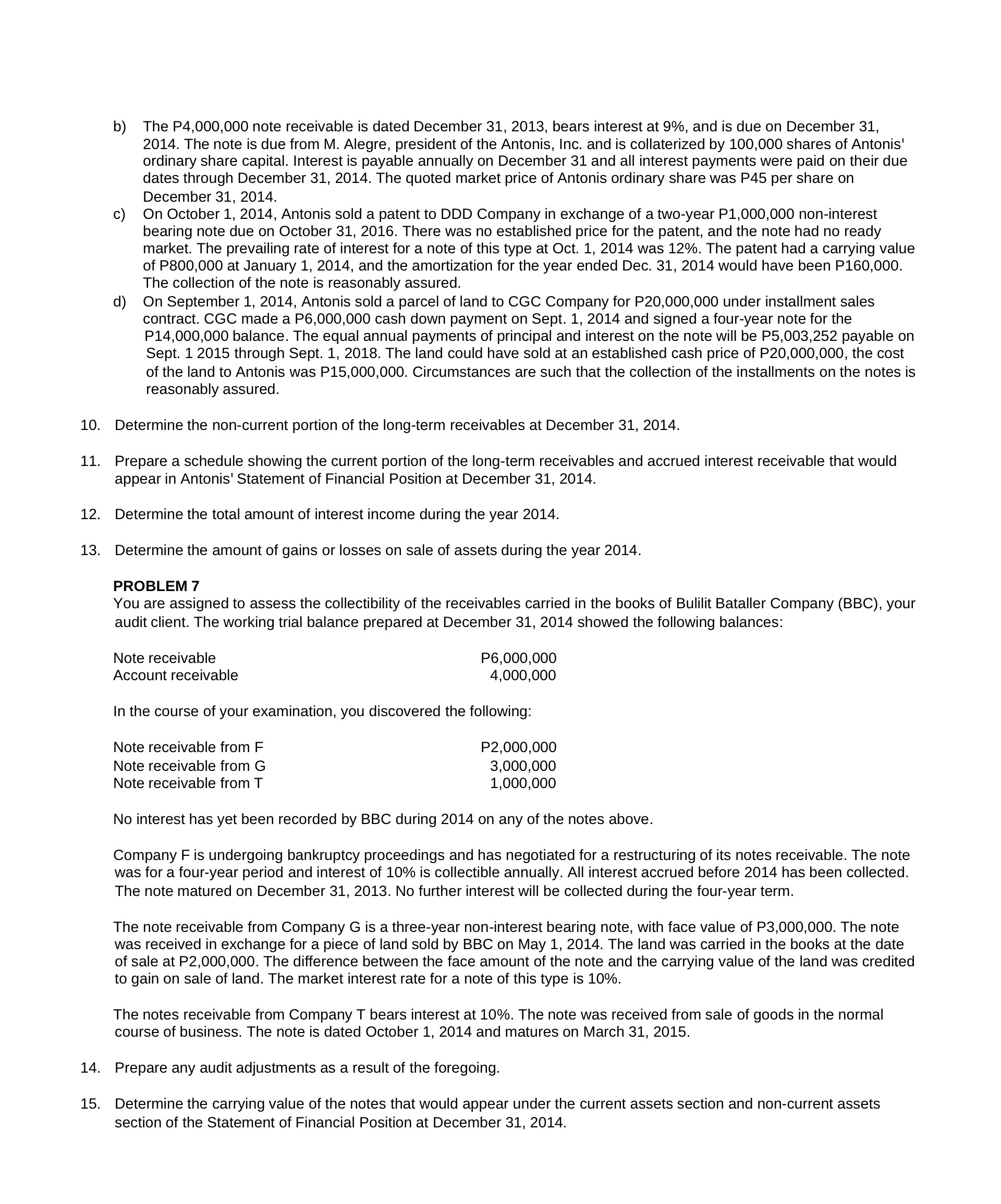

10. 11. 12. 13. 14. 15. b) The P4,000,000 note receivable is dated December 31, 2013, bears interest at 9%, and is due on December 31, 2014. The note is due from M. Alegre, president of the Antonis, Inc. and is collaterized by 100,000 shares of Antonis' ordinary share capital. Interest is payable annually on December 31 and all interest payments were paid on their due dates through December 31, 2014. The quoted market price of Antonis ordinary share was P45 per share on December 31, 2014. c) On October 1, 2014, Antonis sold a patent to DDD Company in exchange of a two-year P1,000,000 non-interest bearing note due on October 31, 2016. There was no established price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at Oct. 1, 2014 was 12%. The patent had a carrying value of P800000 at January 1, 2014, and the amortization for the year ended Dec. 31, 2014 would have been P160000. The collection of the note is reasonably assured. d) On September 1, 2014, Antonis sold a parcel of land to CGC Company for P20,000,000 under installment sales contract. CGC made a P6,000,000 cash down payment on Sept. 1, 2014 and signed a four-year note for the P14,000,000 balance. The equal annual payments of principal and interest on the note will be P5,003,252 payable on Sept. 1 2015 through Sept. 1, 2018. The land could have sold at an established cash price of P20,000,000, the cost of the land to Antonis was P15,000,000. Circumstances are such that the collection of the installments on the notes is reasonably assured. Determine the non-current portion of the long-term receivables at December 31, 2014. Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would appear in Antonis' Statement of Financial Position at December 31, 2014. Determine the total amount of interest income during the year 2014. Determine the amount of gains or losses on sale of assets during the year 2014. PROBLEM 7 You are assigned to assess the collectibility of the receivables carried in the books of Bulilit Bataller Company (BBC), your audit client. The working trial balance prepared at December 31, 2014 showed the following balances: Note receivable P6,000,000 Account receivable 4,000,000 in the course of your examination, you discovered the following: Note receivable from F P2,000,000 Note receivable from G 3,000,000 Note receivable from T 1,000,000 No interest has yet been recorded by BBC during 2014 on any of the notes above. Company F is undergoing bankruptcy proceedings and has negotiated for a restructuring of its notes receivable. The note was for a four-year period and interest of 10% is collectible annually. All interest accrued before 2014 has been collected. The note matured on December 31, 2013. No further interest will be collected during the four-year term. The note receivable from Company (3 is athree-year non-interest bearing note, with face value of P3,000,000. The note was received in exchange for a piece of land sold by BBC on May 1, 2014. The land was carried in the books at the date of sale at P2,000,000. The difference between the face amount of the note and the carrying value of the land was credited to gain on sale of land. The market interest rate for a note of this type is 10%. The notes receivable from Company T bears interest at 10%. The note was received from sale of goods in the normal course of business. The note is dated October 1, 2014 and matures on March 31, 2015. Prepare any audit adjustments as a result of the foregoing. Determine the carrying value of the notes that would appear under the current assets section and non-current assets section of the Statement of Financial Position at December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts