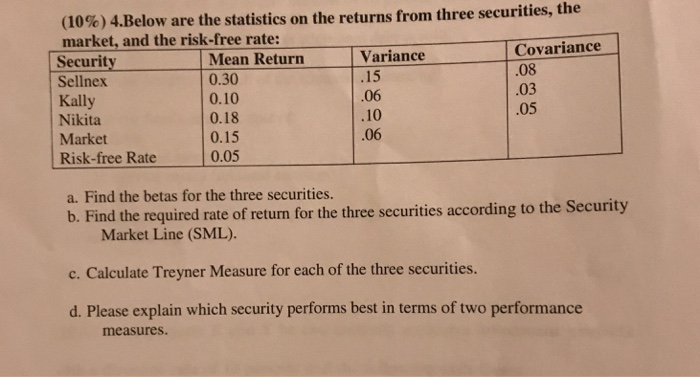

Question: (10%) 4.Below are the statistics on the returns from three securities, the market, and the risk-free rate: Security Sellnex Kally Nikita Market Risk-free Rate Mean

(10%) 4.Below are the statistics on the returns from three securities, the market, and the risk-free rate: Security Sellnex Kally Nikita Market Risk-free Rate Mean Return Variance 0.30 0.10 0.18 0.15 0.05 .15 .06 .10 06 Covariance .08 .03 .05 a. Find the betas for the three securities. b. Find the required rate of return for the three securities according to the Security c. Calculate Treyner Measure for each of the three securities. d. Please explain which security performs best in terms of two performance Market Line (SML). measures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts