Question: 10. (12) A three-year interest rate swap has a level notional amount of 300,000, with annual settlement period. You are given the following prices for

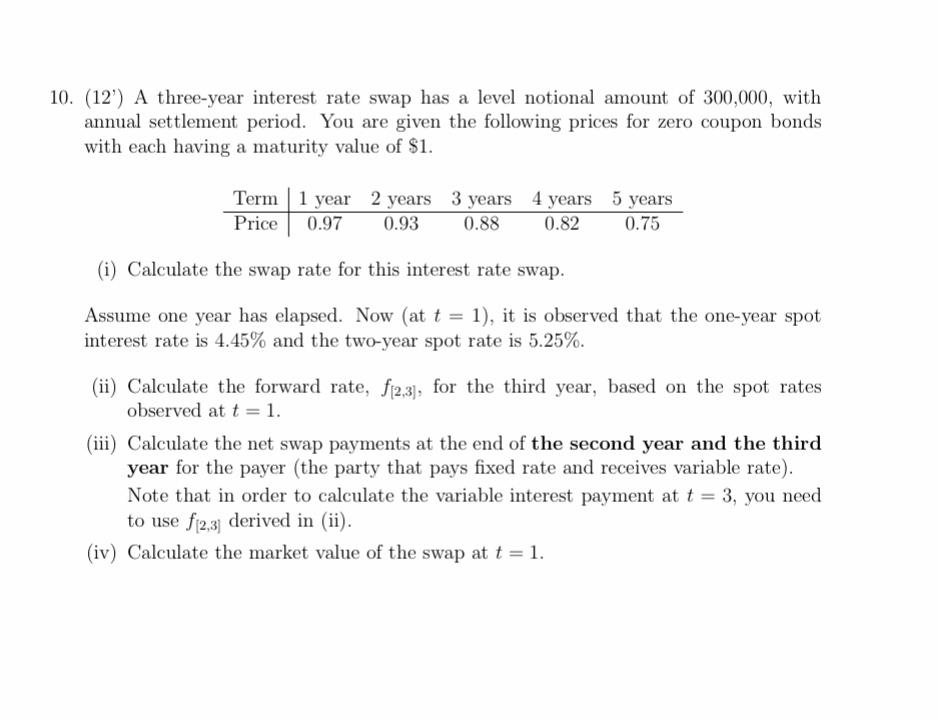

10. (12) A three-year interest rate swap has a level notional amount of 300,000, with annual settlement period. You are given the following prices for zero coupon bonds with each having a maturity value of $1. Term 1 year 2 years 3 years 4 years 5 years Price 0.97 0.93 0.88 0.82 0.75 (i) Calculate the swap rate for this interest rate swap. Assume one year has elapsed. Now (at t = 1), it is observed that the one-year spot interest rate is 4.45% and the two-year spot rate is 5.25%. (ii) Calculate the forward rate, f2,3), for the third year, based on the spot rates observed at t = 1. (iii) Calculate the net swap payments at the end of the second year and the third year for the payer (the party that pays fixed rate and receives variable rate). Note that in order to calculate the variable interest payment at t = 3, you need to use f2.31 derived in (ii). (iv) Calculate the market value of the swap at t = 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts