Question: Consider a Black-Scholes model with sigma = 0.3, S(0) = 50, r = 0.05, delta = 0.03. Suppose you use a bull spread, buying a

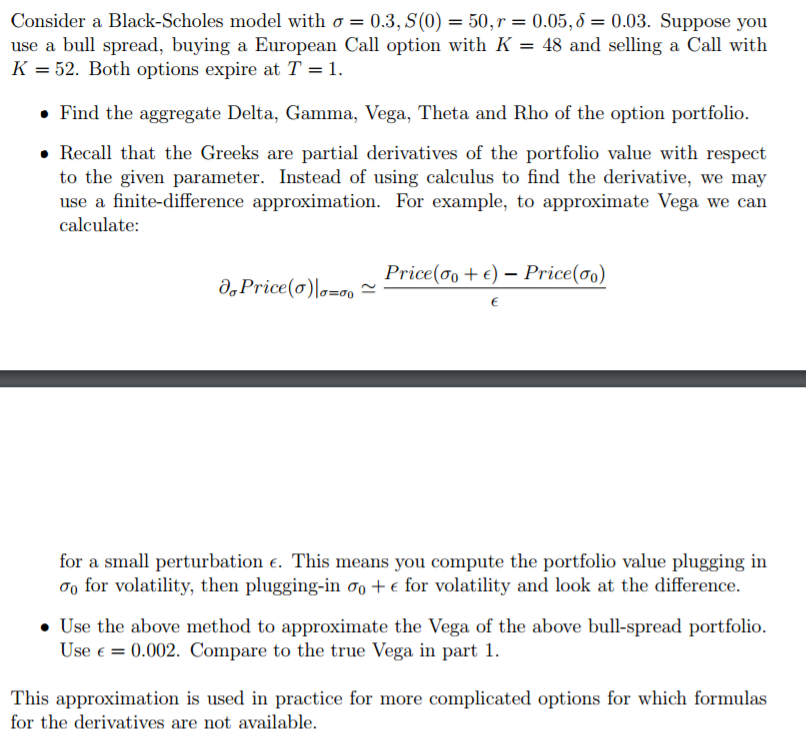

Consider a Black-Scholes model with sigma = 0.3, S(0) = 50, r = 0.05, delta = 0.03. Suppose you use a bull spread, buying a European Call option with K = 48 and selling a Call with K = 52. Both options expire at T = 1. Find the aggregate Delta, Gamma, Vega, Theta and Rho of the option portfolio. Recall that the Greeks are partial derivatives of the portfolio value with respect to the given parameter. Instead of using calculus to find the derivative, we may use a finite-difference approximation. For example, to approximate Vega we can calculate: partial differential_sigma Price (sigma)|_sigma = sigma_0 Price (sigma_0 + elementof) - Price (sigma_0)/elementof for a small perturbation elementof. This means you compute the portfolio value plugging in sigma_0 for volatility, then plugging-in sigma_0 + elementof for volatility and look at the difference. Use the above method to approximate the Vega of the above bull-spread portfolio. Use elementof = 0.002. Compare to the true Vega in part 1. This approximation is used in practice for more complicated options for which formulas for the derivatives are not available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts