Question: PLEASE HELP FAST AND ALL IN ACCOUNTING. I WILL RATE 5 STARS Question 8 The following exhibit is for Kmart bonds. Bonds Kmart 8 3/8

PLEASE HELP FAST AND ALL IN ACCOUNTING. I WILL RATE 5 STARS

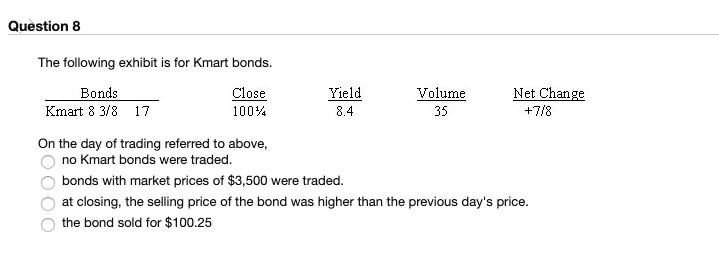

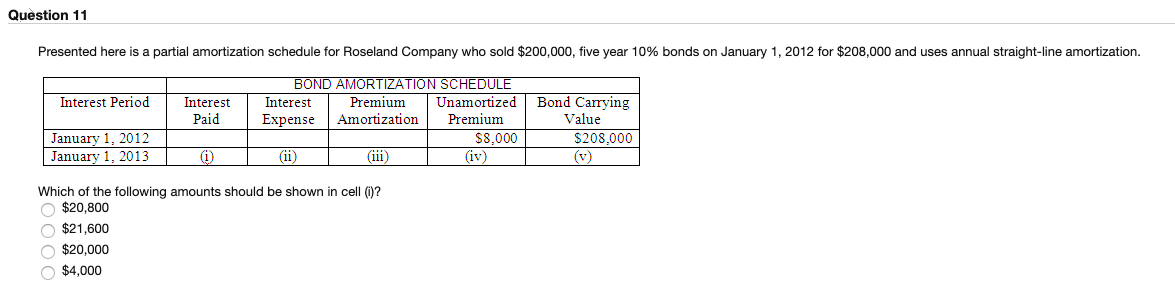

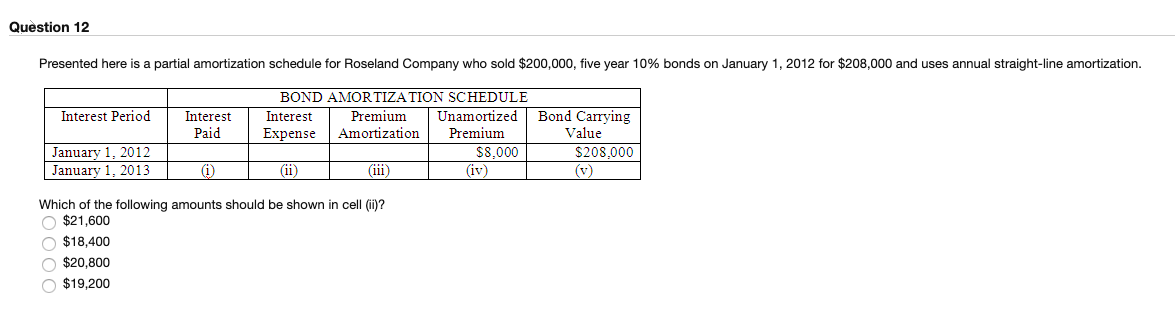

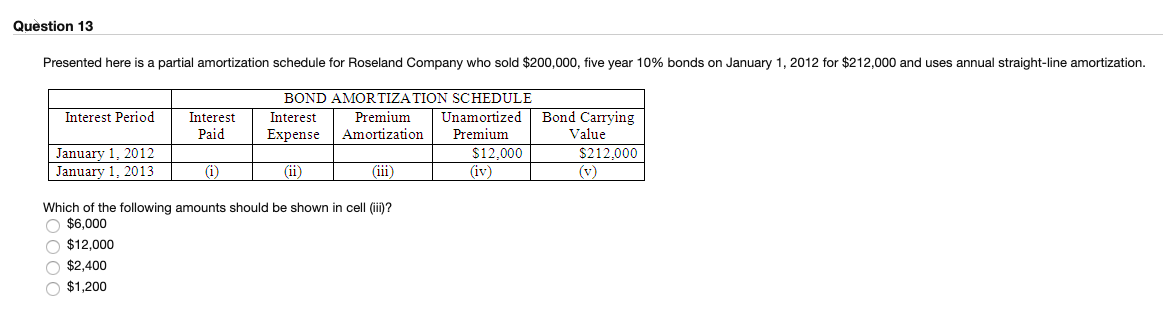

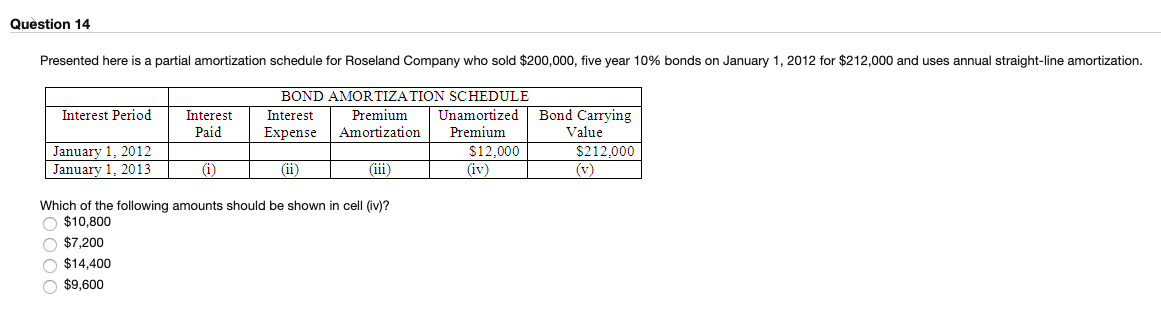

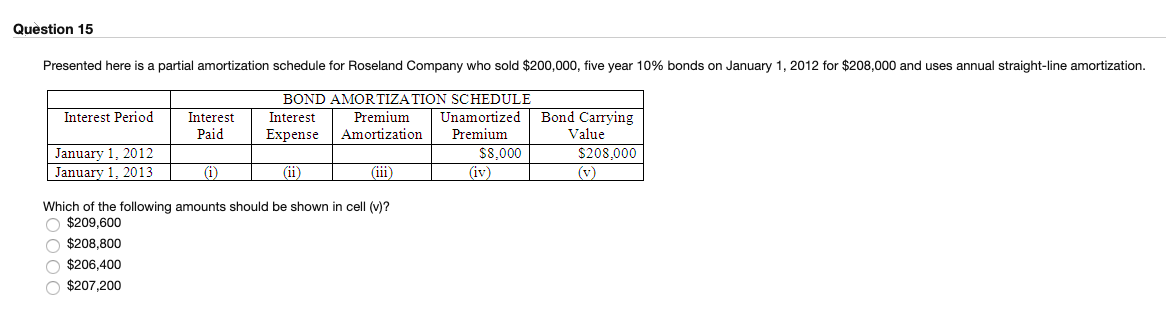

Question 8 The following exhibit is for Kmart bonds. Bonds Kmart 8 3/8 17 Close 100% Yield 8. 4 Volume 35 Net Change +7/8 On the day of trading referred to above, no Kmart bonds were traded. bonds with market prices of $3,500 were traded. O at closing, the selling price of the bond was higher than the previous day's price. the bond sold for $100.25 Question 11 Presented here is a partial amortization schedule for Roseland Company who sold $200,000, five year 10% bonds on January 1, 2012 for $208,000 and uses annual straight-line amortization. Interest Period Interest | Paid BOND AMORTIZATION SCHEDULE Interest | Premium Unamortized | Bond Carrying Expense Amortization Premium Value $8.000 $208,000 (ii) (iii) (iv) (v) January 1, 2012 January 1, 2013 (1) L Which of the following amounts should be shown in cell()? $20,800 $21,600 $20,000 $4,000 Question 12 Presented here is a partial amortization schedule for Roseland Company who sold $200,000, five year 10% bonds on January 1, 2012 for $208,000 and uses annual straight-line amortization. Interest Period Interest Paid BOND AMORTIZATION SCHEDULE Interest Premium Unamortized Bond Carrying Expense | Amortization Premium | Value $8.000 $208.000 (ii) (iii) (iv) (v) January 1, 2012 January 1, 2013 Which of the following amounts should be shown in cell (ii)? $21,600 $18,400 $20,800 $19,200 Question 13 Presented here is a partial amortization schedule for Roseland Company who sold $200,000, five year 10% bonds on January 1, 2012 for $212,000 and uses annual straight-line amortization. Interest Period Interest Paid BOND AMORTIZATION SCHEDULE Interest Premium Unamortized | Bond Carrying Expense Amortization Premium Value $12.000 $212,000 (ii) (iii) (iv) (v) January 1, 2012 | January 1, 2013 1 (1) 1 Which of the following amounts should be shown in cell (iii)? $6,000 $12,000 $2,400 $1,200 Question 14 Presented here is a partial amortization schedule for Roseland Company who sold $200,000, five year 10% bonds on January 1, 2012 for $212,000 and uses annual straight-line amortization. Interest Period Bond Carrying Interest Paid BOND AMORTIZATION SCHEDULE Interest Premium Unamortized Expense | Amortization Premium $12.000 (ii) (iii) (iv) Value $212.000 January 1, 2012 January 1, 2013 (1) Which of the following amounts should be shown in cell (iv)? $10,800 $7,200 $14,400 $9,600 Question 15 Presented here is a partial amortization schedule for Roseland Company who sold $200,000, five year 10% bonds on January 1, 2012 for $208,000 and uses annual straight-line amortization. Interest Period Interest | Paid BOND AMORTIZATION SCHEDULE Interest | Premium Unamortized | Bond Carrying Expense Amortization Premium | Value $8,000 $208,000 (i) I January 1, 2012 January 1, 2013 1 (1) 1 Which of the following amounts should be shown in cell (V)? $209,600 $208,800 $206,400 $207,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts