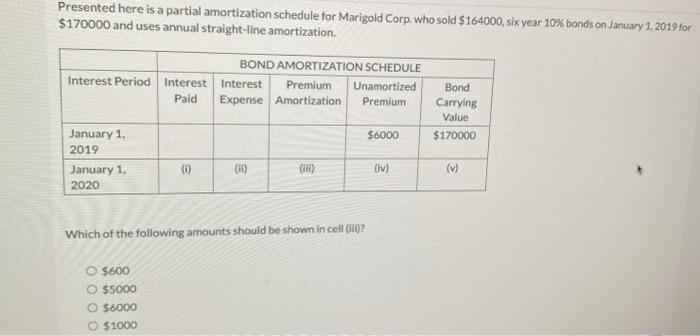

Question: 11. 12. 13. Presented here is a partial amortization schedule for Marigold Corp. who sold $164000, six year 10% bonds on January 1, 2019 for

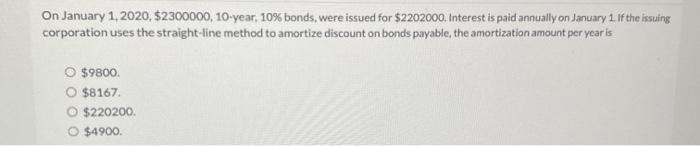

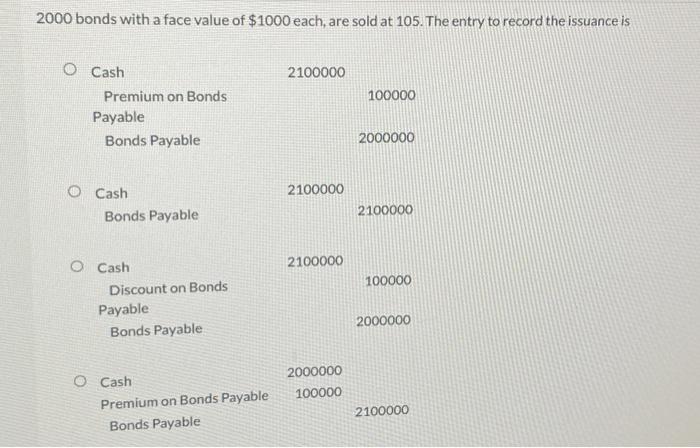

Presented here is a partial amortization schedule for Marigold Corp. who sold $164000, six year 10% bonds on January 1, 2019 for $170000 and uses annual straight-line amortization, BOND AMORTIZATION SCHEDULE Interest Period Interest Interest Premium Unamortized Paid Expense Amortization Premium Bond Carrying Value $170000 $6000 January 1, 2019 January 1. 2020 (1) (10) (iv) (V) Which of the following amounts should be shown in cell (m)? O $600 O $5000 $6000 $1000 On January 1, 2020, $2300000, 10-year, 10% bonds, were issued for $2202000. Interest is paid annually on January 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable the amortization amount per year is $9800 $8167 $220200 O $4900 2000 bonds with a face value of $1000 each, are sold at 105. The entry to record the issuance is O Cash 2100000 100000 Premium on Bonds Payable Bonds Payable 2000000 2100000 Cash Bonds Payable 2100000 2100000 100000 Cash Discount on Bonds Payable Bonds Payable 2000000 2000000 100000 O Cash Premium on Bonds Payable Bonds Payable 2100000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts