Question: 10. Portfolio Theory II (26 points): Use the data below to answer the following questions. a) Plot and label the risk-free security, the Stock Fund,

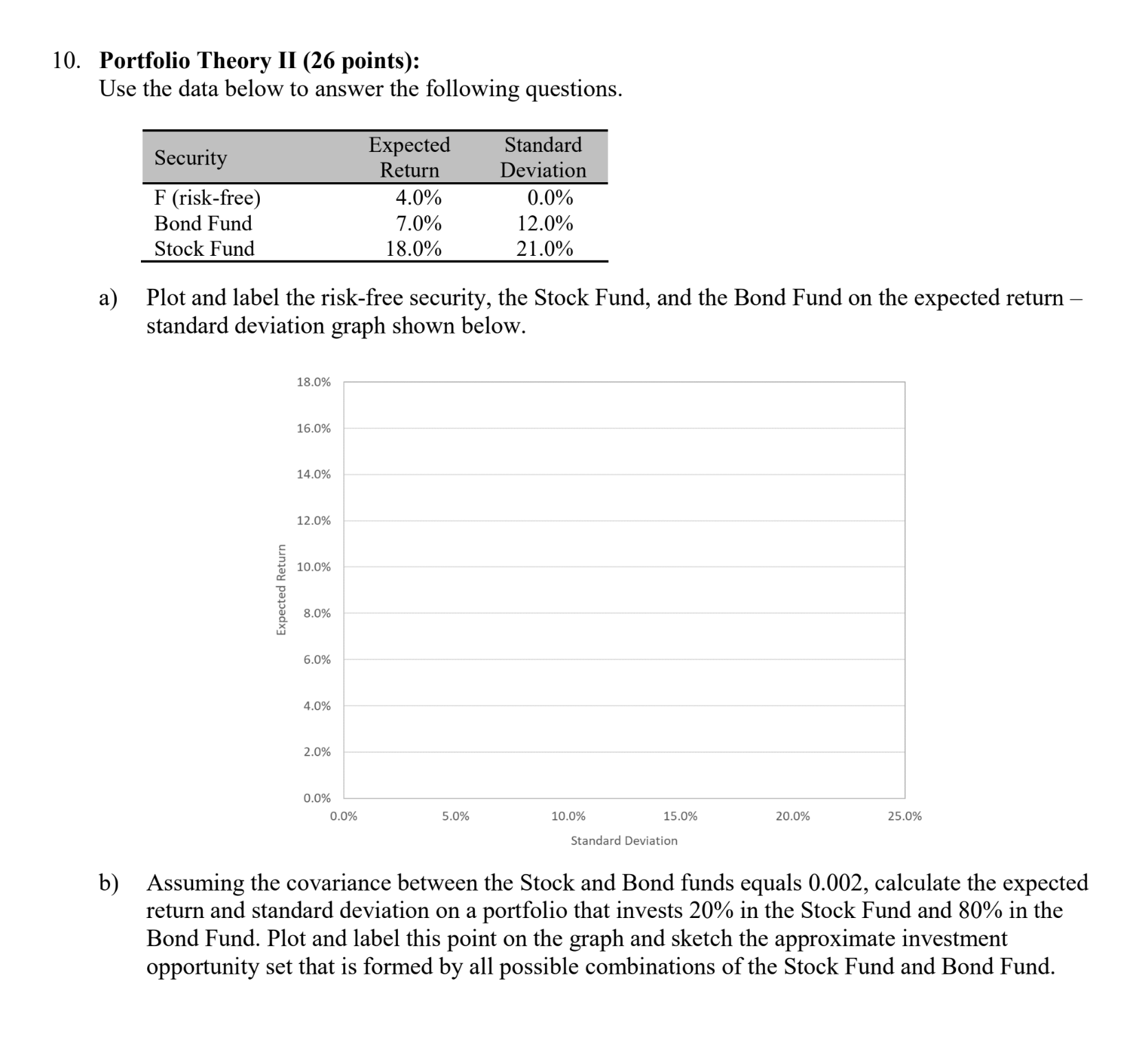

10. Portfolio Theory II (26 points): Use the data below to answer the following questions. a) Plot and label the risk-free security, the Stock Fund, and the Bond Fund on the expected return standard deviation graph shown below. b) Assuming the covariance between the Stock and Bond funds equals 0.002 , calculate the expected return and standard deviation on a portfolio that invests 20% in the Stock Fund and 80% in the Bond Fund. Plot and label this point on the graph and sketch the approximate investment opportunity set that is formed by all possible combinations of the Stock Fund and Bond Fund. 10. Portfolio Theory II (26 points): Use the data below to answer the following questions. a) Plot and label the risk-free security, the Stock Fund, and the Bond Fund on the expected return standard deviation graph shown below. b) Assuming the covariance between the Stock and Bond funds equals 0.002 , calculate the expected return and standard deviation on a portfolio that invests 20% in the Stock Fund and 80% in the Bond Fund. Plot and label this point on the graph and sketch the approximate investment opportunity set that is formed by all possible combinations of the Stock Fund and Bond Fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts