Question: 10. Answer the questions below. (a) In the blank table below show the cash flows for the following four bonds, each of which has a

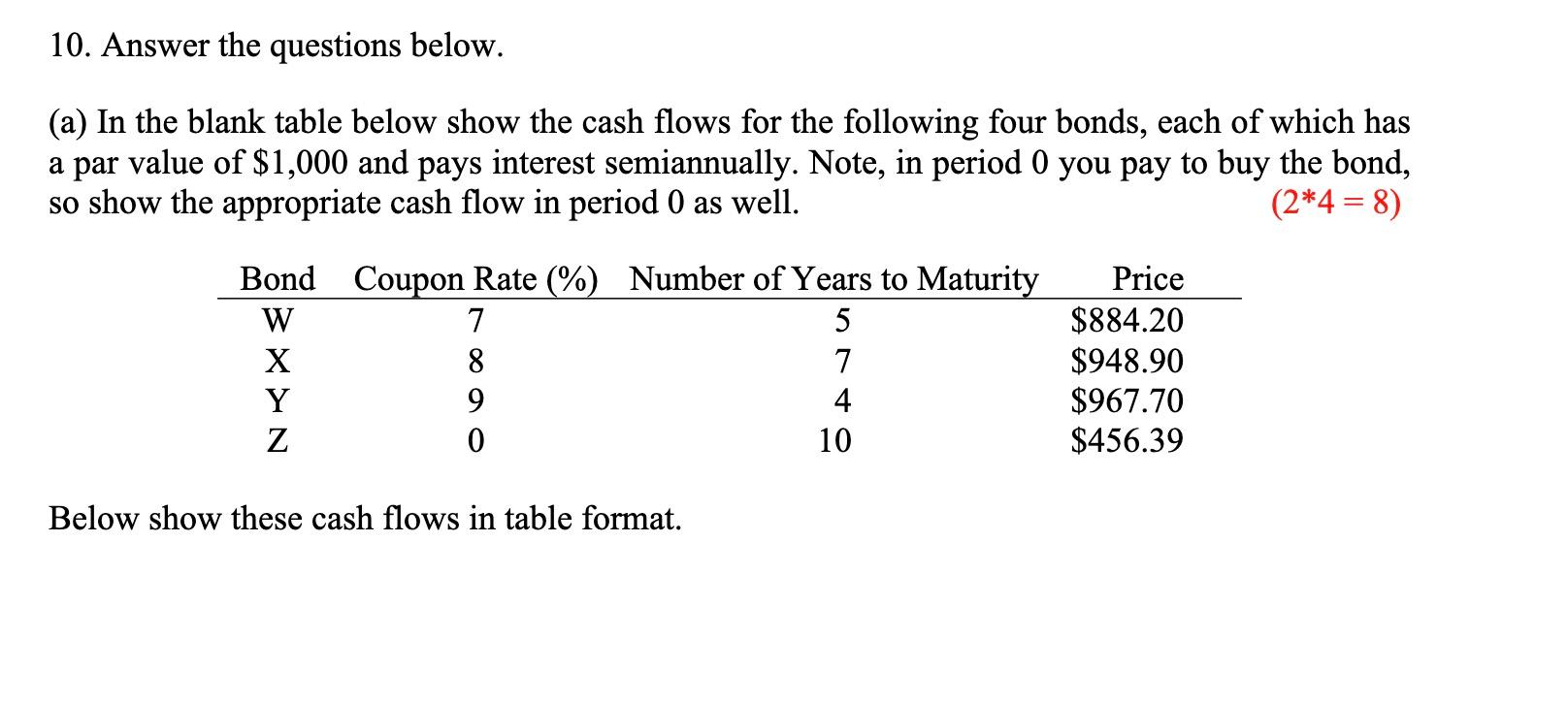

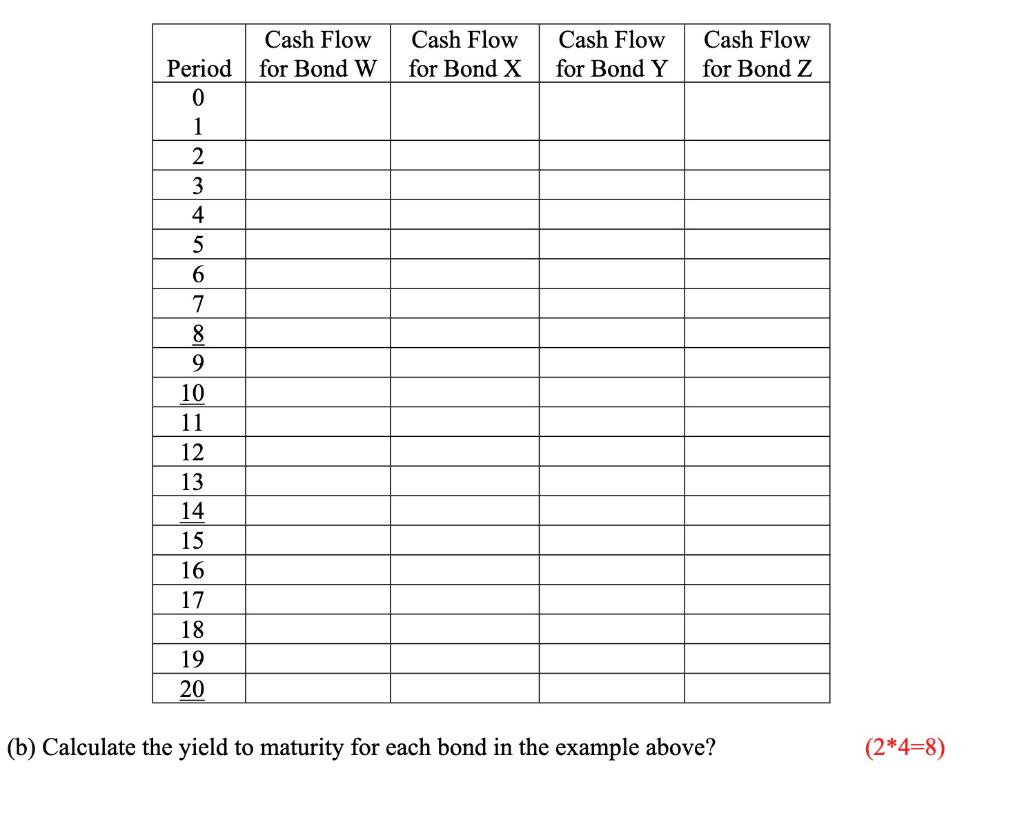

10. Answer the questions below. (a) In the blank table below show the cash flows for the following four bonds, each of which has a par value of $1,000 and pays interest semiannually. Note, in period 0 you pay to buy the bond, so show the appropriate cash flow in period 0 as well. (2*4 = 8) Bond Coupon Rate (%) Number of Years to Maturity W 7 5 X 8 7 Y 9 4 Z 0 10 Price $884.20 $948.90 $967.70 $456.39 Below show these cash flows in table format. Cash Flow for Bond W Cash Flow for Bond X Cash Flow for Bond Y Cash Flow for Bond Z Period 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 (b) Calculate the yield to maturity for each bond in the example above? (2*4=8) 10. Answer the questions below. (a) In the blank table below show the cash flows for the following four bonds, each of which has a par value of $1,000 and pays interest semiannually. Note, in period 0 you pay to buy the bond, so show the appropriate cash flow in period 0 as well. (2*4 = 8) Bond Coupon Rate (%) Number of Years to Maturity W 7 5 X 8 7 Y 9 4 Z 0 10 Price $884.20 $948.90 $967.70 $456.39 Below show these cash flows in table format. Cash Flow for Bond W Cash Flow for Bond X Cash Flow for Bond Y Cash Flow for Bond Z Period 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 (b) Calculate the yield to maturity for each bond in the example above? (2*4=8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts