Question: 10. A $200,000 mortgage at 6.6% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to prepay up to 10%

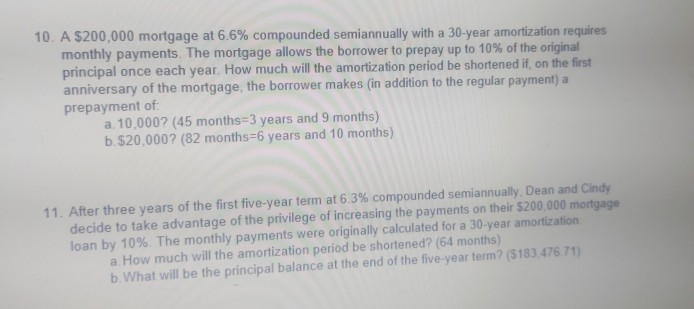

10. A $200,000 mortgage at 6.6% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to prepay up to 10% of the original principal once each year. How much will the amortization period be shortened if, on the first anniversary of the mortgage, the borrower makes (in addition to the regular payment) a prepayment of a 10,000? (45 months=3 years and 9 months) b. $20.000? (82 months=6 years and 10 months) 11. After three years of the first five-year term at 6.3% compounded semiannually. Dean and Cindy decide to take advantage of the privilege of increasing the payments on their $200,000 mortgage loan by 10%. The monthly payments were originally calculated for a 30-year amortization a How much will the amortization period be shortened? (64 months) b. What will be the principal balance at the end of the five-year term? (518347671)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts