Question: 10. black-scholes/options Problem 10. Consider a Black-Scholes model with o = 0.3, S(0) = 50, r = 0.05, 8 = 0.03. Suppose you use a

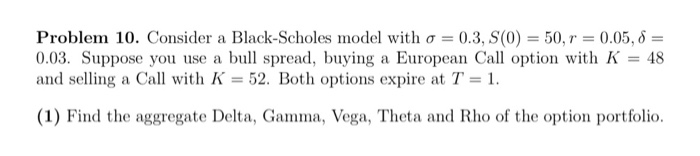

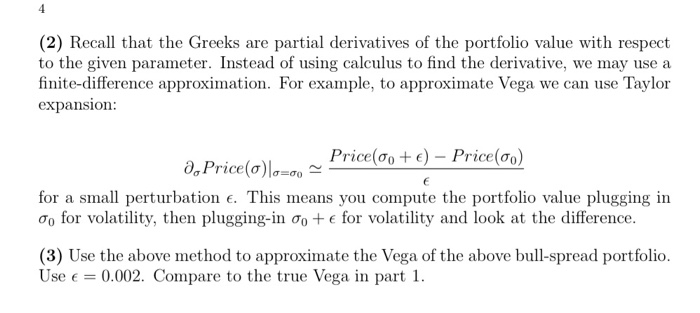

Problem 10. Consider a Black-Scholes model with o = 0.3, S(0) = 50, r = 0.05, 8 = 0.03. Suppose you use a bull spread, buying a European Call option with K = 48 and selling a Call with K = 52. Both options expire at T = 1. (1) Find the aggregate Delta, Gamma, Vega, Theta and Rho of the option portfolio. 4 (2) Recall that the Greeks are partial derivatives of the portfolio value with respect to the given parameter. Instead of using calculus to find the derivative, we may use a finite-difference approximation. For example, to approximate Vega we can use Taylor expansion: Price(00 + ) - Price(oo) 2. Price(o)lo=00 for a small perturbation e. This means you compute the portfolio value plugging in 0, for volatility, then plugging-in 0o + e for volatility and look at the difference. (3) Use the above method to approximate the Vega of the above bull-spread portfolio. Use = 0.002. Compare to the true Vega in part 1. Problem 10. Consider a Black-Scholes model with o = 0.3, S(0) = 50, r = 0.05, 8 = 0.03. Suppose you use a bull spread, buying a European Call option with K = 48 and selling a Call with K = 52. Both options expire at T = 1. (1) Find the aggregate Delta, Gamma, Vega, Theta and Rho of the option portfolio. 4 (2) Recall that the Greeks are partial derivatives of the portfolio value with respect to the given parameter. Instead of using calculus to find the derivative, we may use a finite-difference approximation. For example, to approximate Vega we can use Taylor expansion: Price(00 + ) - Price(oo) 2. Price(o)lo=00 for a small perturbation e. This means you compute the portfolio value plugging in 0, for volatility, then plugging-in 0o + e for volatility and look at the difference. (3) Use the above method to approximate the Vega of the above bull-spread portfolio. Use = 0.002. Compare to the true Vega in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts