Question: 10. An exchange traded fund(ETF) is a secunity that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio

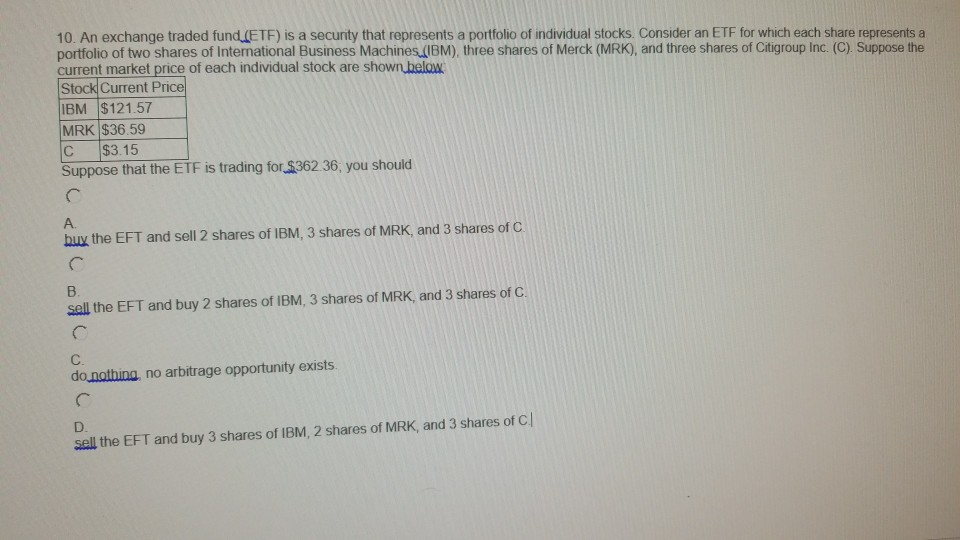

10. An exchange traded fund(ETF) is a secunity that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines.(BM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below Stock Current Price IBM $121.57 MRK $36.59 C $3.15 Suppose that the ETF is trading for $362 36, you should A. bux the EFT and sell 2 shares of IBM, 3 shares of MRK, and 3 shares of C sall the EFT and buy 2 shares of IBM, 3 shares of MRK, and 3 shares of C C. do notbina, no arbitrage opportunity exists D. sall the EFT and buy 3 shares of IBM, 2 shares of MRK, and 3 shares of Cl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts