Question: (10 marks) Part I: Multiple Choice Questions Circle the most appropriate answer. I mark each. 1. Which of the following statement(s) is (are) true regarding

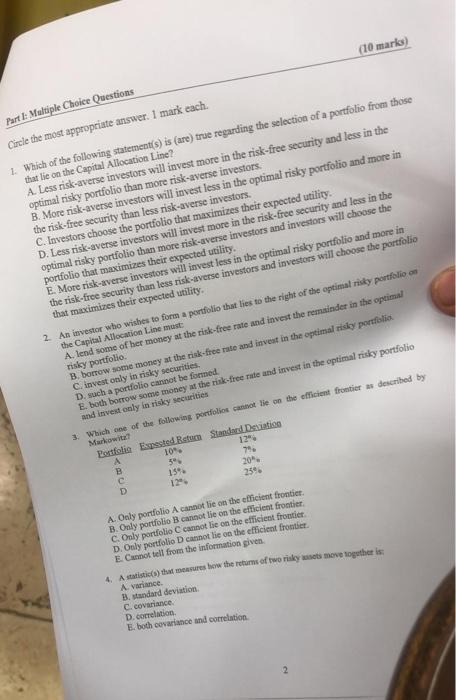

(10 marks) Part I: Multiple Choice Questions Circle the most appropriate answer. I mark each. 1. Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line? A. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors. B. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. C. Investors choose the portfolio that maximizes their expected utility. D. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors and investors will choose the portfolio that maximizes their expected utility. E. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors and investors will choose the portfolio that maximizes their expected utility. 2. An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must A. lend some of her money at the risk-free rate and invest the remainder in the optimal risky portfolio. B. borrow some money at the risk-free rate and invest in the optimal risky portfolio. C. invest only in risky securities. D. such a portfolio cannot be formed. E. both borrow some money at the risk-free rate and invest in the optimal risky portfolio and invest only in risky securities 3. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz Portfolia Espested Return Standard Deviation A 10% 12% 3% 7% 15% 20% D 12% 25% A. Only portfolio A cannot lie on the efficient frontier. B. Only portfolio B cannot lie on the efficient frontier C. Only portfolio C cannot lie on the efficient frontier D. Only portfolio D cannot lie on the efficient frontier E. Cannot tell from the information given. 4. A statistic(s) that measures how the returns of two risky assets move together is: A. variance B. standard deviation C. covariance D. correlation E. both covariance and correlation BU8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts