Question: (10 marks) Avadi Ltd. purchased $200,000 face value 7% bonds on June 1, 2019. Interest on the bonds will be paid semi-annually on May 31st

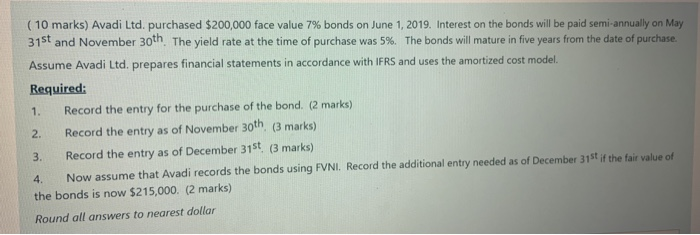

(10 marks) Avadi Ltd. purchased $200,000 face value 7% bonds on June 1, 2019. Interest on the bonds will be paid semi-annually on May 31st and November 30th The yield rate at the time of purchase was 5%. The bonds will mature in five years from the date of purchase Assume Avadi Ltd. prepares financial statements in accordance with IFRS and uses the amortized cost model. Required: 1. Record the entry for the purchase of the bond. (2 marks) 2. Record the entry as of November 30th (3 marks) 3. Record the entry as of December 315 (3 marks) 4. Now assume that Avadi records the bonds using FVNI. Record the additional entry needed as of December 31st if the fair value of the bonds is now $215,000. (2 marks) Round all answers to nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts