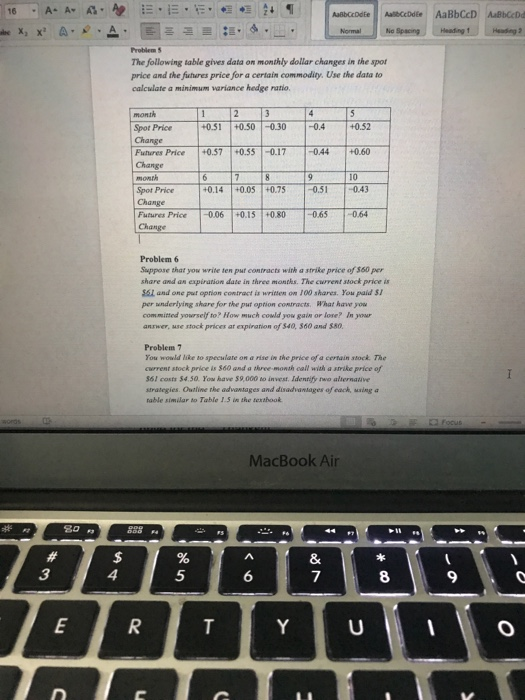

Question: The following table gives data on monthly dollar changes in the spor price and the fuhures price for a certain commodity. Use the data to

The following table gives data on monthly dollar changes in the spor price and the fuhures price for a certain commodity. Use the data to calculate a minimum variance hedge ratio monsh 2 35 |+0.5 1 0.301-0.4 0.17-1-044-T+0.60 Spot Price 1+0.52 +0.5+0.55 Fannes Price Change month Spot Price 10 +0.14 +0.05 +0.750.51-0.43 Futures Price 0.06 +0.15 +0.80 0.65 0.64 Problem 6 Suppose that you write ten put contracts with a strike price of $60 per share and an expiration date in three montks. The current stockprice is $61 and one put oprion contract is written on 100 shares. You paid $ per underlying share for the put eption committed yourself to? How much cowld yow gain or lose? In yowr anrwer, use stock prices ar expiration of $40, 360 and $80 contacts What have you Problem 7 You wowld like to speculate on a rise in the price of a certain stock The current stock price is 360 and a hree monsh call with a smike price of 361 costs $4.50. Yow have $9,000 to invest. Identify two alternative strategies. Outline the advantages and disadvantages of eack, uxing a table similar to Table 1.5 in the texthook MacBook Air #3 3 5 6 7 9 The following table gives data on monthly dollar changes in the spor price and the fuhures price for a certain commodity. Use the data to calculate a minimum variance hedge ratio monsh 2 35 |+0.5 1 0.301-0.4 0.17-1-044-T+0.60 Spot Price 1+0.52 +0.5+0.55 Fannes Price Change month Spot Price 10 +0.14 +0.05 +0.750.51-0.43 Futures Price 0.06 +0.15 +0.80 0.65 0.64 Problem 6 Suppose that you write ten put contracts with a strike price of $60 per share and an expiration date in three montks. The current stockprice is $61 and one put oprion contract is written on 100 shares. You paid $ per underlying share for the put eption committed yourself to? How much cowld yow gain or lose? In yowr anrwer, use stock prices ar expiration of $40, 360 and $80 contacts What have you Problem 7 You wowld like to speculate on a rise in the price of a certain stock The current stock price is 360 and a hree monsh call with a smike price of 361 costs $4.50. Yow have $9,000 to invest. Identify two alternative strategies. Outline the advantages and disadvantages of eack, uxing a table similar to Table 1.5 in the texthook MacBook Air #3 3 5 6 7 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts