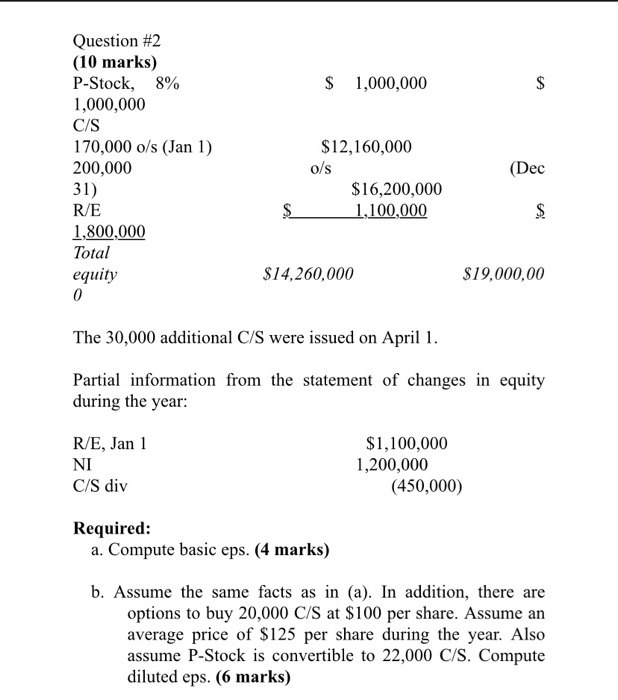

Question: $ 1,000,000 $ $12,160,000 Question #2 (10 marks) P-Stock, 8% 1,000,000 C/S 170,000 o/s (Jan 1) 200,000 31) R/E 1,800,000 Total equity 0 o/s (Dec

$ 1,000,000 $ $12,160,000 Question #2 (10 marks) P-Stock, 8% 1,000,000 C/S 170,000 o/s (Jan 1) 200,000 31) R/E 1,800,000 Total equity 0 o/s (Dec $16,200,000 1,100,000 $ $14,260,000 $19,000,00 The 30,000 additional C/S were issued on April 1. Partial information from the statement of changes in equity during the year: R/E, Jan 1 NI C/S div $1,100,000 1,200,000 (450,000) Required: a. Compute basic eps. (4 marks) b. Assume the same facts as in (a). In addition, there are options to buy 20,000 C/S at $100 per share. Assume an average price of $125 per share during the year. Also assume P-Stock is convertible to 22,000 C/S. Compute diluted eps. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts