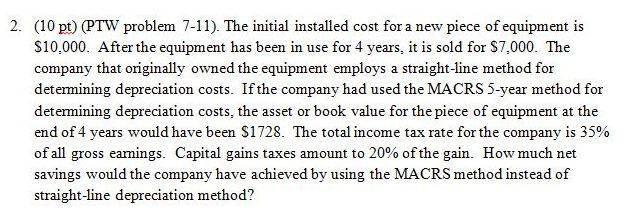

Question: (10 pt) (PTW problem 7-11). The initial installed cost for a new piece of equipment is S10:000. After the equipment has been in use for

(10 pt) (PTW problem 7-11). The initial installed cost for a new piece of equipment is S10:000. After the equipment has been in use for 4 years, it is sold for S7:000. The company that originally owned the equipment employs a straight-line method for determining depreciation costs. If the company had used the MACRS 5-year method for determining depreciation costs, the asset or book value for the piece of equipment at the end of 4 years would have been SI 728. The total income tax rate for the company is 35% of all gross earnings. Capital gains taxes amount to 20% of the gain. How much net savings would the company have achieved by using the MACRS method instead of straight-Une depreciation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts