Question: (10 points). 2. You are given the following data. All forward rates are expected future six-month rates. All rates are stated annually, as BEYs. If

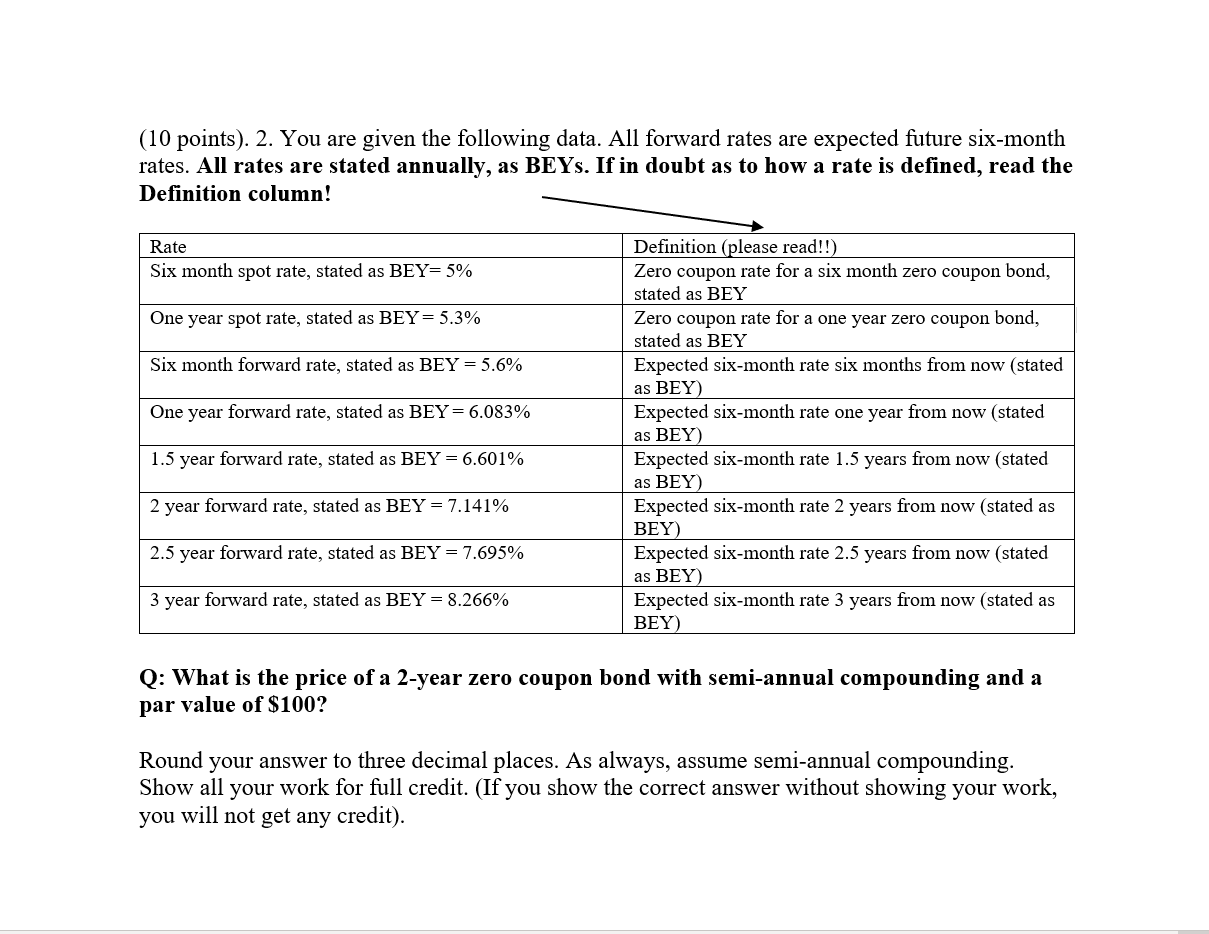

(10 points). 2. You are given the following data. All forward rates are expected future six-month rates. All rates are stated annually, as BEYs. If in doubt as to how a rate is defined, read the Definition column! Rate Six month spot rate, stated as BEY= 5% One year spot rate, stated as BEY= 5.3% Six month forward rate, stated as BEY = 5.6% One year forward rate, stated as BEY= 6.083% Definition (please read!!) Zero coupon rate for a six month zero coupon bond, stated as BEY Zero coupon rate for a one year zero coupon bond, stated as BEY Expected six-month rate six months from now (stated as BEY) Expected six-month rate one year from now (stated as BEY) Expected six-month rate 1.5 years from now (stated as BEY Expected six-month rate 2 years from now (stated as BEY) Expected six-month rate 2.5 years from now (stated as BEY Expected six-month rate 3 years from now (stated as BEY) 1.5 year forward rate, stated as BEY = 6.601% 2 year forward rate, stated as BEY = 7.141% 2.5 year forward rate, stated as BEY = 7.695% 3 year forward rate, stated as BEY = 8.266% Q: What is the price of a 2-year zero coupon bond with semi-annual compounding and a par value of $100? Round your answer to three decimal places. As always, assume semi-annual compounding. Show all your work for full credit. (If you show the correct answer without showing your work, you will not get any credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts