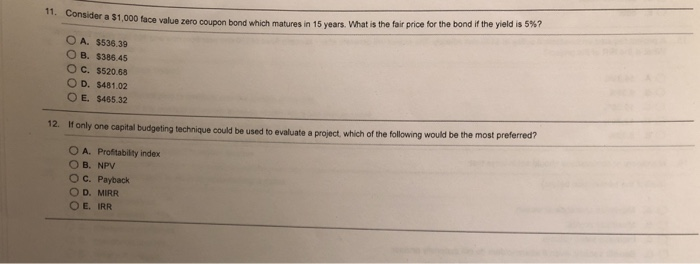

Question: 11. Consider a $1,000 face value zero coupon bond which matures in 15 years, what is the fair price for the bond if the yield

11. Consider a $1,000 face value zero coupon bond which matures in 15 years, what is the fair price for the bond if the yield is 5%? O A. $536.39 OB, $386.45 O C. $520.68 O D. $481.02 O E. $465.32 12. If only one capital budgeting technique could be used to evaluate a project, which of the following would be the most preferred? O A. Proftabilty index O B. NPV . Payback O D. MIRR O E. IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts