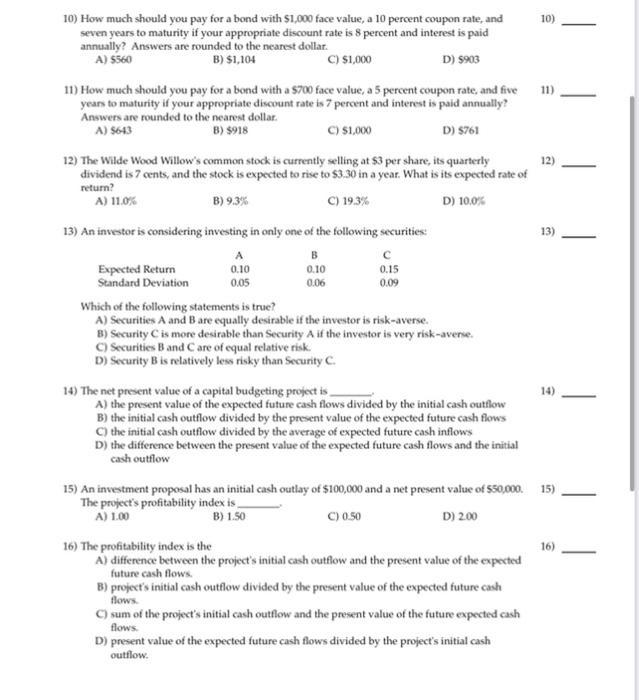

Question: ) 11) ) ) 0.09 10) How much should you pay for a bond with $1,000 face value, a 10 percent coupon rate, and 10)

) 11) ) ) 0.09 10) How much should you pay for a bond with $1,000 face value, a 10 percent coupon rate, and 10) seven years to maturity if your appropriate discount rate is 8 percent and interest is paid annually? Answers are rounded to the nearest dollar. A) 5560 B) $1,104 C) $1,000 D) $903 11) How much should you pay for a bond with a $700 face value, a 5 percent coupon rate, and five years to maturity if your appropriate discount rate is 7 percent and interest is paid annually? Answers are rounded to the nearest dollar. A) $643 B) 9918 C) $1,000 D) 8761 12) The Wilde Wood Willow's common stock is currently selling at $3 per share, its quarterly 12) dividend is 7 cents, and the stock is expected to rise to $3.30 in a year. What is its expected rate of return? A) 11.0% B) 9.3% C) 193% D) 100% 13) An investor is considering investing in only one of the following securities: 13) A B Expected Return 0.10 0.10 0.15 Standard Deviation 0.05 0.06 Which of the following statements is true? A) Securities A and B are equally desirable if the investor is risk-averse. B) Security C is more desirable than Security A if the investor is very risk-avenie C) Securities and care of equal relative risk D) Security B is relatively less risky than Security C 14) The net present value of a capital budgeting project is 14) A) the present value of the expected future cash flows divided by the initial cash outflow B) the initial cash outflow divided by the present value of the expected future cash flows C) the initial cash outflow divided by the average of expected future cash inflows D) the difference between the present value of the expected future cash flows and the initial cash outflow 15) An investment proposal has an initial cash outlay of $100,000 and a net present value of 550,000. 15) The project's profitability index is A) 1.00 B) 1.50 C) 0.50 D) 200 16) The profitability index is the 16) A) difference between the project's initial cash outflow and the present value of the expected future cash flows. B) project's initial cash outflow divided by the present value of the expected future cash Hows. C) sum of the project's initial cash outflow and the present value of the future expected cash flows D) present value of the expected future cash flows divided by the project's initial cash ) outflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts