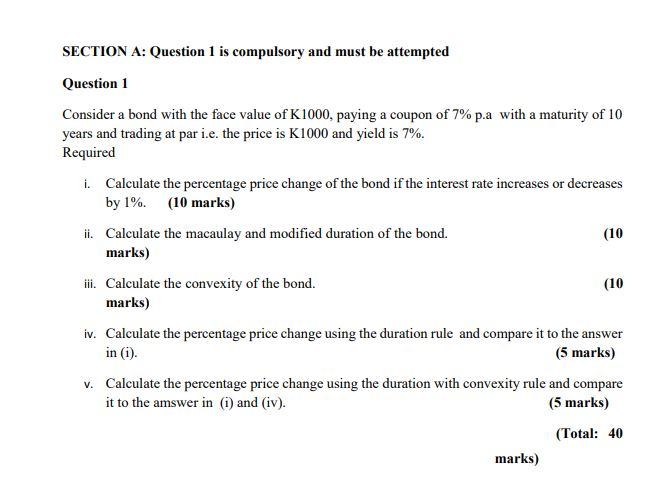

Question: (10 SECTION A: Question 1 is compulsory and must be attempted Question 1 Consider a bond with the face value of K1000, paying a coupon

(10 SECTION A: Question 1 is compulsory and must be attempted Question 1 Consider a bond with the face value of K1000, paying a coupon of 7% p.a with a maturity of 10 years and trading at par i.e. the price is K1000 and yield is 7%. Required i. Calculate the percentage price change of the bond if the interest rate increases or decreases by 1%. (10 marks) ii. Calculate the macaulay and modified duration of the bond. marks) ii. Calculate the convexity of the bond. (10 marks) iv. Calculate the percentage price change using the duration rule and compare it to the answer in (1) (5 marks) v. Calculate the percentage price change using the duration with convexity rule and compare it to the amswer in (i) and (iv). (5 marks) (Total: 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts