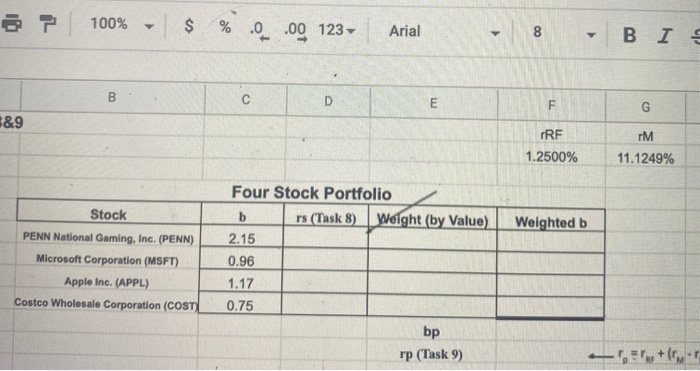

Question: . ? 100% - $ % ._ .00 123, Arial - 8 - B I B C D &9 rM IRF 1.2500% 11.1249% Weighted b

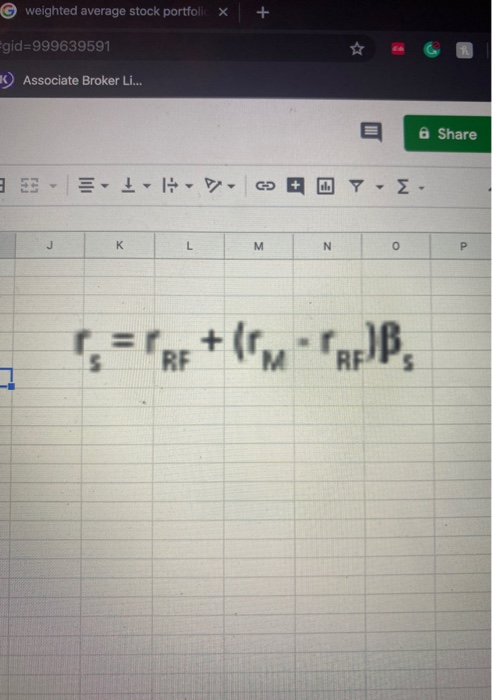

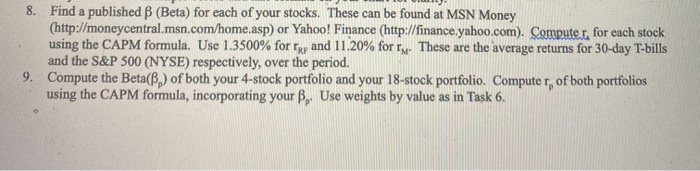

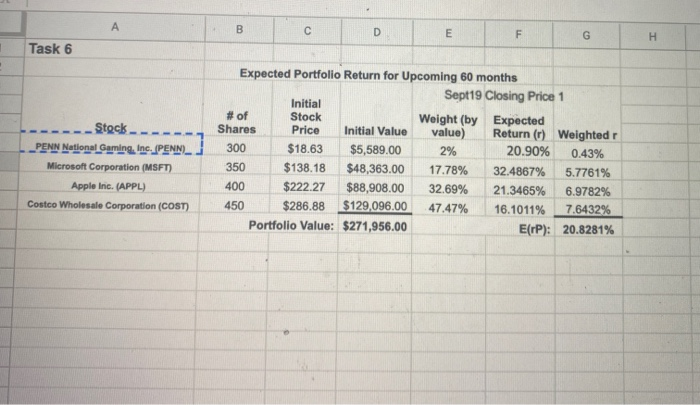

. ? 100% - $ % ._ .00 123, Arial - 8 - B I B C D &9 rM IRF 1.2500% 11.1249% Weighted b Stock PENN National Gaming, Inc. (PENN) Microsoft Corporation (MSFT) Apple Inc. (APPL) Costco Wholesale Corporation (COST) Four Stock Portfolio rs (Task 8) Weight (by Value) 2.15 0.96 1.17 0.75 bp rp (Task 9) weighted average stock portfoli x + Egid=999639591 * Associate Broker Li... Share ES - I D + OY.E. 8. Find a published B (Beta) for each of your stocks. These can be found at MSN Money (http://moneycentral.msn.com/home.asp) or Yahoo! Finance (http://finance.yahoo.com). Computer, for each stock using the CAPM formula. Use 1.3500% for rr and 11.20% for ty. These are the average returns for 30-day T-bills and the S&P 500 (NYSE) respectively, over the period. 9. Compute the Beta(b) of both your 4-stock portfolio and your 18-stock portfolio. Computer, of both portfolios using the CAPM formula, incorporating your B. Use weights by value as in Task 6. Task 6 ------ Stocks ---- PENN National Gaming, Inc. PENN Microsoft Corporation (MSFT) Apple Inc. (APPL) Costco Wholesale Corporation (COST) Expected Portfolio Return for Upcoming 60 months Sept19 Closing Price 1 Initial # of Stock Weight (by Expected Shares Price Initial Value value) Return (1) Weighted 300 $18.63 $5,589.00 2% 20.90% 0.43% 350 $138.18 $48,363.00 17.78% 32.4867% 5.7761% 400 $222.27 $88,908.00 32.69% 21.3465% 6.9782% 450 $286.88 $129,096.00 47.47% 16.1011% 7.6432% Portfolio Value: $271,956.00 E(IP): 20.8281% . ? 100% - $ % ._ .00 123, Arial - 8 - B I B C D &9 rM IRF 1.2500% 11.1249% Weighted b Stock PENN National Gaming, Inc. (PENN) Microsoft Corporation (MSFT) Apple Inc. (APPL) Costco Wholesale Corporation (COST) Four Stock Portfolio rs (Task 8) Weight (by Value) 2.15 0.96 1.17 0.75 bp rp (Task 9) weighted average stock portfoli x + Egid=999639591 * Associate Broker Li... Share ES - I D + OY.E. 8. Find a published B (Beta) for each of your stocks. These can be found at MSN Money (http://moneycentral.msn.com/home.asp) or Yahoo! Finance (http://finance.yahoo.com). Computer, for each stock using the CAPM formula. Use 1.3500% for rr and 11.20% for ty. These are the average returns for 30-day T-bills and the S&P 500 (NYSE) respectively, over the period. 9. Compute the Beta(b) of both your 4-stock portfolio and your 18-stock portfolio. Computer, of both portfolios using the CAPM formula, incorporating your B. Use weights by value as in Task 6. Task 6 ------ Stocks ---- PENN National Gaming, Inc. PENN Microsoft Corporation (MSFT) Apple Inc. (APPL) Costco Wholesale Corporation (COST) Expected Portfolio Return for Upcoming 60 months Sept19 Closing Price 1 Initial # of Stock Weight (by Expected Shares Price Initial Value value) Return (1) Weighted 300 $18.63 $5,589.00 2% 20.90% 0.43% 350 $138.18 $48,363.00 17.78% 32.4867% 5.7761% 400 $222.27 $88,908.00 32.69% 21.3465% 6.9782% 450 $286.88 $129,096.00 47.47% 16.1011% 7.6432% Portfolio Value: $271,956.00 E(IP): 20.8281%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts