Question: 10 Answer the following a. Suppose data are collected for a certain stock: Stock price Call price (1-year expiration, E $105) Put price (1-year expiration,

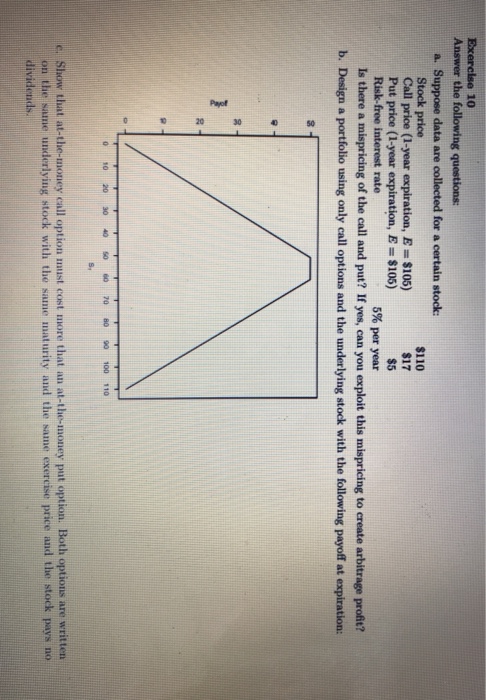

10 Answer the following a. Suppose data are collected for a certain stock: Stock price Call price (1-year expiration, E $105) Put price (1-year expiration, E 105) $110 $17 $5 5% per year Risk-free interest rate Is there a mispricing of the call and put? If yes, can you exploit this mispricing to create arbitrage proft? b. Design a portfolio using only call options and the underlying stock with the following payoff at expiration: 0 10 20 30 40 S0 6 70 0 90 100 110 c. Show that at-the-money call option must cost more that an at-the-money put option. Both options are written on the same underlying stock with the same maturity and the same exercise price and the stock pays no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts