Question: 10. Given the financial statements provided in the appendix for Ford Motors Inc and Tesla Inc: i. Calculate the cash conversion cycle for Ford and

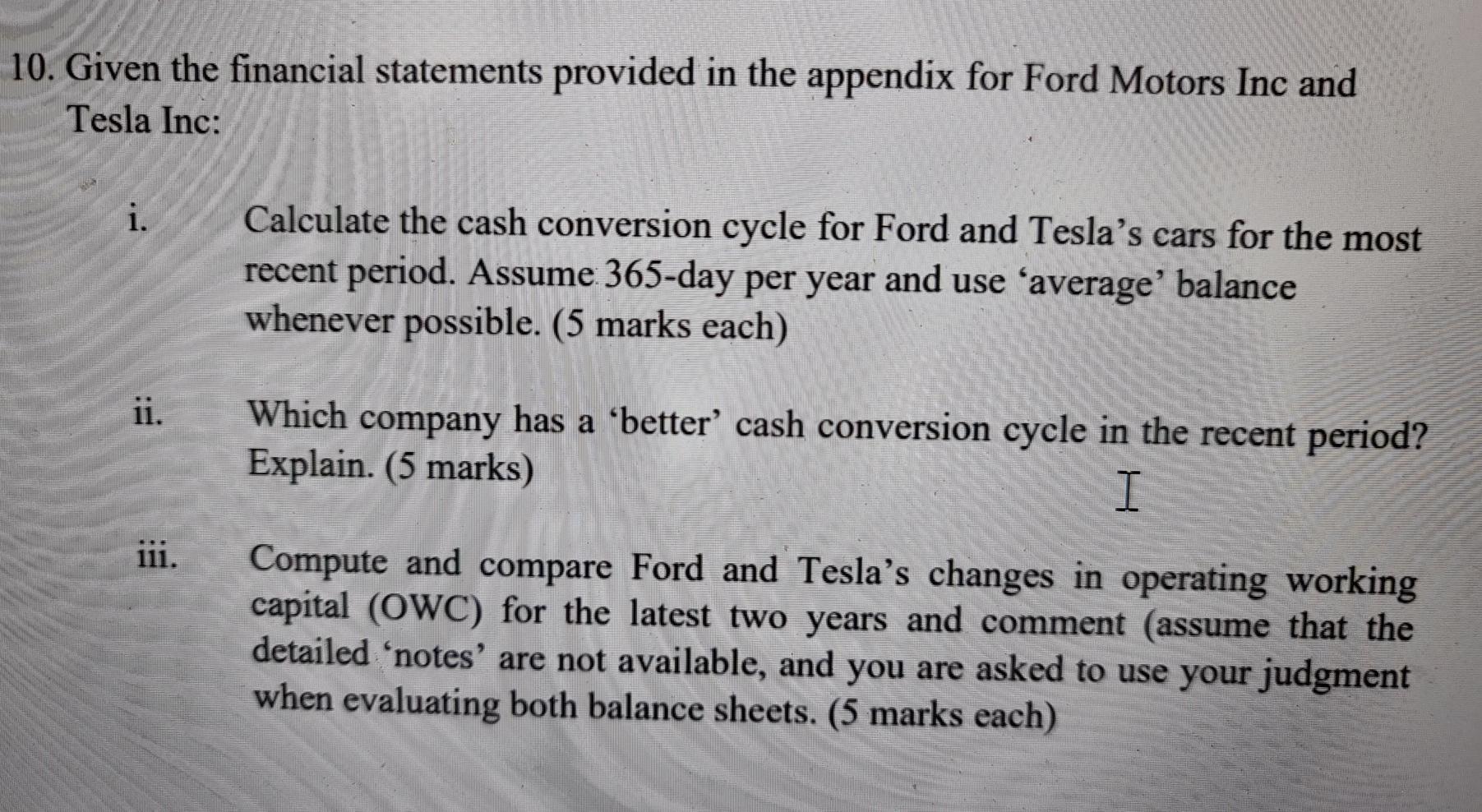

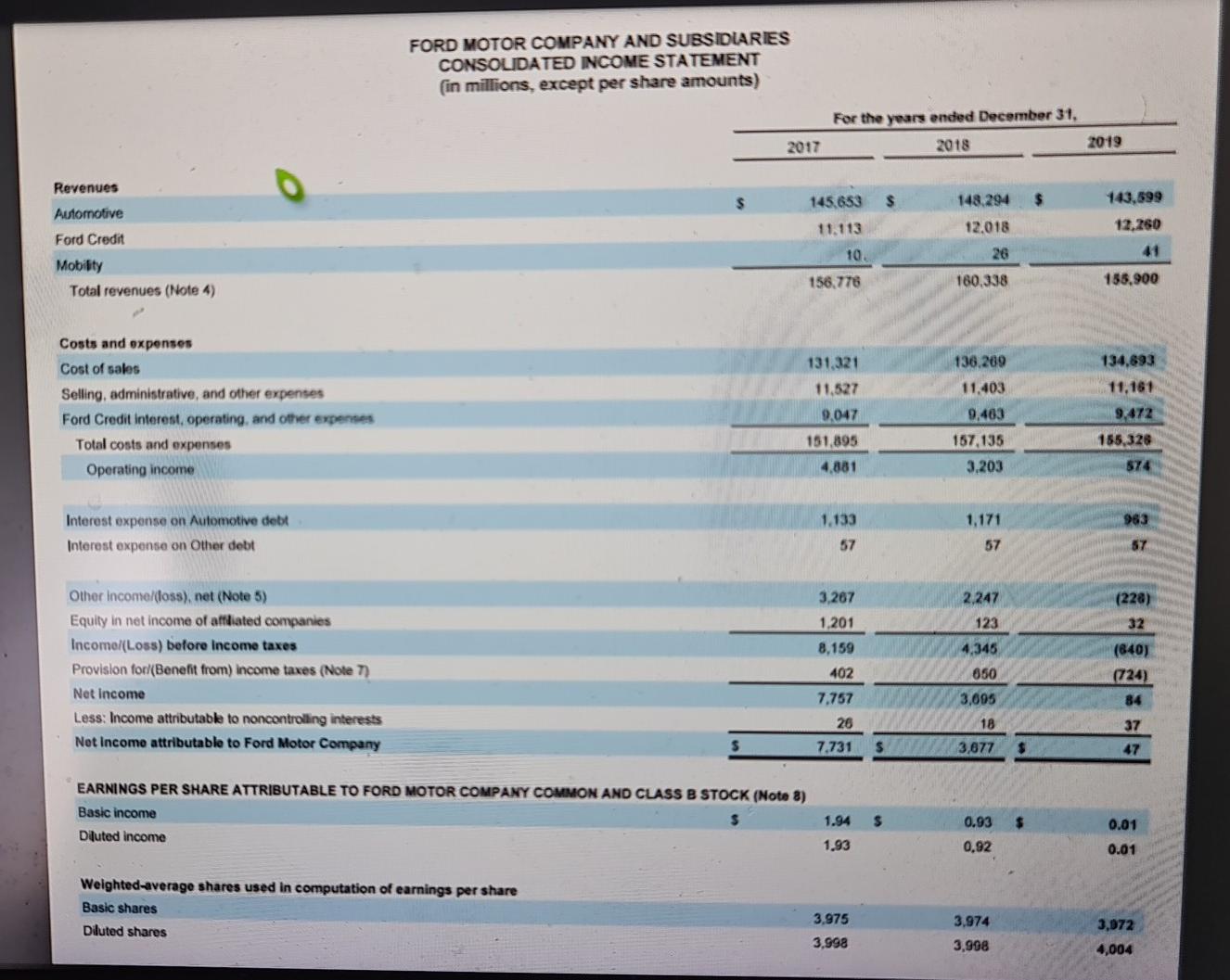

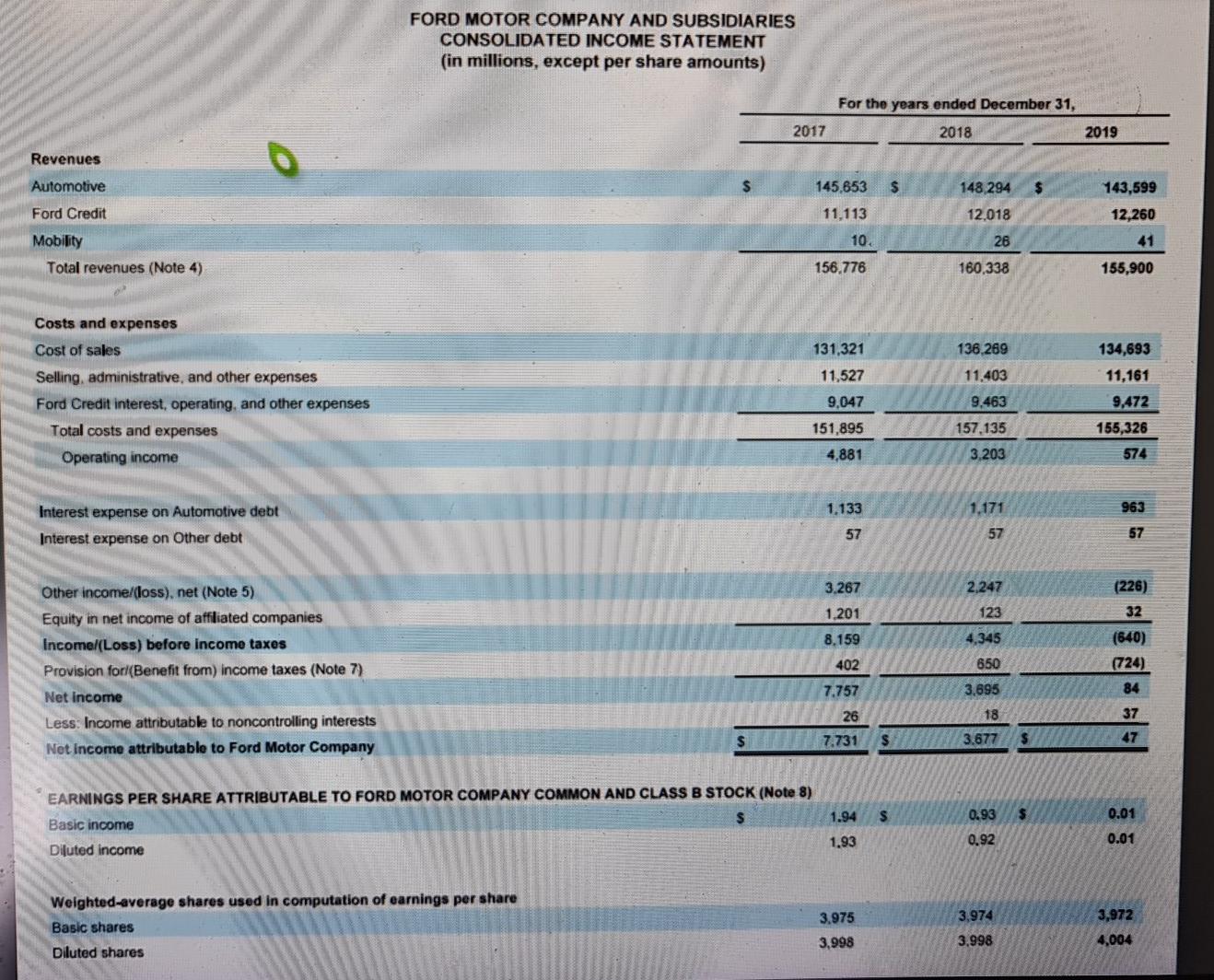

10. Given the financial statements provided in the appendix for Ford Motors Inc and Tesla Inc: i. Calculate the cash conversion cycle for Ford and Tesla's cars for the most recent period. Assume 365-day per year and use average' balance whenever possible. (5 marks each) ii. Which company has a better cash conversion cycle in the recent period? Explain. (5 marks) I iii. Compute and compare Ford and Tesla's changes in operating working capital (OWC) for the latest two years and comment (assume that the detailed 'notes' are not available, and you are asked to use your judgment when evaluating both balance sheets. (5 marks each) FORD MOTOR COMPANY AND SURSDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 s 145.653 $ 143,599 148.294 12.018 11.113 12,260 Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 10 26 41 156.776 160.338 155,900 131,321 136,209 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit Interest, operating, and other expenses Total costs and expenses Operating income 11.527 9.047 151.895 4,881 11.403 9.403 157,135 3.203 134,893 11,161 9.472 155,328 574 1,171 983 Interest expense on Automotive debit Interest expense on other debt 1.133 57 57 57 3.267 1,201 2,247 123 4,345 Other income foss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision forl(Benefit from) income taxes (Note 7) Net Income Less: Income attributable to noncontrolling interests Net Income attributable to Ford Motor Company (228) 32 (640) (724) 84 8.159 402 7.757 26 7.731 650 3,095 18 37 $ 3,677 47 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS E STOCK (Note 3) Basic income 1.94 $ 0.93 $ Diluted Income 0.01 0.01 1,93 0.92 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3.975 3.974 3,908 3,998 3,072 4,004 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 Revenues Automotive $ 145,653 $ 148 294 $ 143,599 12,260 Ford Credit 11,113 12.018 Mobility 10. 26 41 Total revenues (Note 4) 156.776 160,338 155,900 136.269 131,321 11,527 11.403 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses Operating income 134,693 11,161 9,472 9.047 9.463 151,895 157.135 3.203 155,326 574 4,881 1.133 1,171 963 Interest expense on Automotive debt Interest expense on Other debt 57 57 57 3,267 2,247 (226) 1,201 123 8.159 4,345 32 (640) (724) 402 650 Other income/(loss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision forl(Benefit from) income taxes (Note 7) Net Income Less: Income attributable to noncontrolling interests Net Income attributable to Ford Motor Company 7.757 3.695 84 26 18 37 $ 7.731 $ 3,677 47 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income Diluted income 1.94 $ 0.93 $ 0.01 1.93 0.92 0.01 3,974 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3.975 3,998 3,972 4,004 3,998 10. Given the financial statements provided in the appendix for Ford Motors Inc and Tesla Inc: i. Calculate the cash conversion cycle for Ford and Tesla's cars for the most recent period. Assume 365-day per year and use average' balance whenever possible. (5 marks each) ii. Which company has a better cash conversion cycle in the recent period? Explain. (5 marks) I iii. Compute and compare Ford and Tesla's changes in operating working capital (OWC) for the latest two years and comment (assume that the detailed 'notes' are not available, and you are asked to use your judgment when evaluating both balance sheets. (5 marks each) FORD MOTOR COMPANY AND SURSDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 s 145.653 $ 143,599 148.294 12.018 11.113 12,260 Revenues Automotive Ford Credit Mobility Total revenues (Note 4) 10 26 41 156.776 160.338 155,900 131,321 136,209 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit Interest, operating, and other expenses Total costs and expenses Operating income 11.527 9.047 151.895 4,881 11.403 9.403 157,135 3.203 134,893 11,161 9.472 155,328 574 1,171 983 Interest expense on Automotive debit Interest expense on other debt 1.133 57 57 57 3.267 1,201 2,247 123 4,345 Other income foss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision forl(Benefit from) income taxes (Note 7) Net Income Less: Income attributable to noncontrolling interests Net Income attributable to Ford Motor Company (228) 32 (640) (724) 84 8.159 402 7.757 26 7.731 650 3,095 18 37 $ 3,677 47 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS E STOCK (Note 3) Basic income 1.94 $ 0.93 $ Diluted Income 0.01 0.01 1,93 0.92 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3.975 3.974 3,908 3,998 3,072 4,004 FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2017 2018 2019 Revenues Automotive $ 145,653 $ 148 294 $ 143,599 12,260 Ford Credit 11,113 12.018 Mobility 10. 26 41 Total revenues (Note 4) 156.776 160,338 155,900 136.269 131,321 11,527 11.403 Costs and expenses Cost of sales Selling, administrative, and other expenses Ford Credit interest, operating, and other expenses Total costs and expenses Operating income 134,693 11,161 9,472 9.047 9.463 151,895 157.135 3.203 155,326 574 4,881 1.133 1,171 963 Interest expense on Automotive debt Interest expense on Other debt 57 57 57 3,267 2,247 (226) 1,201 123 8.159 4,345 32 (640) (724) 402 650 Other income/(loss), net (Note 5) Equity in net income of affiliated companies Income/(Loss) before income taxes Provision forl(Benefit from) income taxes (Note 7) Net Income Less: Income attributable to noncontrolling interests Net Income attributable to Ford Motor Company 7.757 3.695 84 26 18 37 $ 7.731 $ 3,677 47 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK (Note 8) Basic income Diluted income 1.94 $ 0.93 $ 0.01 1.93 0.92 0.01 3,974 Weighted average shares used in computation of earnings per share Basic shares Diluted shares 3.975 3,998 3,972 4,004 3,998

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts