Question: 10. In a typical loan amortization schedule, the dollar amount of interest paid each period: a. decreases with each payment. b. increases with each

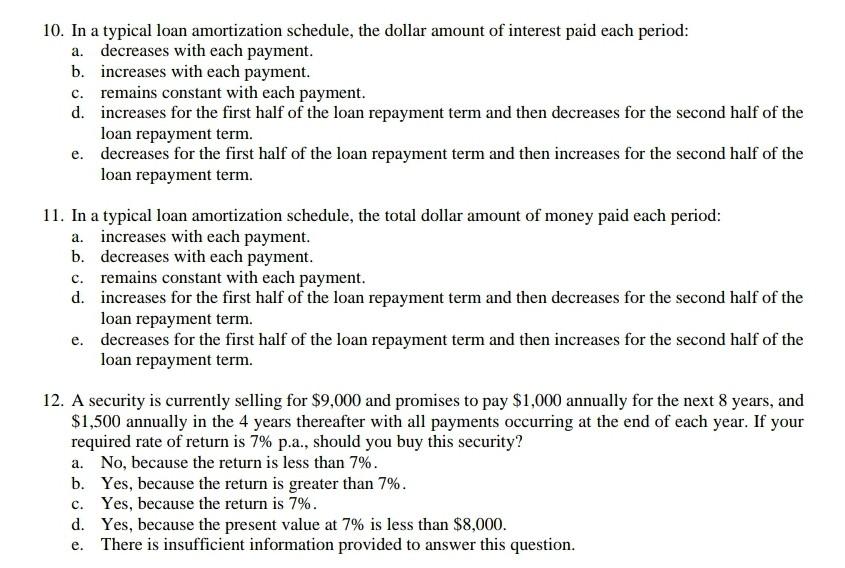

10. In a typical loan amortization schedule, the dollar amount of interest paid each period: a. decreases with each payment. b. increases with each payment. c. remains constant with each payment. d. increases for the first half of the loan repayment term and then decreases for the second half of the loan repayment term. e. decreases for the first half of the loan repayment term and then increases for the second half of the loan repayment term. 11. In a typical loan amortization schedule, the total dollar amount of money paid each period: a. increases with each payment. b. decreases with each payment. c. remains constant with each payment. d. increases for the first half of the loan repayment term and then decreases for the second half of the loan repayment term. e. decreases for the first half of the loan repayment term and then increases for the second half of the loan repayment term. 12. A security is currently selling for $9,000 and promises to pay $1,000 annually for the next 8 years, and $1,500 annually in the 4 years thereafter with all payments occurring at the end of each year. If your required rate of return is 7% p.a., should you buy this security? a. No, because the return is less than 7%. b. Yes, because the return is greater than 7%. c. Yes, because the return is 7%. d. Yes, because the present value at 7% is less than $8,000. e. There is insufficient information provided to answer this question.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

10 In a typical loan amortization schedule the dollar amount of interest paid each period The correct option is Option a ie Decrease with each payment ... View full answer

Get step-by-step solutions from verified subject matter experts