Question: 2021 T1 AFM305 ASSIGNMENT 1: Value: Submission date: 40 marks (20% of unit mark) 01 April, 2021 Assessment criteria: While this assignment relates to the

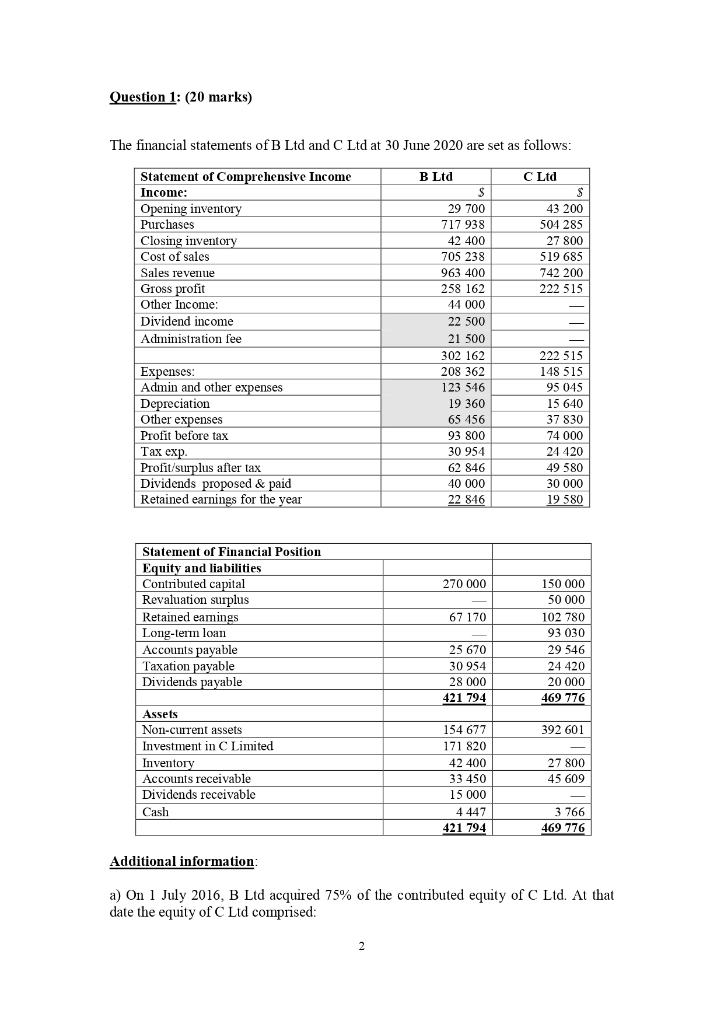

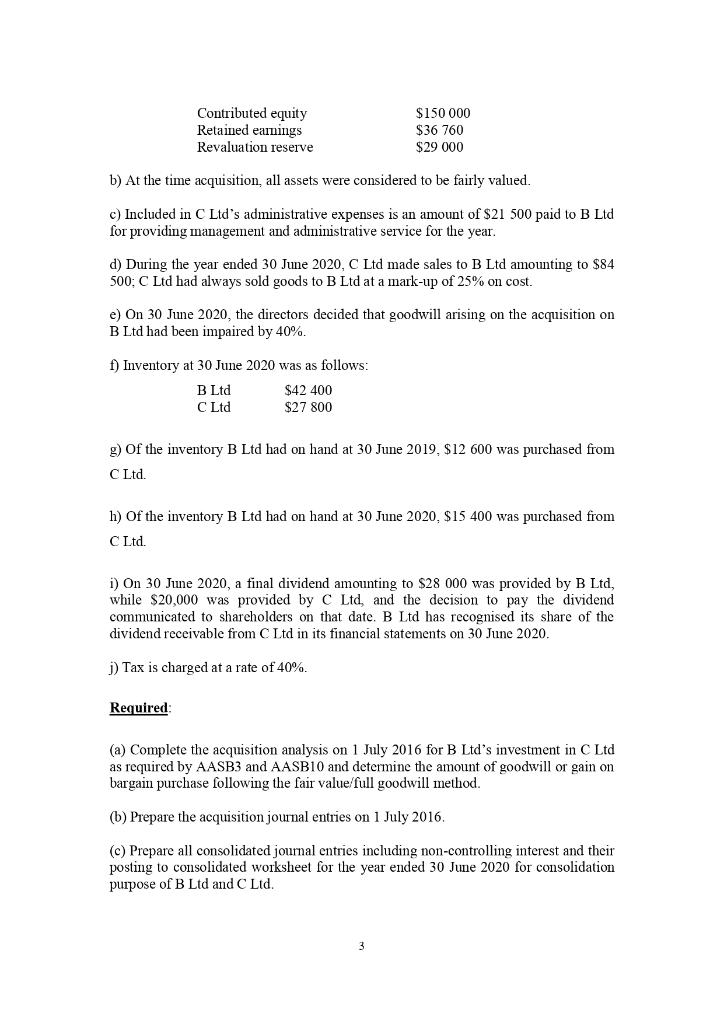

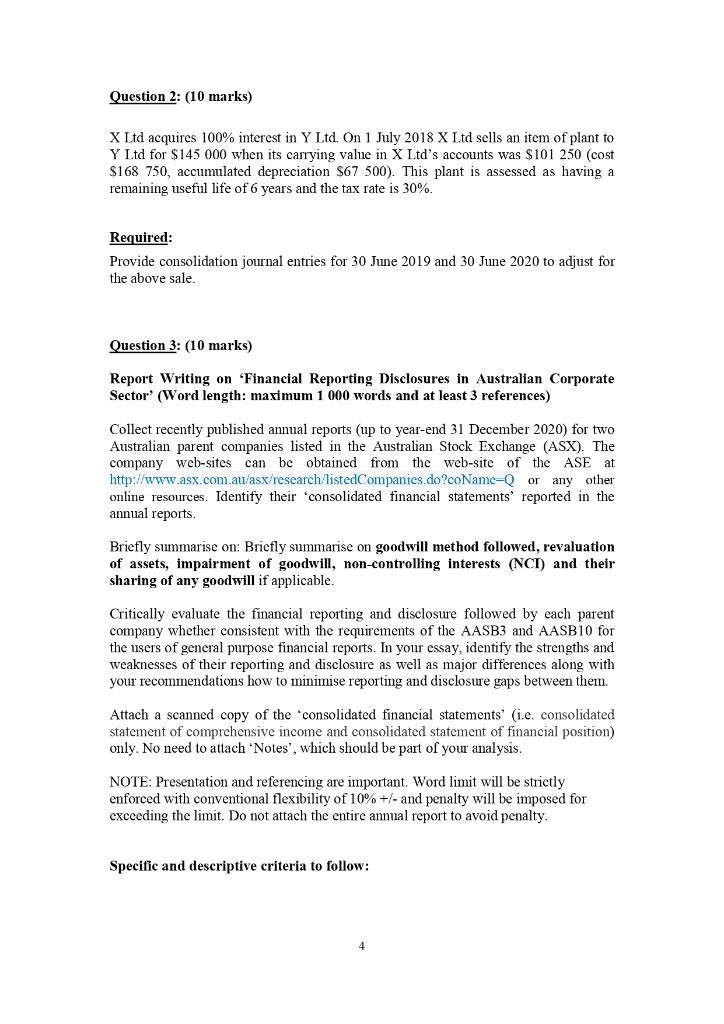

2021 T1 AFM305 ASSIGNMENT 1: Value: Submission date: 40 marks (20% of unit mark) 01 April, 2021 Assessment criteria: While this assignment relates to the following three learning outcomes (LOS) of the unit: 1. demonstrate broad and coherent understanding of advanced issues in financial accounting with depth in corporate group structures with subsidiaries and distinguish it from extended group structures with associate and joint arrangements, and how to read and interpret/analyse contemporary financial reports for them underpinning accounting standards (AASBs), and apply to business-related contexts; 2. demonstrate professional knowledge of consolidated financial statements, in particular preparing consolidation journals, worksheet and statement comprehensive income (Profit and Loss) and statement of financial position (Balance Sheet); 4. use a range of cognitive and communication skills to review, analyse, consolidate and synthesise relevant accounting information drawn from financial statements in order to demonstrate critical thinking and judgement in solving complex business-related problems; 5. work independently and/or collaboratively to plan and execute tasks to enhance professional knowledge and skills in advanced financial accounting; You are expected to demonstrate the ability to produce, describe, analyse, and/or explain the underlying concepts and accounting frameworks to which the assignment questions are linked. The following marking criteria and weightings will be used: Completion of acquisition analysis under the method(s) suggested and preparation of appropriate journal entries after the acquisition (12%); Preparation of appropriate consolidation journal entries and worksheet for consolidation (63%), and Adequate discussion on the specified topic or issue raised by providing relevant and reasonable opinions/comments. There must have sufficient analysis of reporting practices the selected companies/entities in compliance with the relevant accounting standards along with a solid comparison between the companies. Also requires logical flow from introduction to conclusion according to academic standards of essay writing. (25%) Question 1: (20 marks) The financial statements of B Ltd and C Ltd at 30 June 2020 are set as follows: Statement of Comprehensive Income Income: Opening inventory Purchases Closing inventory Cost of sales Sales revenue Gross profit Other Income: Dividend income Administration fee B Ltd $ 29 700 717 938 42 400 705 238 963 400 258 162 C Ltd S 43 200 504285 27 800 519 685 742 200 222 515 14 000 Expenses: Admin and other expenses Depreciation Other expenses Profit before tax Tax exp Profit/surplus after tax Dividends proposed & paid Retained earnings for the year 22 500 21 500 302 162 208 362 123 546 19 360 65 456 09 on 93 800 30 954 62 846 40 000 22 846 222 515 148 515 95 045 104 15 640 30 37 830 od 74 000 24 420 49 580 30 000 19 580 270 000 Statement of Financial Position Equity and liabilities Contributed capital Revaluation surplus Retained eamings Long-term loan Accounts payable Taxation payable Dividends payable 67 170 150 000 50 000 102 780 93 030 29 546 24 420 20 000 469 776 25 670 30 954 28 000 421 794 392 601 Assets Non-current assets Investment in C Limited Inventory Accounts receivable Dividends receivable 154 677 171 820 42 400 33 450 15 000 4 447 421 794 27 800 45 609 Cash 3 766 469 776 Additional information: a) On 1 July 2016, B Ltd acquired 75% of the contributed equity of C Ltd. At that date the equity of C Ltd comprised: 2 Contributed equity Retained earnings Revaluation reserve $150 000 $36 760 $29 000 b) At the time acquisition, all assets were considered to be fairly valued. c) Included in C Ltd's administrative expenses is an amount of $21 500 paid to B Ltd for providing management and administrative service for the year. d) During the year ended 30 June 2020, C Ltd made sales to B Ltd amounting to $84 500: C Ltd had always sold goods to B Ltd at a mark-up of 25% on cost. e) On 30 June 2020, the directors decided that goodwill arising on the acquisition on B Ltd had been impaired by 40%. f) Inventory at 30 June 2020 was as follows: B Ltd $42 400 C Ltd $27 800 g) of the inventory B Ltd had on hand at 30 June 2019. $12 600 was purchased from C Ltd. 1) Of the inventory B Ltd had on hand at 30 June 2020, $15 400 was purchased from C Ltd. i) On 30 June 2020, a final dividend amounting to $28 000 was provided by B Ltd, while $20,000 was provided by C Ltd, and the decision to pay the dividend communicated to shareholders on that date. B Ltd has recognised its share of the dividend receivable from C Ltd in its financial statements on 30 June 2020. 1) Tax is charged at a rate of 40% Required (a) Complete the acquisition analysis on 1 July 2016 for B Ltd's investment in C Ltd as required by AASB3 and AASB10 and determine the amount of goodwill or gain on bargain purchase following the fair value/full goodwill method. (b) Prepare the acquisition journal entries on 1 July 2016. (c) Prepare all consolidated journal entries including non-controlling interest and their posting to consolidated worksheet for the year ended 30 June 2020 for consolidation purpose of B Ltd and C Ltd. Question 2: (10 marks) X Ltd acquires 100% interest in Y Ltd, On 1 July 2018 X Ltd sells an item of plant to Y Ltd for $145 000 when its carrying value in X Ltd's accounts was $101 250 (cost $168 750, accumulated depreciation $67 500). This plant is assessed as having a remaining useful life of 6 years and the tax rate is 30%. Required: Provide consolidation journal entries for 30 June 2019 and 30 June 2020 to adjust for the above sale. Question 3: (10 marks) Report Writing on 'Financial Reporting Disclosures in Australian Corporate Sector' (Word length: maximum 1 000 words and at least 3 references) Collect recently published annual reports (up to year-end 31 December 2020) for two Australian parent companies listed in the Australian Stock Exchange (ASX). The company web-sites can obtained from the web-site of the ASE at http://www.asx.com.au/asx/research listedCompanies.do?coName=Qor any other online resources. Identify their consolidated financial statements reported in the annual reports. Briefly summarise on: Briefly summarise on goodwill method followed, revaluation of assets, impairment of goodwill, non-controlling interests (NCT) and their sharing of any goodwill if applicable. Critically evaluate the financial reporting and disclosure followed by each parent company whether consistent with the requirements of the AASB3 and AASB10 for the users of general purpose financial reports. In your essay, identify the strengths and weaknesses of their reporting and disclosure as well as major differences along with your recommendations how to minimise reporting and disclosure gaps between them. Attach a scanned copy of the consolidated financial statements (i.e. consolidated statement of comprehensive income and consolidated statement of financial position) only. No need to attach 'Notes', which should be part of your analysis. NOTE: Presentation and referencing are important. Word limit will be strictly enforced with conventional flexibility of 10% +/- and penalty will be imposed for exceeding the limit. Do not attach the entire annual report to avoid penalty. Specific and descriptive criteria to follow: (1) There must be an introduction and conclusion section and references, if any, and a scanned copy of the consolidated financial statement' attached for both group of companies. (2) There must be a very brief discussion of the selected listed groups of companies (i.e. parents) and their subsidiaries operating activities. (3) Adequate discussion on consolidated financial statements components taken care of in the process of preparing in accordance with AASB3 and AASB10. A better understanding of concepts as well as group statements is expected. (4) There must be an analysis of reporting practices as in point (3) above whether AASB3 and AASB10 are properly followed or not. The strengths and weaknesses of reporting should be identified from the users' perspective. In evaluating reporting practices, any relevant comment or recommendation should be taken into account. (5) The reporting practices of both groups of companies as in point (3) above must be compared with a decision which group is in compliance with respective AASBs than the other and why and how more compliance is achievable. In evaluating reporting practices, any relevant comment or recommendation for each group should be taken into account. 2021 T1 AFM305 ASSIGNMENT 1: Value: Submission date: 40 marks (20% of unit mark) 01 April, 2021 Assessment criteria: While this assignment relates to the following three learning outcomes (LOS) of the unit: 1. demonstrate broad and coherent understanding of advanced issues in financial accounting with depth in corporate group structures with subsidiaries and distinguish it from extended group structures with associate and joint arrangements, and how to read and interpret/analyse contemporary financial reports for them underpinning accounting standards (AASBs), and apply to business-related contexts; 2. demonstrate professional knowledge of consolidated financial statements, in particular preparing consolidation journals, worksheet and statement comprehensive income (Profit and Loss) and statement of financial position (Balance Sheet); 4. use a range of cognitive and communication skills to review, analyse, consolidate and synthesise relevant accounting information drawn from financial statements in order to demonstrate critical thinking and judgement in solving complex business-related problems; 5. work independently and/or collaboratively to plan and execute tasks to enhance professional knowledge and skills in advanced financial accounting; You are expected to demonstrate the ability to produce, describe, analyse, and/or explain the underlying concepts and accounting frameworks to which the assignment questions are linked. The following marking criteria and weightings will be used: Completion of acquisition analysis under the method(s) suggested and preparation of appropriate journal entries after the acquisition (12%); Preparation of appropriate consolidation journal entries and worksheet for consolidation (63%), and Adequate discussion on the specified topic or issue raised by providing relevant and reasonable opinions/comments. There must have sufficient analysis of reporting practices the selected companies/entities in compliance with the relevant accounting standards along with a solid comparison between the companies. Also requires logical flow from introduction to conclusion according to academic standards of essay writing. (25%) Question 1: (20 marks) The financial statements of B Ltd and C Ltd at 30 June 2020 are set as follows: Statement of Comprehensive Income Income: Opening inventory Purchases Closing inventory Cost of sales Sales revenue Gross profit Other Income: Dividend income Administration fee B Ltd $ 29 700 717 938 42 400 705 238 963 400 258 162 C Ltd S 43 200 504285 27 800 519 685 742 200 222 515 14 000 Expenses: Admin and other expenses Depreciation Other expenses Profit before tax Tax exp Profit/surplus after tax Dividends proposed & paid Retained earnings for the year 22 500 21 500 302 162 208 362 123 546 19 360 65 456 09 on 93 800 30 954 62 846 40 000 22 846 222 515 148 515 95 045 104 15 640 30 37 830 od 74 000 24 420 49 580 30 000 19 580 270 000 Statement of Financial Position Equity and liabilities Contributed capital Revaluation surplus Retained eamings Long-term loan Accounts payable Taxation payable Dividends payable 67 170 150 000 50 000 102 780 93 030 29 546 24 420 20 000 469 776 25 670 30 954 28 000 421 794 392 601 Assets Non-current assets Investment in C Limited Inventory Accounts receivable Dividends receivable 154 677 171 820 42 400 33 450 15 000 4 447 421 794 27 800 45 609 Cash 3 766 469 776 Additional information: a) On 1 July 2016, B Ltd acquired 75% of the contributed equity of C Ltd. At that date the equity of C Ltd comprised: 2 Contributed equity Retained earnings Revaluation reserve $150 000 $36 760 $29 000 b) At the time acquisition, all assets were considered to be fairly valued. c) Included in C Ltd's administrative expenses is an amount of $21 500 paid to B Ltd for providing management and administrative service for the year. d) During the year ended 30 June 2020, C Ltd made sales to B Ltd amounting to $84 500: C Ltd had always sold goods to B Ltd at a mark-up of 25% on cost. e) On 30 June 2020, the directors decided that goodwill arising on the acquisition on B Ltd had been impaired by 40%. f) Inventory at 30 June 2020 was as follows: B Ltd $42 400 C Ltd $27 800 g) of the inventory B Ltd had on hand at 30 June 2019. $12 600 was purchased from C Ltd. 1) Of the inventory B Ltd had on hand at 30 June 2020, $15 400 was purchased from C Ltd. i) On 30 June 2020, a final dividend amounting to $28 000 was provided by B Ltd, while $20,000 was provided by C Ltd, and the decision to pay the dividend communicated to shareholders on that date. B Ltd has recognised its share of the dividend receivable from C Ltd in its financial statements on 30 June 2020. 1) Tax is charged at a rate of 40% Required (a) Complete the acquisition analysis on 1 July 2016 for B Ltd's investment in C Ltd as required by AASB3 and AASB10 and determine the amount of goodwill or gain on bargain purchase following the fair value/full goodwill method. (b) Prepare the acquisition journal entries on 1 July 2016. (c) Prepare all consolidated journal entries including non-controlling interest and their posting to consolidated worksheet for the year ended 30 June 2020 for consolidation purpose of B Ltd and C Ltd. Question 2: (10 marks) X Ltd acquires 100% interest in Y Ltd, On 1 July 2018 X Ltd sells an item of plant to Y Ltd for $145 000 when its carrying value in X Ltd's accounts was $101 250 (cost $168 750, accumulated depreciation $67 500). This plant is assessed as having a remaining useful life of 6 years and the tax rate is 30%. Required: Provide consolidation journal entries for 30 June 2019 and 30 June 2020 to adjust for the above sale. Question 3: (10 marks) Report Writing on 'Financial Reporting Disclosures in Australian Corporate Sector' (Word length: maximum 1 000 words and at least 3 references) Collect recently published annual reports (up to year-end 31 December 2020) for two Australian parent companies listed in the Australian Stock Exchange (ASX). The company web-sites can obtained from the web-site of the ASE at http://www.asx.com.au/asx/research listedCompanies.do?coName=Qor any other online resources. Identify their consolidated financial statements reported in the annual reports. Briefly summarise on: Briefly summarise on goodwill method followed, revaluation of assets, impairment of goodwill, non-controlling interests (NCT) and their sharing of any goodwill if applicable. Critically evaluate the financial reporting and disclosure followed by each parent company whether consistent with the requirements of the AASB3 and AASB10 for the users of general purpose financial reports. In your essay, identify the strengths and weaknesses of their reporting and disclosure as well as major differences along with your recommendations how to minimise reporting and disclosure gaps between them. Attach a scanned copy of the consolidated financial statements (i.e. consolidated statement of comprehensive income and consolidated statement of financial position) only. No need to attach 'Notes', which should be part of your analysis. NOTE: Presentation and referencing are important. Word limit will be strictly enforced with conventional flexibility of 10% +/- and penalty will be imposed for exceeding the limit. Do not attach the entire annual report to avoid penalty. Specific and descriptive criteria to follow: (1) There must be an introduction and conclusion section and references, if any, and a scanned copy of the consolidated financial statement' attached for both group of companies. (2) There must be a very brief discussion of the selected listed groups of companies (i.e. parents) and their subsidiaries operating activities. (3) Adequate discussion on consolidated financial statements components taken care of in the process of preparing in accordance with AASB3 and AASB10. A better understanding of concepts as well as group statements is expected. (4) There must be an analysis of reporting practices as in point (3) above whether AASB3 and AASB10 are properly followed or not. The strengths and weaknesses of reporting should be identified from the users' perspective. In evaluating reporting practices, any relevant comment or recommendation should be taken into account. (5) The reporting practices of both groups of companies as in point (3) above must be compared with a decision which group is in compliance with respective AASBs than the other and why and how more compliance is achievable. In evaluating reporting practices, any relevant comment or recommendation for each group should be taken into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts