Question: (10 marks) Part I: Multiple Choice Questions Circle the most appropriate answer. I mark each. 1. Which of the following statement(s) is (are) true regarding

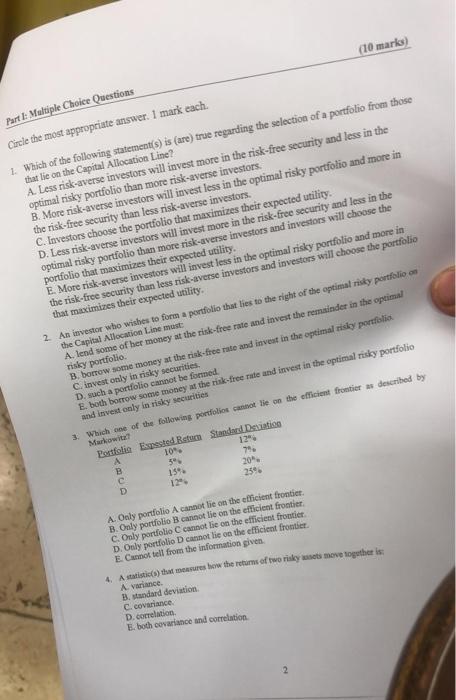

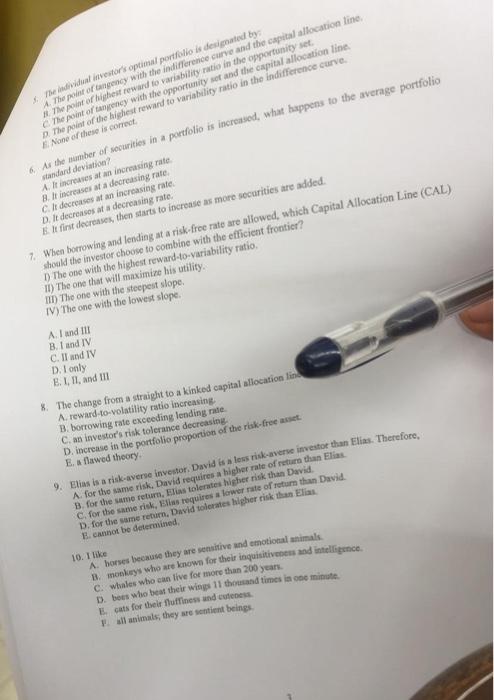

(10 marks) Part I: Multiple Choice Questions Circle the most appropriate answer. I mark each. 1. Which of the following statement(s) is (are) true regarding the selection of a portfolio from those that lie on the Capital Allocation Line? A. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors. B. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. C. Investors choose the portfolio that maximizes their expected utility. D. Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors and investors will choose the portfolio that maximizes their expected utility. E. More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors and investors will choose the portfolio that maximizes their expected utility. 2. An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must A. lend some of her money at the risk-free rate and invest the remainder in the optimal risky portfolio. B. borrow some money at the risk-free rate and invest in the optimal risky portfolio. C. invest only in risky securities. D. such a portfolio cannot be formed. E. both borrow some money at the risk-free rate and invest in the optimal risky portfolio and invest only in risky securities 3. Which one of the following portfolios cannot lie on the efficient frontier as described by Markowitz Portfolia Espested Return Standard Deviation A 10% 12% 3% 7% 15% 20% D 12% 25% A. Only portfolio A cannot lie on the efficient frontier. B. Only portfolio B cannot lie on the efficient frontier C. Only portfolio C cannot lie on the efficient frontier D. Only portfolio D cannot lie on the efficient frontier E. Cannot tell from the information given. 4. A statistic(s) that measures how the returns of two risky assets move together is: A. variance B. standard deviation C. covariance D. correlation E. both covariance and correlation BU8 5. The individual investor's optimal portfolio is designated by: A. The point of tangency with the indifference curve and the capital allocation line, B. The point of highest reward to variability ratio in the opportunity set. C. The point of tangency with the opportunity set and the capital allocation line. D. The point of the highest reward to variability ratio in the indifference curve. E None of these is correct. 6. As the number of securities in a portfolio is increased, what happens to the average portfolio standard deviation? A. It increases at an increasing rate B. It increases at a decreasing rate. C. It decreases at an increasing rate. D. It decreases at a decreasing rate. It first decreases, then starts to increase as more securities are added. 7. When borrowing and lending at a risk-free rate are allowed, which Capital Allocation Line (CAL) should the investor choose to combine with the efficient frontier? 1) The one with the highest reward-to-variability ratio. II) The one that will maximize his utility. III) The one with the steepest slope. IV) The one with the lowest slope. A. I and III B. I and IV C. II and IV D. I only E. I, II, and III 8. The change from a straight to a kinked capital allocation lin A. reward-to-volatility ratio increasing. B. borrowing rate exceeding lending rate C. an investor's risk tolerance decreasing. D. increase in the portfolio proportion of the risk-free asset. E. a flawed theory. 9. Elias is a risk-averse investor. David is a less risk-averse investor than Elias. Therefore, A. for the same risk, David requires a higher rate of return than Elias B. for the same return, Elias tolerates higher risk than David. C. for the same risk, Elias requires a lower rate of return than David. D. for the same return, David tolerates higher risk than Elias E. cannot be determined. 10. I like A. horses because they are sensitive and emotional animals. B. monkeys who are known for their inquisitiveness and intelligence. C. whales who can live for more than 200 years. D. bees who beat their wings 11 thousand times in one minute. E. cats for their fluffiness and cuteness. F. all animals, they are sentient beings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts