Question: help need all 3 !! AutoSave Chapter 9 Activity 2 - C.Saved - a File Home Insert Draw Design Layout References Mailings Review View Help

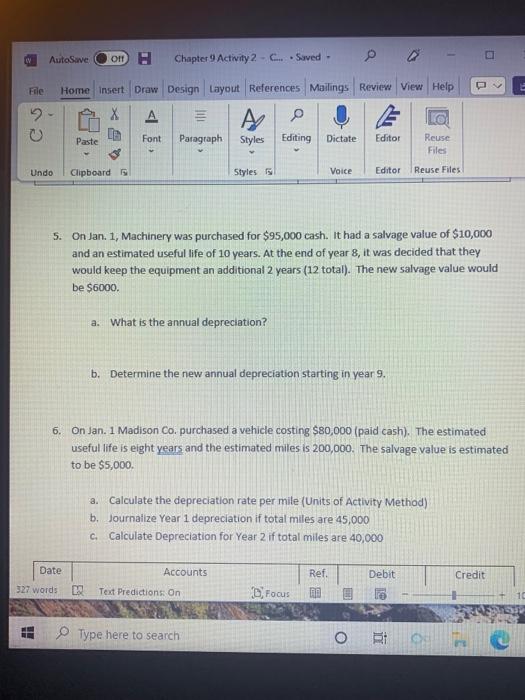

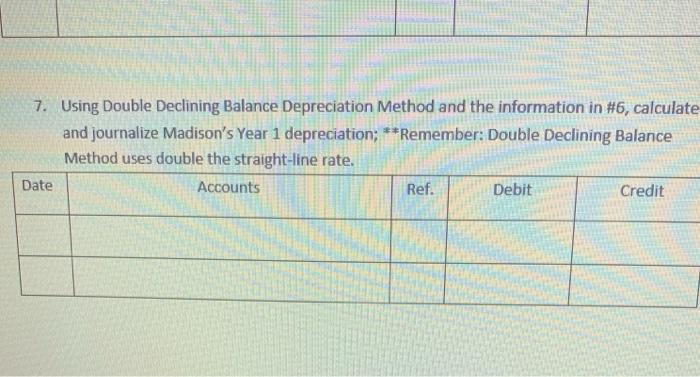

AutoSave Chapter 9 Activity 2 - C.Saved - a File Home Insert Draw Design Layout References Mailings Review View Help A til 0 Paste Font Paragraph Styles Editing Dictate Editor Reuse Files Undo Clipboard 5 Styles Voice Editor Reuse Files 5. On Jan. 1, Machinery was purchased for $95,000 cash. It had a salvage value of $10,000 and an estimated useful life of 10 years. At the end of year 8, it was decided that they would keep the equipment an additional 2 years (12 total). The new salvage value would be $6000 a. What is the annual depreciation? b. Determine the new annual depreciation starting in year 9. 6. On Jan. 1 Madison Co. purchased a vehicle costing $80,000 (paid cash). The estimated useful life is eight years and the estimated miles is 200,000. The salvage value is estimated to be $5,000 a. Calculate the depreciation rate per mile (Units of Activity Method) b. Journalize Year 1 depreciation if total miles are 45,000 C. Calculate Depreciation for Year 2 if total miles are 40,000 Date Accounts Ref. Debit Credit 327 words Text Predictions On D Focus 1. Type here to search ORI Od 7. Using Double Declining Balance Depreciation Method and the information in #6, calculate and journalize Madison's Year 1 depreciation; **Remember: Double Declining Balance Method uses double the straight-line rate. Date Accounts Ref. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts