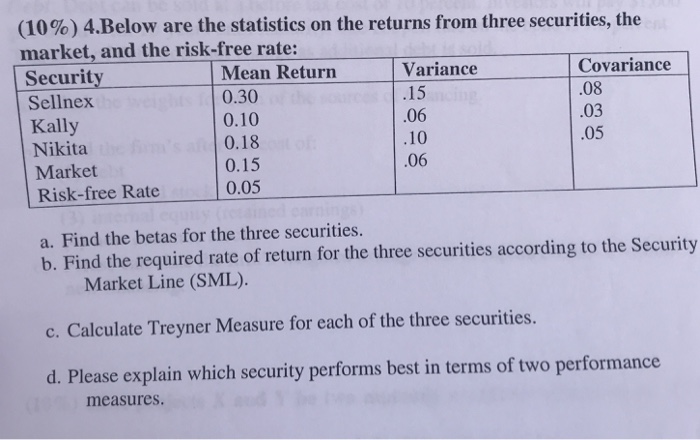

Question: (10%) 4.Below are the statistics on the returns from three securities, the market, and the risk-free rate: Security0.30 Variance 15 06 .10 06 Covariance .08

(10%) 4.Below are the statistics on the returns from three securities, the market, and the risk-free rate: Security0.30 Variance 15 06 .10 06 Covariance .08 .03 05 Mean Return Sellnex Kally Nikita Market Risk-free Rate 0.10 0.18 0.15 0.05 a. Find the betas for the three securities b. Find the required rate of return for the three securities according to the Security Market Line (SML). c. Calculate Treyner Measure for each of the three securities. d. Please explain which security performs best in terms of two performance measures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts