Question: 10. Explain how Treasury notes and bonds are quoted and how to translate those quotes into the market price. 11. If nominal interest rate is

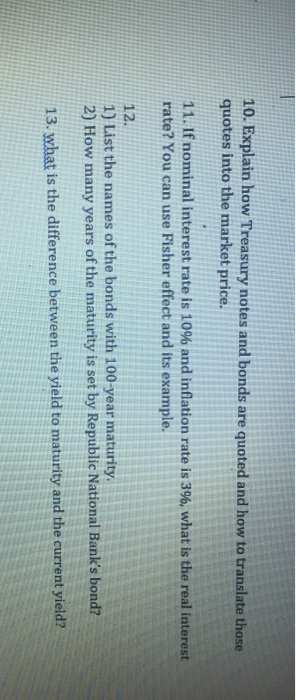

10. Explain how Treasury notes and bonds are quoted and how to translate those quotes into the market price. 11. If nominal interest rate is 10% and inflation rate is 3%, what is the real interest rate? You can use Fisher effect and its example. 12. 1) List the names of the bonds with 100-year maturity. 2) How many years of the maturity is set by Republic National Bank's bond? 13. what is the difference between the yield to maturity and the current yield

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock