Question: 11 - A A Aav A DA Dictate A a Sensitivity SELE Styles Styles Para Question A. President Trump's Tax Cuts and Jobs Act (CIA)

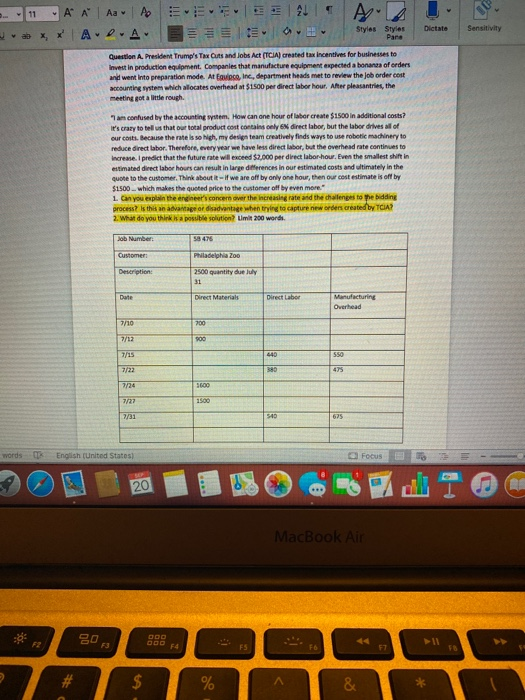

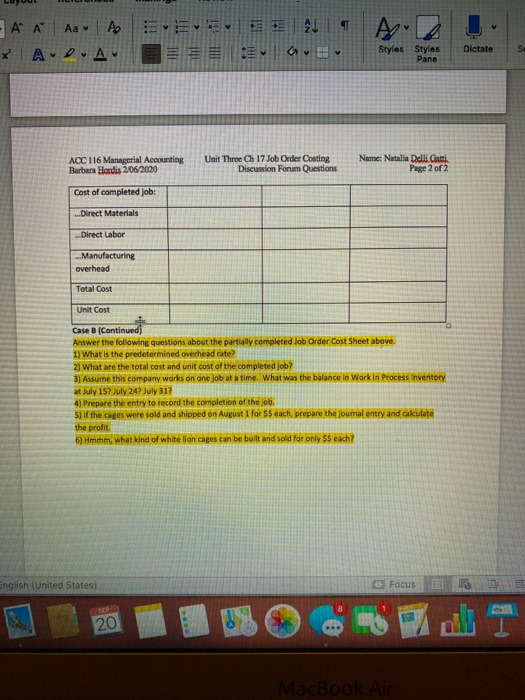

11 - A A Aav A DA Dictate A a Sensitivity SELE Styles Styles Para Question A. President Trump's Tax Cuts and Jobs Act (CIA) created tax incentives for businesses to Invest in production equipment Companies that manufacture equipment expected abonans of orders and went into preparation mode. At Equipo Inc., department headset to review the job order cost accounting system which allocates overhead at $1500 per direct labor hour. After pleasantries, the meeting of a little rough Tan confused by the accounting system. How can one hour of labor create $1500 in additional costs? It's crazy to tell us that our total product cost contains cely direct labor, but the labor drives all of our costs. Because the rate is so high, my design team creatively finds ways to use robotic machinery to reduce direct labor. Therefore, every year we have less direct labor, but the overhead rate continues to Increase. I predict that the future rate will exceed $2,000 per direct labor hour. Even the smallest shift in estimated direct labor hours can result in large differences in our estimated costs and ultimately in the quote to the customer. Think about it if we are off by only one hour, then our cost estimate is off by $1500 - which makes the quoted price to the customer off by even more." 1. Can you explain the engine concern over the increasing rate and the challenges to the bidding process? Is this an advantage or disadvantage when capture new orders created by TCIA? 2. What do you think posible solution Limit 200 words Job Number: 58 476 Customer Philadelphia 200 Description: 2500 quantity due July 31 Date Direct Materials Direct Labor Manufacturing Overhead 7/10 700 7/12 900 7/15 440 550 7/22 380 475 7/24 3600 7/27 1500 7/31 540 675 words English (United States) Focus 20 MacBook Air 20 F3 F4 F7 $ % A & A Aav Po XADA El 21 T an A. THE Dictate Styles Styles Pane S. ACC 116 Managerial Accounting Barbara Hordis 2/06/2020 Unit Three Ch 17 Job Order Costing Discussion Forum Questions Name: Natalia Delli Ganti Page 2 of 2 Cost of completed job: ...Direct Materials Direct Labor ... Manufacturing overhead Total Cost Unit Cost Case B (Continued Answer the following questions about the partially completed Job Order Cost Sheet above. 1) What is the predetermined overhead rate? 2) What are the total cost and unit cost of the completed job? 3) Assume this company works on one Job at a time. What was the balance in Work in Process inventory at July 17 July 24? July 317 4) Prepare the entry to record the completion of the job. 5) If the cages were sold and shipped on August 1 for 55 each, prepare the journal entry and calculate the profit. 6) Hmmm, what kind of white lion cages can be built and sold for only $5 each? English (United States) Focus ere 20 MacBook Air 11 - A A Aav A DA Dictate A a Sensitivity SELE Styles Styles Para Question A. President Trump's Tax Cuts and Jobs Act (CIA) created tax incentives for businesses to Invest in production equipment Companies that manufacture equipment expected abonans of orders and went into preparation mode. At Equipo Inc., department headset to review the job order cost accounting system which allocates overhead at $1500 per direct labor hour. After pleasantries, the meeting of a little rough Tan confused by the accounting system. How can one hour of labor create $1500 in additional costs? It's crazy to tell us that our total product cost contains cely direct labor, but the labor drives all of our costs. Because the rate is so high, my design team creatively finds ways to use robotic machinery to reduce direct labor. Therefore, every year we have less direct labor, but the overhead rate continues to Increase. I predict that the future rate will exceed $2,000 per direct labor hour. Even the smallest shift in estimated direct labor hours can result in large differences in our estimated costs and ultimately in the quote to the customer. Think about it if we are off by only one hour, then our cost estimate is off by $1500 - which makes the quoted price to the customer off by even more." 1. Can you explain the engine concern over the increasing rate and the challenges to the bidding process? Is this an advantage or disadvantage when capture new orders created by TCIA? 2. What do you think posible solution Limit 200 words Job Number: 58 476 Customer Philadelphia 200 Description: 2500 quantity due July 31 Date Direct Materials Direct Labor Manufacturing Overhead 7/10 700 7/12 900 7/15 440 550 7/22 380 475 7/24 3600 7/27 1500 7/31 540 675 words English (United States) Focus 20 MacBook Air 20 F3 F4 F7 $ % A & A Aav Po XADA El 21 T an A. THE Dictate Styles Styles Pane S. ACC 116 Managerial Accounting Barbara Hordis 2/06/2020 Unit Three Ch 17 Job Order Costing Discussion Forum Questions Name: Natalia Delli Ganti Page 2 of 2 Cost of completed job: ...Direct Materials Direct Labor ... Manufacturing overhead Total Cost Unit Cost Case B (Continued Answer the following questions about the partially completed Job Order Cost Sheet above. 1) What is the predetermined overhead rate? 2) What are the total cost and unit cost of the completed job? 3) Assume this company works on one Job at a time. What was the balance in Work in Process inventory at July 17 July 24? July 317 4) Prepare the entry to record the completion of the job. 5) If the cages were sold and shipped on August 1 for 55 each, prepare the journal entry and calculate the profit. 6) Hmmm, what kind of white lion cages can be built and sold for only $5 each? English (United States) Focus ere 20 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts