Question: 10. Inputs for WACC (Re computed using CAPM only) LT Debt: 8000 bonds outstanding of a 5-year maturity; 1015 = PV; 4.2% = Coupon Rate

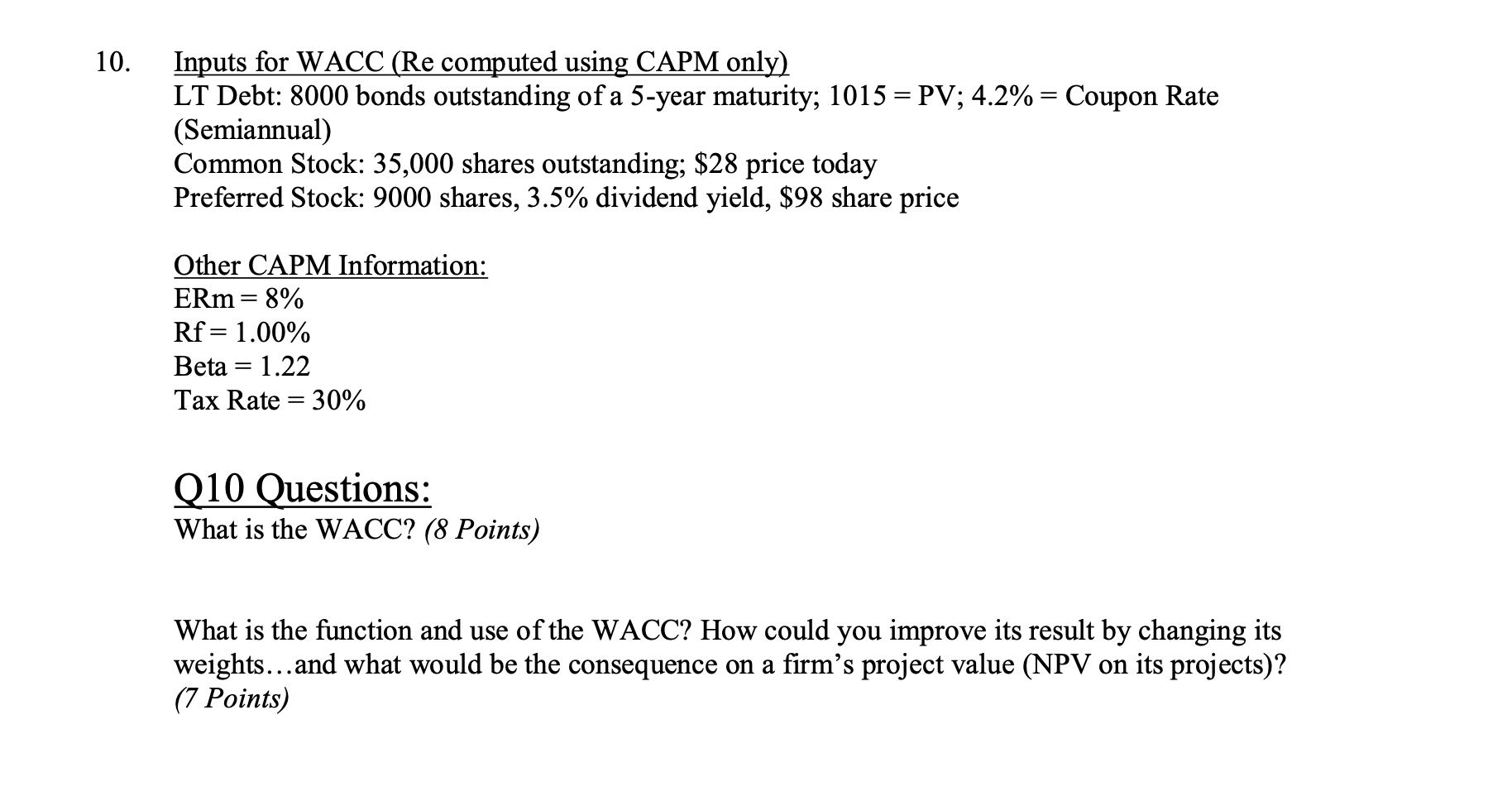

10. Inputs for WACC (Re computed using CAPM only) LT Debt: 8000 bonds outstanding of a 5-year maturity; 1015 = PV; 4.2% = Coupon Rate (Semiannual) Common Stock: 35,000 shares outstanding; $28 price today Preferred Stock: 9000 shares, 3.5% dividend yield, $98 share price Other CAPM Information: ERm= 8% Rf= 1.00% Beta = 1.22 Tax Rate = 30% Q10 Questions: What is the WACC? (8 Points) What is the function and use of the WACC? How could you improve its result by changing its weights...and what would be the consequence on a firm's project value (NPV on its projects)? (7 Points) 10. Inputs for WACC (Re computed using CAPM only) LT Debt: 8000 bonds outstanding of a 5-year maturity; 1015 = PV; 4.2% = Coupon Rate (Semiannual) Common Stock: 35,000 shares outstanding; $28 price today Preferred Stock: 9000 shares, 3.5% dividend yield, $98 share price Other CAPM Information: ERm= 8% Rf= 1.00% Beta = 1.22 Tax Rate = 30% Q10 Questions: What is the WACC? (8 Points) What is the function and use of the WACC? How could you improve its result by changing its weights...and what would be the consequence on a firm's project value (NPV on its projects)? (7 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts