Question: (10 marks) Avadi Ltd. purchased $200,000 face value 7% bonds on June 1, 2019. Interest on the bonds will be paid semi-annually on May 31st

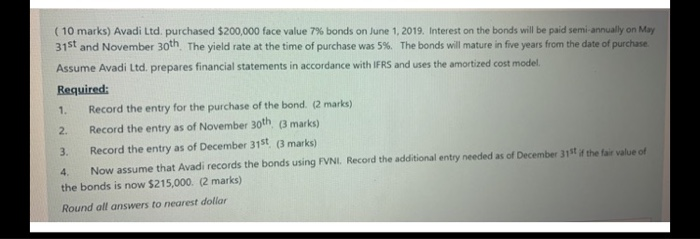

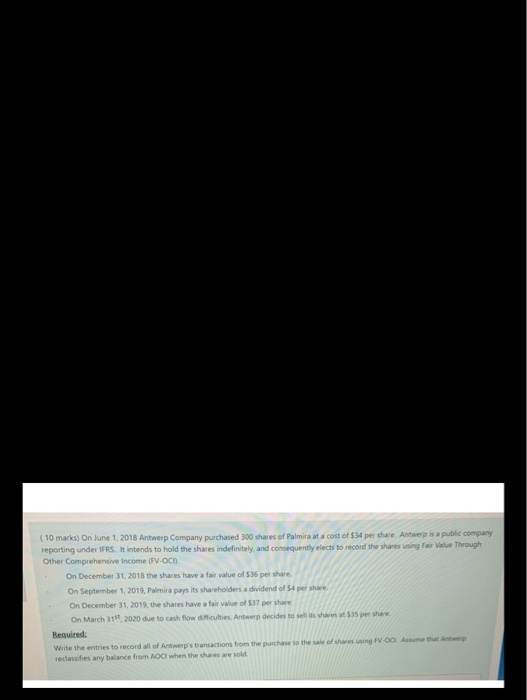

(10 marks) Avadi Ltd. purchased $200,000 face value 7% bonds on June 1, 2019. Interest on the bonds will be paid semi-annually on May 31st and November 30th The yield rate at the time of purchase was 5%. The bonds will mature in five years from the date of purchase Assume Avadi Ltd. prepares financial statements in accordance with IFRS and uses the amortized cost model Required: 1. Record the entry for the purchase of the bond. (2 marks) 2. Record the entry as of November 30th (3 marks) 3. Record the entry as of December 315 3 marks) 4. Now assume that Avadi records the bonds using FVNI Record the additional entry needed as of December 311 if the fair value of the bonds is now $215,000 (2 marks) Round all answers to nearest dollar company through (10 marks) on June 1, 2018 Antwerp Company purchased 300 shares of Palmira at a cost of $34 per Share Antwerp is a reporting under FS It intends to hold the shares indefinitely and consequently elects to record the shares using Other Comprehensive Income FV-OCH On December 31, 2015 the shares have a fair value of 536 per share On September 1, 2011. Palmira pay it sholders a dividend of 4 pershe On December 31, 2011, the shares have a value of 537 per share On March 31, 2020 de to cash flow does. A decides to s h are Red with to record of A pstations to the purchase to the VOL A e n blance to when the shares sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts