Question: 10 Paste Font Paragraph Styles Editing 2. Create and Share Request Adobe PDF Signatures Dictate Editor Reuse Files Clipboard Styles Adobe Acrobat Voice Editor Reuse

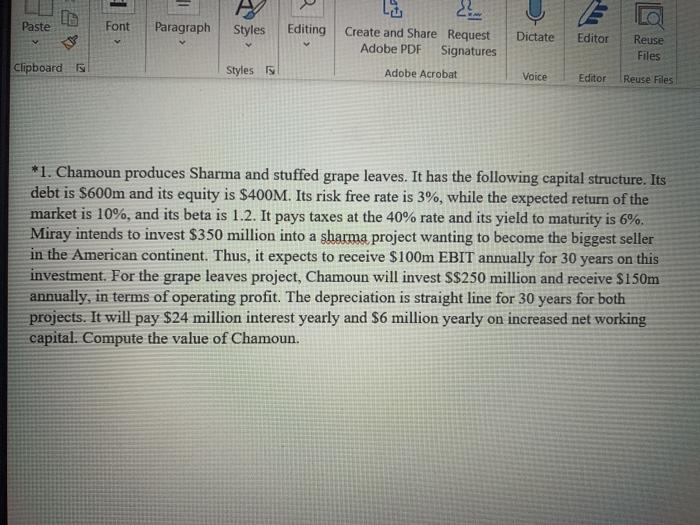

10 Paste Font Paragraph Styles Editing 2. Create and Share Request Adobe PDF Signatures Dictate Editor Reuse Files Clipboard Styles Adobe Acrobat Voice Editor Reuse Files *1. Chamoun produces Sharma and stuffed grape leaves. It has the following capital structure. Its debt is $600m and its equity is $400M. Its risk free rate is 3%, while the expected return of the market is 10%, and its beta is 1.2. It pays taxes at the 40% rate and its yield to maturity is 6%. Miray intends to invest $350 million into a sharma project wanting to become the biggest seller in the American continent. Thus, it expects to receive $100m EBIT annually for 30 years on this investment. For the grape leaves project, Chamoun will invest S$250 million and receive $150m annually, in terms of operating profit. The depreciation is straight line for 30 years for both projects. It will pay $24 million interest yearly and $6 million yearly on increased net working capital. Compute the value of Chamoun. 10 Paste Font Paragraph Styles Editing 2. Create and Share Request Adobe PDF Signatures Dictate Editor Reuse Files Clipboard Styles Adobe Acrobat Voice Editor Reuse Files *1. Chamoun produces Sharma and stuffed grape leaves. It has the following capital structure. Its debt is $600m and its equity is $400M. Its risk free rate is 3%, while the expected return of the market is 10%, and its beta is 1.2. It pays taxes at the 40% rate and its yield to maturity is 6%. Miray intends to invest $350 million into a sharma project wanting to become the biggest seller in the American continent. Thus, it expects to receive $100m EBIT annually for 30 years on this investment. For the grape leaves project, Chamoun will invest S$250 million and receive $150m annually, in terms of operating profit. The depreciation is straight line for 30 years for both projects. It will pay $24 million interest yearly and $6 million yearly on increased net working capital. Compute the value of Chamoun

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts