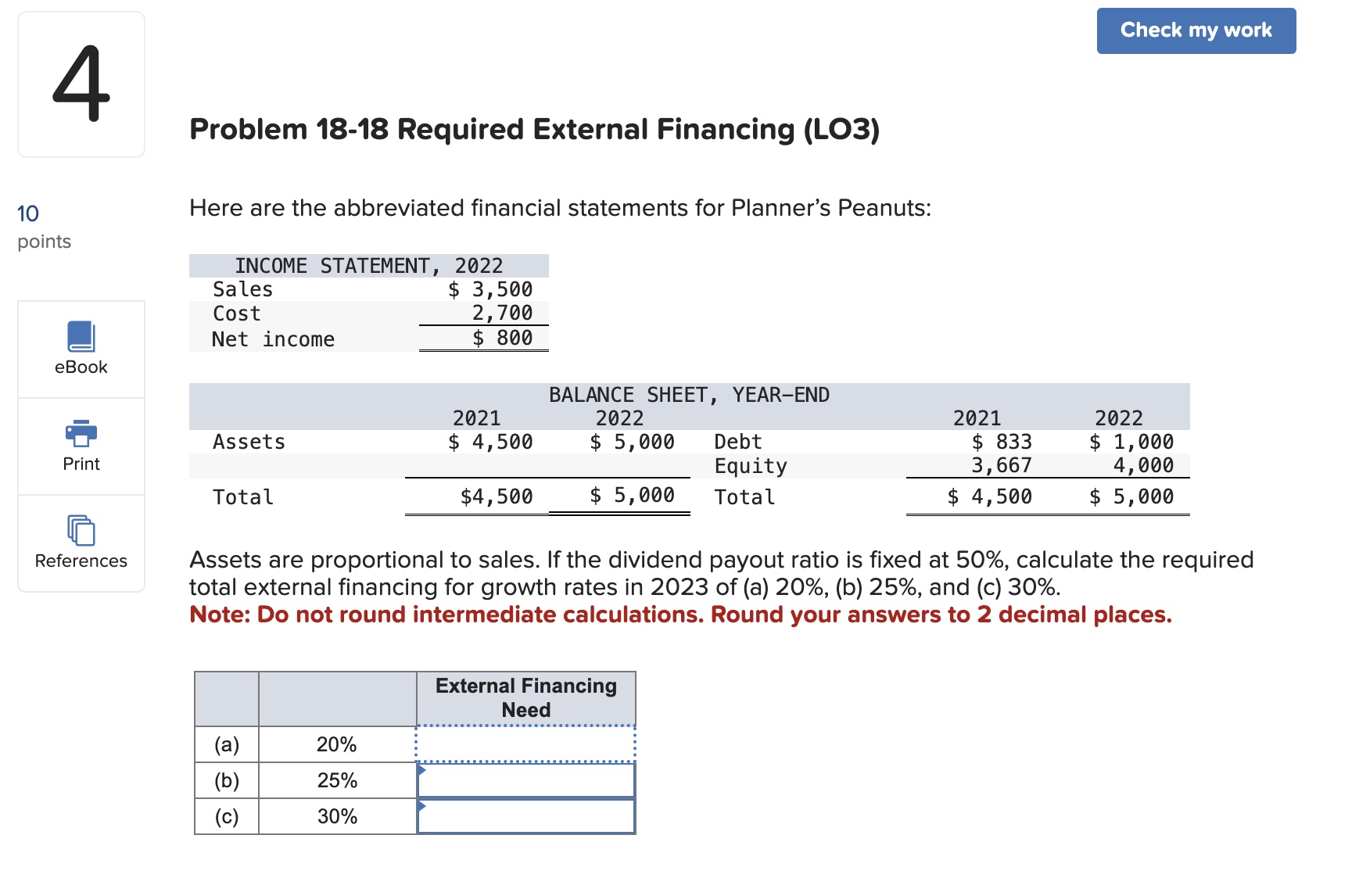

Question: 10 4 points Problem 18-18 Required External Financing (LO3) Here are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2022 Sales Cost Net

10 4 points Problem 18-18 Required External Financing (LO3) Here are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2022 Sales Cost Net income eBook $ 3,500 2,700 $ 800 Check my work 2021 Assets $ 4,500 BALANCE SHEET, YEAR-END 2022 $ 5,000 Print Total $4,500 $ 5,000 Debt Equity Total References 2021 $ 833 3,667 $ 4,500 2022 $ 1,000 4,000 $ 5,000 Assets are proportional to sales. If the dividend payout ratio is fixed at 50%, calculate the required total external financing for growth rates in 2023 of (a) 20%, (b) 25%, and (c) 30%. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. External Financing Need (a) 20% (b) 25% (c) 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts