Question: 10. We defined the basis at time t as B St FT If the market is in contango when you initiate your position at time

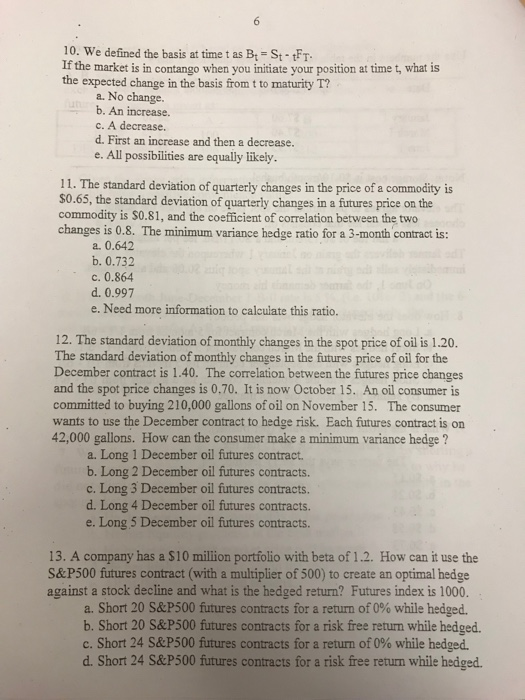

10. We defined the basis at time t as B St FT If the market is in contango when you initiate your position at time t, what is the expected change in the basis from t to maturity T? a. No change b. An increase. c. A decrease. d. First an increase and then a decrease. e. All possibilities are equally likely. 11. The standard deviation of quarterly changes in the price of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.81, and the coefficient of correlation between the two changes is 0.8. The minimum variance hedge ratio for a 3-month contract is: a. 0.642 b. 0.732 c. 0.864 d. 0.997 e. Need more information to calculate this ratio. 12. The standard deviation of monthly changes in the spot price of oil is 1.20. The standard deviation of monthly changes in the futures price of oil for the December contract is 1.40. The correlation between the futures price changes and the spot price changes is 0.70. It is now October 15. An oil consumer is committed to buying 210,000 gallons ofoil on November 15. The consumer wants to use the December contract to hedge risk. Each futures contract is on 42,000 gallons. How can the consumer make a minimum variance hedge ? a. Long 1 December oil futures contract. b. Long 2 December oil futures contracts. c. Long 3 December oil futures contracts. d. Long 4 December oil futures contracts. e. Long 5 December oil futures contracts. 13. A company has a $10 million portfolio with beta of 1-2. How can it use the S& P500 futures contract (with a multiplier of 500) to create an optimal hedge against a stock decline and what is the hedged return? Futures index is 1000. a. Short 20 S&P500 futures contracts for a return of 0% while hedged. b. Short 20 S&P500 futures contracts for a risk free return while hedged. C. Short 24 S&P500 futures contracts for a return of 0% while hedged. d. Short 24 S&P500 futures contracts for a risk free return while hedged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts