Question: Question on private placement You need to choose between making a public offering and arranging a private placement. In each case the issue involves $10

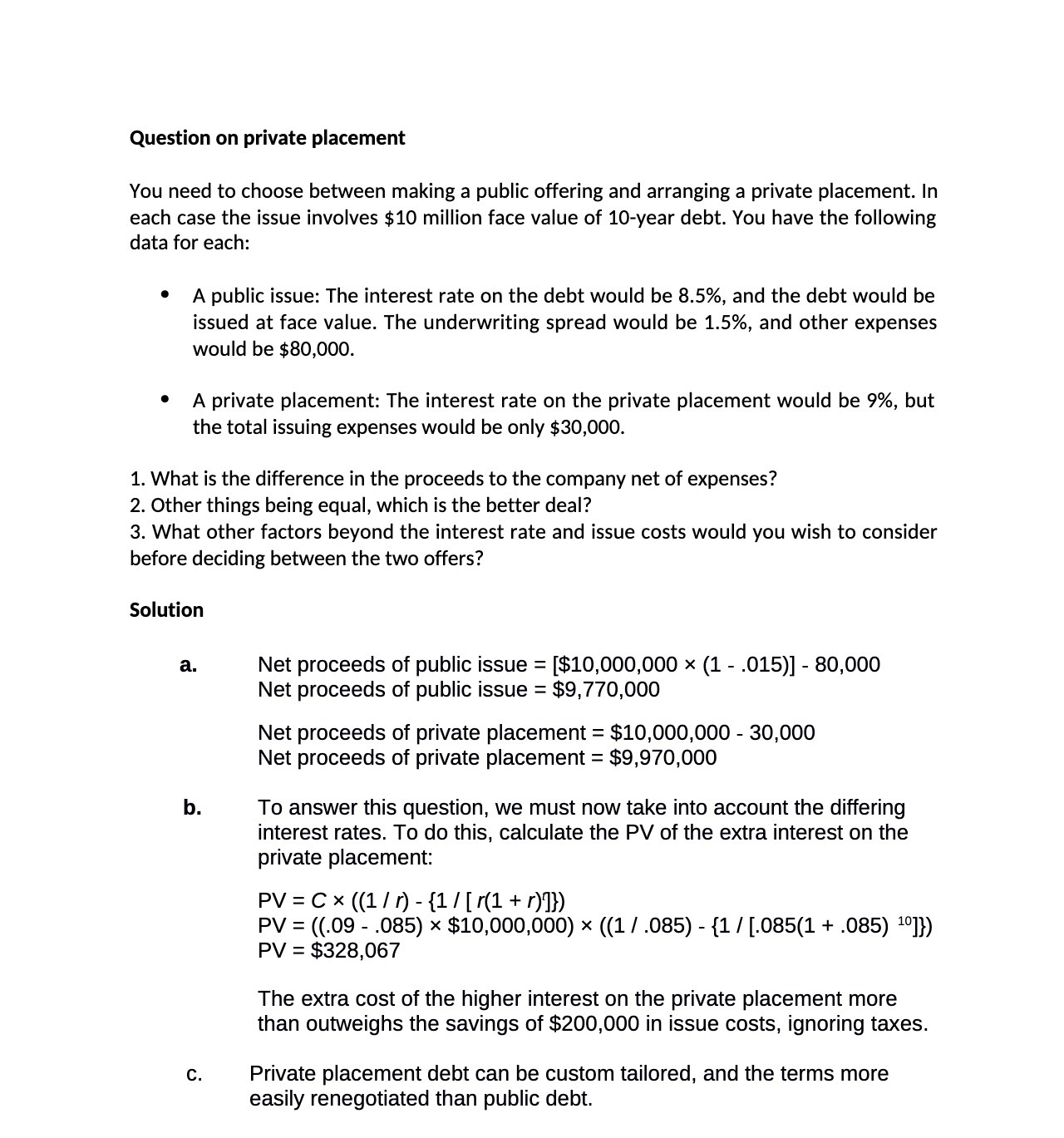

Question on private placement You need to choose between making a public offering and arranging a private placement. In each case the issue involves $10 million face value of 10-year debt. You have the following data for each: 0 A public issue: The interest rate on the debt would be 8.5%, and the debt would be issued at face value. The underwriting spread would be 1.5%, and other expenses would be $80,000. ' A private placement: The interest rate on the private placement would be 9%, but the total issuing expenses would be only $30,000. 1. What is the difference in the proceeds to the company net of expenses? 2. Other things being equal, which is the better deal? 3. What other factors beyond the interest rate and issue costs would you wish to consider before deciding between the two offers? Solution a. Net proceeds of public issue = [$10,000,000 x (1 - .015)] - 80,000 Net proceeds of public issue 2 $9,770,000 Net proceeds of private placement 2 $10,000,000 30,000 Net proceeds of private placement = $9,970,000 To answer this question, we must now take into account the differing interest rates. To do this, calculate the PV of the extra interest on the private placement: PV=CX ((1fr)-{1![r(1+r)']}) PV = ((09 _ .085) x $10,000,000) x ((11 .085) _{1r[.035(1 + .035) 101}) PV = $328,067 The extra cost of the higher interest on the private placement more than outweighs the savings of $200,000 in issue costs, ignoring taxes. Private placement debt can be custom tailored, and the terms more easily renegotiated than public debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts